Silver Hangs on by a Thread / Commodities / Gold & Silver 2023

As anxiety grips the white metal, is aretest of the 2023 lows or highs more likely?

With the Fed’s hawkish crusade helping tosuppress gold, silver, and mining stocks, the permabulls have gonefrom loud to quiet. Moreover, with resilient demand supporting inflation andkeeping the pressure on the Fed, we warned on Mar. 31, 2022, that consumerspending would cause problems for the central bank. We wrote:

Thereis a misnomer in the financial markets that inflation is a supply-sidephenomenon. In a nutshell: COVID-19 restrictions, labor shortages, andmanufacturing disruptions are the reasons for inflation’s reign. As such, whenthese issues are no longer present, inflation will normalize and the U.S.economy will enjoy a “soft landing.”

However,investors’ faith in the narrative will likely lead to plenty of pain over themedium term….

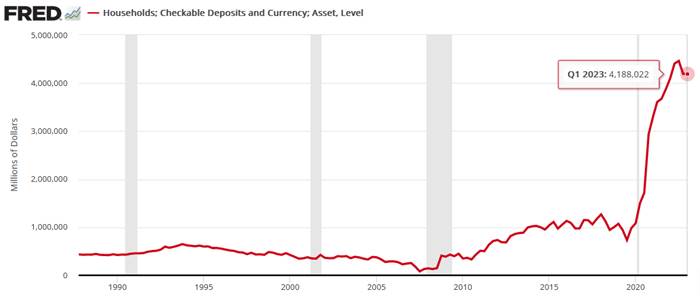

U.S. households have nearly$3.89 trillion in their checking accounts. For context, this is 288% more thanQ4 2019 (pre-COVID-19). As a result, investors misunderstand the amount ofdemand that’s driving inflation.

Fed's Updated Metric

To that point, the Fed updated themetric again on Jun. 8. And with household checkable deposits still highlyelevated, Americans have more money now than they did then.

Please see below:

To explain, the figure is north of $4 trillion as of Q1 2023, and only a milddrawdown from the all-time high has been realized. Consequently, there isstill too much cash out there to suppress demand enough to normalizeinflation.

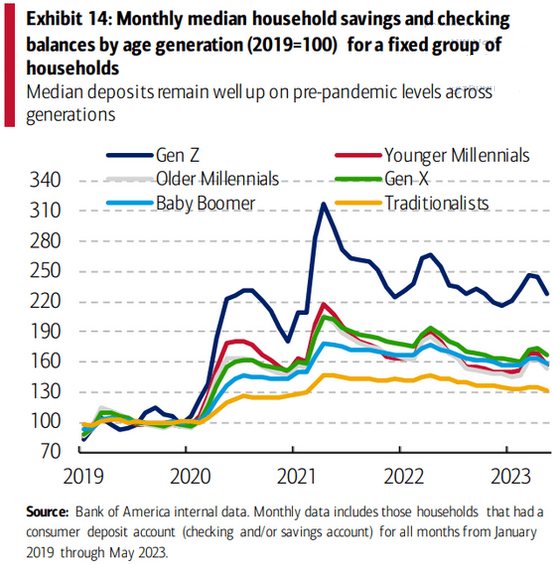

As further evidence, Bank of Americahighlighted the phenomenon recently.

Please see below:

To explain, BofA broke down its depositdata across different age cohorts. And the results showed that householdsavings and checking account balances remain well above their pre-pandemicbaseline (100), with Gen Z sporting the largest increase. So, while we warned12+ months ago that Americans were flush with cash, there is still plenty ofmoney out there.

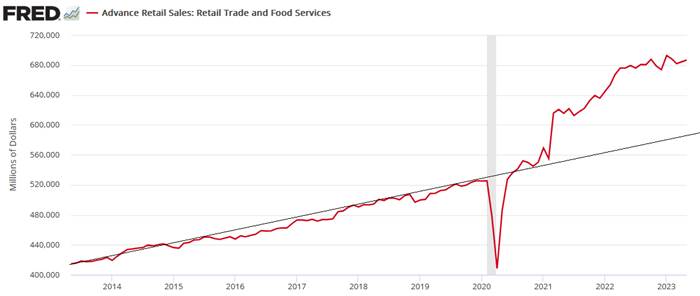

In addition, retail sales are on the riseagain, and the metric outperformed expectations on Jun. 15. Moreover, if thiscontinues, it'sbad news for silver.

Please see below:

To explain, retail sales are stillmaterially outpacing their 10-year trend, as resilientwage inflation and buoyant deposit balances keep consumerspending elevated. Therefore, we still believe that interest rates are too low to provoke the demand destruction necessaryto tame inflation.

Small Signals

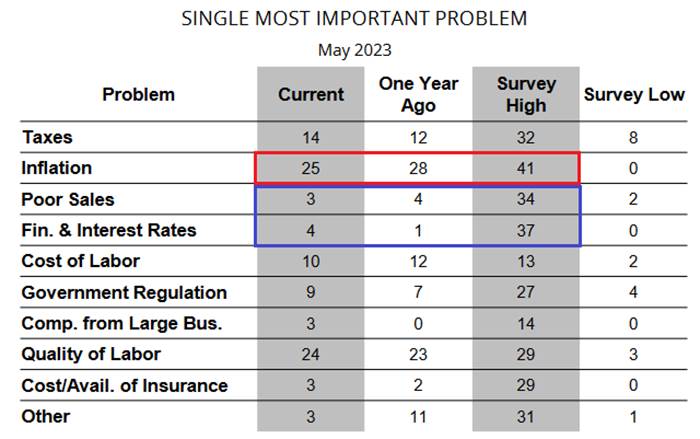

The NFIB released its Small BusinessOptimism Index on Jun. 13. The headline index increased from 89 in April to89.4 in May. More importantly, respondents still cite inflation as their“single most important problem.”

Please see below:

To explain, the red rectangle above showshow 25% of respondents cited inflation as their most pressing issue. And whilethe metric declined by three points from the May 2022 reading and is materiallybelow the record high, it’s still too high for comfort.

Furthermore, the implications of the bluerectangle are equally important. Only 3% of respondents cited poor sales astheir most important problem, which is less than the May 2022 reading, wellbelow the survey high, and only one point above the survey low. As a result,demand destruction is absent right now.

Likewise, while those citing the impactof interest rates rose by three points, the current 4% reading is well belowthe survey high of 37%. Thus, with poor sales and interest rates consideredlargely immaterial while inflation remains highly problematic, they indicatewhy long-term rates need to rise tomatch the FFR’s ascent.

Overall, the S&P 500 remains in la-laland, as investors assume that a fairytale ending is on the horizon.However, since 1948, six of the last seven times the headline CPI rose above 5%YoY, recessions followed. And with the imbalances much greater this timearound, in our opinion, a soft landing is extremely unrealistic.

In reality, recession fearsresduced oil prices, and base effects provided similar support to theheadline CPI. Yet, those benefits end when June’s data is released in July, andwe have been consistent in our thesis that interest rates are too low to causea recession. As such, the Fed should have to do more, and few expect or arepositioned for this outcome.

Why have the PMs been so weak while theS&P 500 has been so strong?

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.