Silver Investing Trend Analysis and Price Forecast 2019 / Commodities / Gold & Silver 2019

Formulating a Trend Forecast

The long-term picture is of the Silver price being stuck in a trading range of between $21 and $14 pending a breakout higher with the current resistance at $15.25. Then resistance at $16,25, $18.50 and finally $21.

The silver price only really tends to come alive during a monetary crisis of sorts be it financial or inflation, stock market panic etc. So is there a crisis on the horizon? Well whilst Trump's china trade war is stressing the system a bit, it's not exactly reached the point yet where each side is threatening military action and trade embargo's so we are not quite there yet. Whilst many may argue that another financial crisis is brewing out there, perhaps in student and auto loans. But again we are not quite there yet hence Silver remaining in hibernation. Whilst the US economy may be slowing, it's not exactly teetering on the brink of recession yet.

This analysis was first made Patrons who support my work. Silver Investing Trend Analysis and Price Forecast 2019

Silver Investing Trend AnalysisGold Price Trend ForecastSilver Long-Term Trend AnalysisSilver Medium-Term Trend AnalysisSilver Short-Term Trend AnalysisGold - Silver RatioSilver Price Trend Forecast ConclusionHow to Invest in SilverSo for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

So where Silver is concerned, the technical's, fundamentals and inter markets are saying were not quite there yet in terms of that Spike higher. So whilst Silver may reluctantly follow the Gold price higher, I am not seeing it blasting off past resistance of $21 anytime soon.

Silver Price Trend Forecast Conclusion

Therefore my forecast conclusion is for the Silver price to continue to trade in a volatile trading range with an upward bias towards a target of $18.50 later in 2019 as it steps higher into each successive trading range i.e. $15.25 to $16.25, then $16.25 to $17.30, then $17.30 to $18.50, which would represent a 25% gain on it's current price of $14.74. Whilst a spike to at $35+ remains a longer term objective.

Remember Silver is for Long-term INVESTING rather than to try and trade because it is a volatile messy market in terms of TA. Where the key accumulation zone for the past 5 years has been $14 to $15 which is where we find the Silver price currently trading.

The bottom line is that I see Silver as a coiled spring because in historic terms it is very undervalued against Gold and so I expect that spring to eventually propel Silver into an overbought state against Gold even though we are likely several years away from when that happens.

How to Invest in Silver

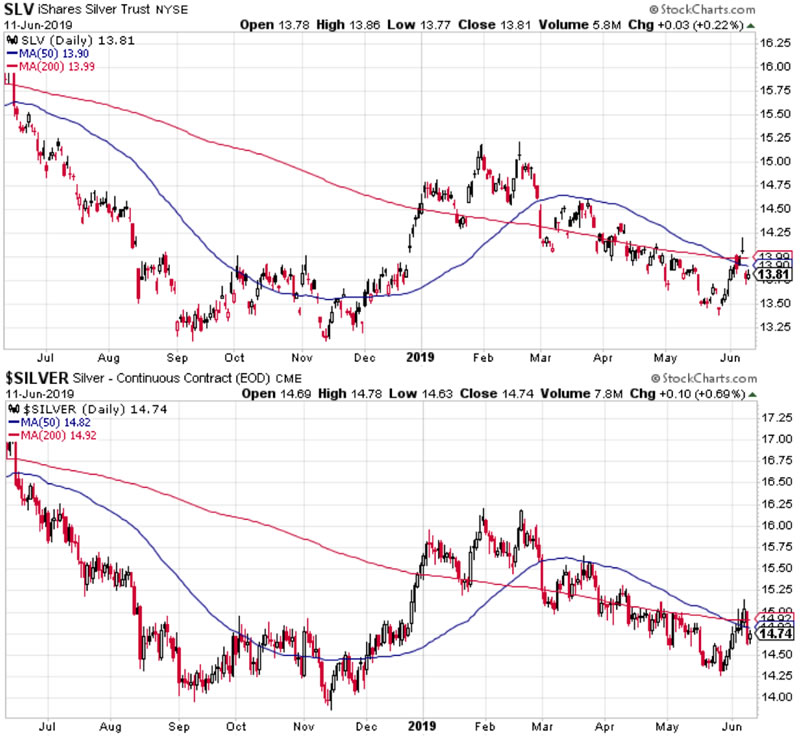

The easiest way to gain exposure to Silver is via the SLV ETF. Though remember you are investing in a trust so the SLV trading price will not be the same as the Silver market price, but the SLV price trend usually does quite closely track the Silver price trend as the following chart illustrates:

Disclaimer - I am invested in Silver (SLV)

This analysis was first made Patrons who support my work. Silver Investing Trend Analysis and Price Forecast 2019

So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis :

Stock Market Trend Forecast UpdateGold and Silver Trend Analysis UpdateChina Stock Market SSECBitcoin UpdateUK Housing market seriesMachine Intelligence Investing stocks sub sector analysisRecent Analysis includes: Investing to Profit and Benefit from Human Life Extension AI Stocks and TechnologiesSilver Investing Trend Analysis and Price Forecast 2019Next British Prime Minister Tory Leadership Betfair Betting Markets Gold Price Trend Forecast Summer 2019Stock Market US China Trade War Panic! Trend Forecast May 2019 UpdateUS House Prices Trend Forecast 2019 to 2021Bitcoin Price Trend Forecast 2019 UpdateTop 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trendAnd ensure you are subscribed to my FREE Newsletter to get my public analysis in your email in box (only requirement is an email address).

Your analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.