Silver Elephant Mining Corp. (TSX: ELEF, OTC: SILEF): Developing a Resources of Over 300 Million Ounces of Silver; Interview with Joaquin Merino, VP of South American Operations, Bolivia

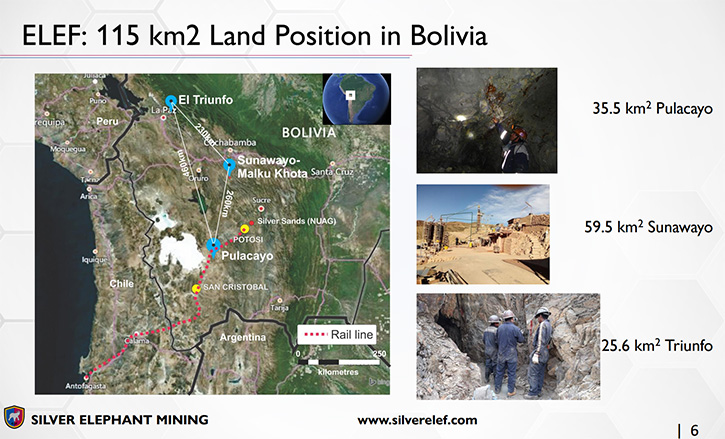

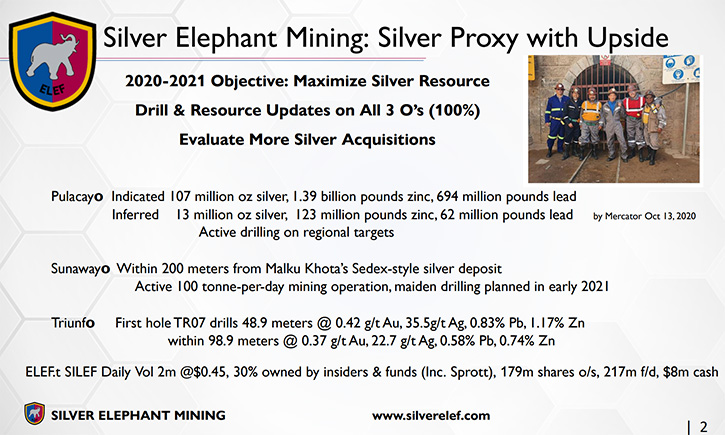

We learned from Joaquin Merino, VP of South American Operations, Bolivia, for Silver Elephant Mining Corp.(TSX: ELEF, OTC: SILEF), that their shareholders own as much silver in the ground aspossible. Their objective for 2021 and 2022 is to develop resources over 300 million ounces of silver, based on exploration, at four of their projects, and possibly with additional acquisitions. Silver Elephant Mining CorpDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Joaquin Merino, who is VP of South American Operations, Bolivia, for Silver Elephant Mining. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?Joaquin Merino:Silver Elephant is focused on exploring for silver deposits. Right now, we do have resources for over 100 million ounces of silver from two of our projects, Pulacayo and Paca. We have recently acquired another two, Sunawayo and Triunfo, and our objective for 2021 and 2022 is to develop resources over 300 million ounces of silver, based on exploration, and possibly with additional acquisitions. I think, for those who believe in silver, Silver Elephant will gain a very strong position when it comes to total resources very soon.Dr. Allen Alper:Well, that's an amazing resource. You really are an Elephant Silver Company.Joaquin Merino:Yes, that's what we think. We already have 100 million ounces as the current resource, and we believe with exploration and acquisition, we're going to be able to increase that up to 300 million ounces.

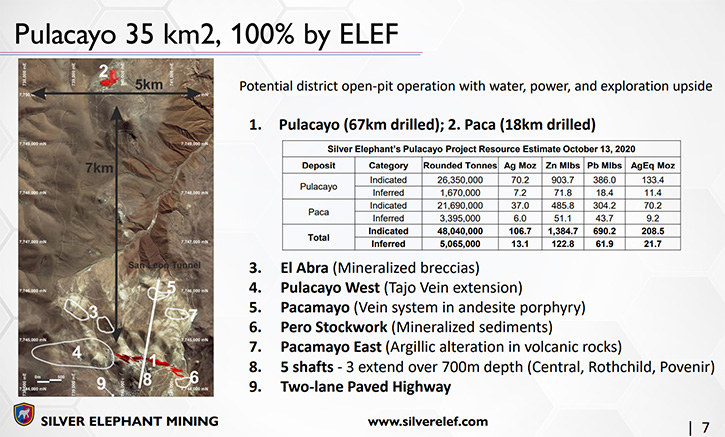

Silver Elephant Mining CorpDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Joaquin Merino, who is VP of South American Operations, Bolivia, for Silver Elephant Mining. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?Joaquin Merino:Silver Elephant is focused on exploring for silver deposits. Right now, we do have resources for over 100 million ounces of silver from two of our projects, Pulacayo and Paca. We have recently acquired another two, Sunawayo and Triunfo, and our objective for 2021 and 2022 is to develop resources over 300 million ounces of silver, based on exploration, and possibly with additional acquisitions. I think, for those who believe in silver, Silver Elephant will gain a very strong position when it comes to total resources very soon.Dr. Allen Alper:Well, that's an amazing resource. You really are an Elephant Silver Company.Joaquin Merino:Yes, that's what we think. We already have 100 million ounces as the current resource, and we believe with exploration and acquisition, we're going to be able to increase that up to 300 million ounces. Dr Allen Alper:And you also have huge quantities of zinc and lead.Joaquin Merino:Yes, that is correct. We also have some significant amounts of zinc and lead in the current resources. To the 107 million oz of silver we added 1.39 Billion pounds zinc and 694 Million pounds of lead. Dr Allen Alper:Well, that sounds great. Could you tell us a little bit about the geology of the area and a little bit more about your projects and deposits?Joaquin Merino:Yes. Let me start from the Pulacayo project, which it is a large epithermal system, considered an intermediate sulphidation deposit. It has a very impressive epithermal footprint. You can see that from the satellite image. Pulacayo Project comprises 30 square Km of prospective ground, and so far has explored two deposits:Pulacayo and Paca, which are 7.0 Km apart. Both deposits remain open in all possible directions and still numerous targets to explore. We believe this is another epithermal deposit, which is characterized by intrusions in sedimentary units along a stronger east-west corridor.

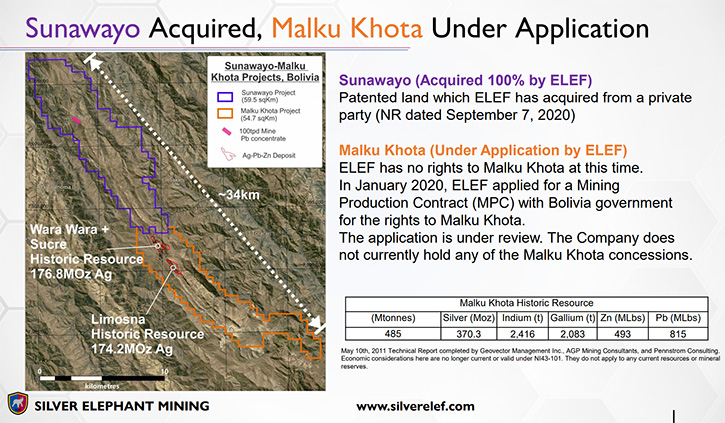

Dr Allen Alper:And you also have huge quantities of zinc and lead.Joaquin Merino:Yes, that is correct. We also have some significant amounts of zinc and lead in the current resources. To the 107 million oz of silver we added 1.39 Billion pounds zinc and 694 Million pounds of lead. Dr Allen Alper:Well, that sounds great. Could you tell us a little bit about the geology of the area and a little bit more about your projects and deposits?Joaquin Merino:Yes. Let me start from the Pulacayo project, which it is a large epithermal system, considered an intermediate sulphidation deposit. It has a very impressive epithermal footprint. You can see that from the satellite image. Pulacayo Project comprises 30 square Km of prospective ground, and so far has explored two deposits:Pulacayo and Paca, which are 7.0 Km apart. Both deposits remain open in all possible directions and still numerous targets to explore. We believe this is another epithermal deposit, which is characterized by intrusions in sedimentary units along a stronger east-west corridor. Dr. Allen Alper:That sounds very good. Could you tell us about some of the other projects too, and deposits?Joaquin Merino:The next project is a recent acquisition, Sunawayo project, which is the continuation of Malku-kota, a project explored in the past with a resource of 350M oz of silver. These deposits are classified as Sedex deposits, a well-known deposit type in the world. In Sunawayo the Company has identified 4 areas, which plan to drill in Q1 2021 for the first time ever. The lithological trend runs at least for another 8km into the Sunawayo property. El Triunfo project, also acquired in 2020, is a polymetallic deposit, characterized by sulphide mineralization hosted in shales. Recent drilling indicates values slightly over 1 g/t gold equivalent. Triunfo priority area spans 1km strike, up to 150 m width, and has been drilled down to 100 m and is still open at depth.

Dr. Allen Alper:That sounds very good. Could you tell us about some of the other projects too, and deposits?Joaquin Merino:The next project is a recent acquisition, Sunawayo project, which is the continuation of Malku-kota, a project explored in the past with a resource of 350M oz of silver. These deposits are classified as Sedex deposits, a well-known deposit type in the world. In Sunawayo the Company has identified 4 areas, which plan to drill in Q1 2021 for the first time ever. The lithological trend runs at least for another 8km into the Sunawayo property. El Triunfo project, also acquired in 2020, is a polymetallic deposit, characterized by sulphide mineralization hosted in shales. Recent drilling indicates values slightly over 1 g/t gold equivalent. Triunfo priority area spans 1km strike, up to 150 m width, and has been drilled down to 100 m and is still open at depth.  Dr. Allen Alper:Could you tell our readers/investors how it is operating in Bolivia?Joaquin Merino:Working in Bolivia has been positive. Bolivia has over 5 centuries of mining tradition. Bolivia is the 6th largest silver producer in the world, despite a decade of under investment. Coeur, Pan American silver, Sumitomo had all operated successfully.Official results that MAS candidate, Mr. Luis Arce, is the new Bolivian President. Luis Arce was Morales Minister of Economy during most of the 14 years of MAS administration of Bolivia that saw Bolivia GDP tripled and poverty cut in half by focusing on infrastructure development. Mr. Arce is an Economist, and has a Masters in Economics from the Warwick University of the UK. He has worked at the Bolivian Central Bank and was a university professor. Locals want employment. Sunawayo has had an operating mine there for 10 years, with community support because for them it is about jobs and providing for their families. We hire locally and procure supplies locally, we use Bolivian Management. We have a good foundation of mutual trust, on which we will continue to build. Dr. Allen Alper:That sounds very good. Could you tell our readers/investors about your background and the backgrounds of the other team members?Joaquin Merino:I'm a geologist by training. I'm originally from Spain. I worked in Chile at the beginning of my career. I've developed my career in exploration and also in mining operations for major companies and also in the junior sector. I worked in Porgera Mine, for Barrick gold, in Papua New Guinea and La Camorra Mine for Hecla Mining in Venezuela among others. About a year and a half ago, I joined Silver Elephant team. Part, of my main responsibilities, is to ensure operations in Bolivia and the acquisition of new opportunities in South America.Danniel Oosterman, P. Geo, is our VP Exploration. He has extensive experience working in exploration in Canada and also in South America, from grass roots to feasibility. He worked for Falconbridge and Inco. Dan managed multi-million dollar drilling programs in Canada. Our Executive Chairman, John Lee is an accredited mining investor, with an engineering and economics degree from Rice University. John founded the Company in 2009 and raised more than $120M, including the financing to acquire Pulacayo in 2017 and more recently Triunfo and Sunawayo.

Dr. Allen Alper:Could you tell our readers/investors how it is operating in Bolivia?Joaquin Merino:Working in Bolivia has been positive. Bolivia has over 5 centuries of mining tradition. Bolivia is the 6th largest silver producer in the world, despite a decade of under investment. Coeur, Pan American silver, Sumitomo had all operated successfully.Official results that MAS candidate, Mr. Luis Arce, is the new Bolivian President. Luis Arce was Morales Minister of Economy during most of the 14 years of MAS administration of Bolivia that saw Bolivia GDP tripled and poverty cut in half by focusing on infrastructure development. Mr. Arce is an Economist, and has a Masters in Economics from the Warwick University of the UK. He has worked at the Bolivian Central Bank and was a university professor. Locals want employment. Sunawayo has had an operating mine there for 10 years, with community support because for them it is about jobs and providing for their families. We hire locally and procure supplies locally, we use Bolivian Management. We have a good foundation of mutual trust, on which we will continue to build. Dr. Allen Alper:That sounds very good. Could you tell our readers/investors about your background and the backgrounds of the other team members?Joaquin Merino:I'm a geologist by training. I'm originally from Spain. I worked in Chile at the beginning of my career. I've developed my career in exploration and also in mining operations for major companies and also in the junior sector. I worked in Porgera Mine, for Barrick gold, in Papua New Guinea and La Camorra Mine for Hecla Mining in Venezuela among others. About a year and a half ago, I joined Silver Elephant team. Part, of my main responsibilities, is to ensure operations in Bolivia and the acquisition of new opportunities in South America.Danniel Oosterman, P. Geo, is our VP Exploration. He has extensive experience working in exploration in Canada and also in South America, from grass roots to feasibility. He worked for Falconbridge and Inco. Dan managed multi-million dollar drilling programs in Canada. Our Executive Chairman, John Lee is an accredited mining investor, with an engineering and economics degree from Rice University. John founded the Company in 2009 and raised more than $120M, including the financing to acquire Pulacayo in 2017 and more recently Triunfo and Sunawayo. Dr. Allen Alper:That sounds like a very strong Team, an experienced Team. Could you tell us about your share and capital structure?Joaquin Merino:We have 179 million shares, 217 million fully diluted. About 8.0 million in cash. The volume of SELEF in the market is 2.0M shares daily at $0.45, about 30% of the Company is owned by insiders and funds (Inc. Sprott).

Dr. Allen Alper:That sounds like a very strong Team, an experienced Team. Could you tell us about your share and capital structure?Joaquin Merino:We have 179 million shares, 217 million fully diluted. About 8.0 million in cash. The volume of SELEF in the market is 2.0M shares daily at $0.45, about 30% of the Company is owned by insiders and funds (Inc. Sprott).  Dr. Allen Alper:That sounds very good. Could you tell our readers/investors the primary reasons they should consider Silver Elephant Mining Corp? Joaquin Merino:We have a secure path, looking forward to develop these 300 million ounces of silver. That is our objective, and is very much achievable, and I think we are making the right decisions when it comes to laying out exploration programs and selecting new opportunities. From a geological point of view, we have a low risk, because all our projects have already been tested and they have been proved to be large and some of them are high-grade silver too. We have a very good relationship with the communities and we never had any problem working in Bolivia. So I think we can move the projects forward very quickly and in the right direction.Dr. Allen Alper:That's very good. Is there anything you'd like to add?Joaquin Merino:Our intention is to keep growing within the Country and make other acquisitions, not just in silver. We're also considering other good opportunities in the Country. We're going to get a very strong position and then I'm sure it will produce good results.Dr. Allen Alper:Well, that sounds excellent! https://www.silverelef.comFor more information about Silver Elephant, please contact Investor Relations:+1.604.569.3661 ext. 101ir@silverelef.com

Dr. Allen Alper:That sounds very good. Could you tell our readers/investors the primary reasons they should consider Silver Elephant Mining Corp? Joaquin Merino:We have a secure path, looking forward to develop these 300 million ounces of silver. That is our objective, and is very much achievable, and I think we are making the right decisions when it comes to laying out exploration programs and selecting new opportunities. From a geological point of view, we have a low risk, because all our projects have already been tested and they have been proved to be large and some of them are high-grade silver too. We have a very good relationship with the communities and we never had any problem working in Bolivia. So I think we can move the projects forward very quickly and in the right direction.Dr. Allen Alper:That's very good. Is there anything you'd like to add?Joaquin Merino:Our intention is to keep growing within the Country and make other acquisitions, not just in silver. We're also considering other good opportunities in the Country. We're going to get a very strong position and then I'm sure it will produce good results.Dr. Allen Alper:Well, that sounds excellent! https://www.silverelef.comFor more information about Silver Elephant, please contact Investor Relations:+1.604.569.3661 ext. 101ir@silverelef.com