Silver Forecast 2018 and Beyond, Investing for the $35+ Price Spike! / Commodities / Gold and Silver 2018

Silver the poor mans gold has so far failed to show any spark of life this year, opening the 2018 at $17.20, and then briefly rallying to a February peak of $17.60 before turning and remaining negative for the year, under performing Gold which has managed to remain positive for the year as both precious metals have effectively flat lined since their February highs, with Silver remaining stuck within a tight trading range of between $16.90 and $16.10 which is a far cry from the bullish expectations of many Silver bugs at the start of the year.

Silver the poor mans gold has so far failed to show any spark of life this year, opening the 2018 at $17.20, and then briefly rallying to a February peak of $17.60 before turning and remaining negative for the year, under performing Gold which has managed to remain positive for the year as both precious metals have effectively flat lined since their February highs, with Silver remaining stuck within a tight trading range of between $16.90 and $16.10 which is a far cry from the bullish expectations of many Silver bugs at the start of the year.

In terms of a Silver market position then as is currently the case the silver market can usually be expected to be a dead market with the tendency to flat line not just for many months but even years as it tends to play second fiddle to Gold in terms of tradable swings, usually only really coming alive towards the latter stages of precious metal bull markets.

So as per my analysis and price forecast of December 2016 my favoured exposure to Silver was via taking a long-term view i.e. to accumulate Silver at a low price (at the bottom of its trading range)which at the time was to buy at sub $16 for an eventual spike to at least $35 which at the time I expected to occur over a3-5 year time horizon, to deliver a return of at least 120% and possibly as high as 200% when the Silver price spike eventually materialises.

04 Dec 2016 - Gold and Silver Bullion Buying Opportunity for 2017?

In terms of long-term potential, $35 screams out from the chart whilst support lies along $14, so on the last close this would represent a risk of 17% against a potential return of 110%. Whilst from a drop to $16 would be a risk of 12.5% against potential of 120%.

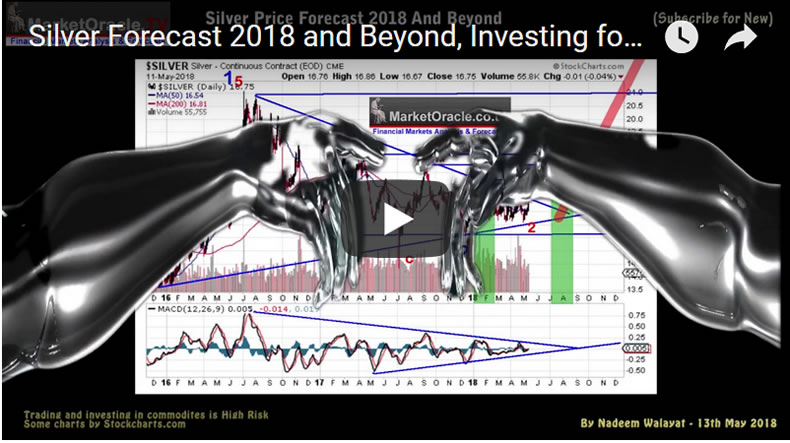

For what to expect for Silver over the rest of 2018 in terms trend and accumulating a position for that Silver spike to $35+, then find out in my latest Silver video analysis:

Ensure you are subscribed to my always free newsletter and youtube channel for my forthcoming in-depth analysis and detailed trend forecasts.

Source and comments: http://www.marketoracle.co.uk/Article62270.html

By Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.