Silver Plays a Small but Vital Role in Every Portfolio / Commodities / Gold & Silver 2019

Portfoliostrategies like Modern Portfolio Theory andothers tend to assume that market returns follow a normal distribution.

Portfoliostrategies like Modern Portfolio Theory andothers tend to assume that market returns follow a normal distribution.

Notreally.

Certainsecurities have high kurtosis.That is where out-of-the ordinary returns (larger or smaller) occur morefrequently than the normal distribution predicts.

Ofcourse, nobody who is stable and balanced puts 100% of their assets intosomething which has the possibility of extreme returns.

Butrisk 90 cents for the possibility of making 10 bucks? All day long.

That’swhy here I’ll talk about investing in… silver.

Silver’s Role in the Portfolio

Nobodyactually “invests” in silver. I am a silver investor and I wouldn’t say that I“invest” in it. I keep it around for when something crazy happens.

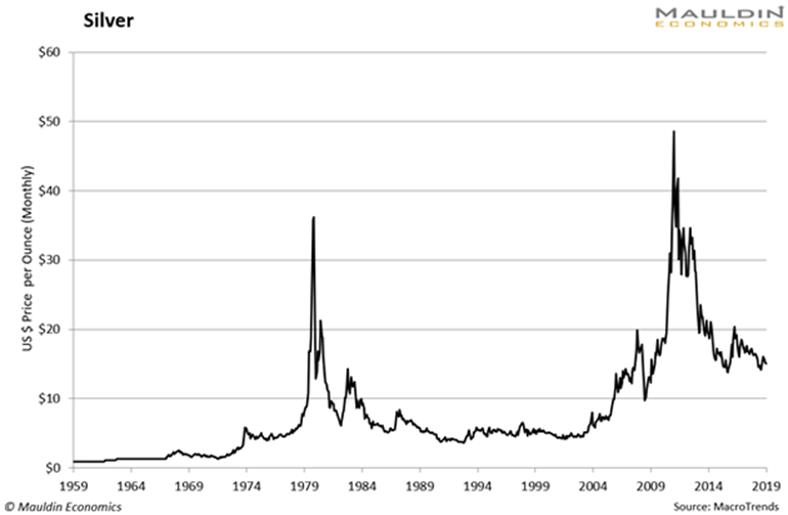

Hereis a chart of silver going back a long time so you can see what I mean:

Youcan see “Silver Thursday” in March 1980, the result of Bunker Hunt attemptingto corner the silver market. And you can see the freak-out in 2011.

Soyou might come to the conclusion that an asset that goes bananas every once ina while could be a good asset to hold.

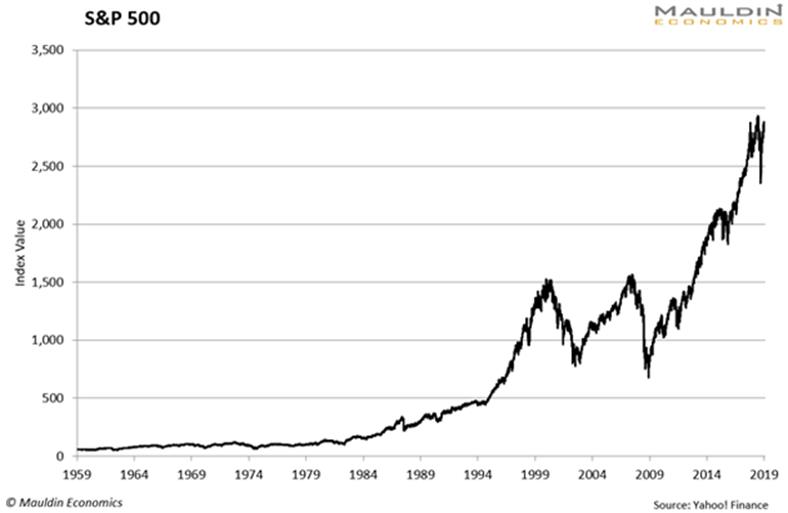

Especiallyin light of what is going on in the world at the same time:

I recently talked about the35/55/3/3/4 portfolio: 35 percent stocks, 55 percent bonds, 3 percentcommodities, 3 percent gold, and 4 percent REITs (Real Estate InvestmentTrusts).

Thatportfolio gives you almost the return of the 80 percent stocks/20 percent bondsportfolio with about half the risk.

Ithink if you threw 1 percent silver in there, the risk characteristics get evenbetter.

Sadly,people get a little carried away with silver, like they did a few years back.They start ordering monster boxes of coins and getting them delivered to theirfront door by very unhappy FedEx guys.

Silver Might Be Worth a Lot One Day

Industrialuse of silver went way down after the demise of film photography. Investmentdemand has also pretty much dwindled to nothing. The fundamental picture is notgreat.

Still,you never know. Strange things can and do happen with precious metals.Palladium has gone nuts, and platinum is a fraction of what it once was.

Andas I said earlier, market returns don’t follow a normal distribution. Extremelypositive (and negative) returns happen much more often than a normaldistribution expects them to.

Silverlooks relatively cheap. It’s about where it was in 2010, when the breakoutoccurred. It has done the round trip.

Butthat’s not why I own it, because of some subjective opinion of cheapness. Wewant to own it for what it does to your portfolio.

Somepeople like to trade silver in the futures market, which seems insane to me.Silver is notoriously difficult to trade in the short-term. It has earned thereputation of being the “rich man’s casino.” Pass.

Nobodyshould be trying to scalp a couple of percent out of a silver ETF. You buy itand hold it and wait for it to go 5x or 10x. And then—you actually have to sellit.

Silverminers are also a possibility. Since the bear market, many miners have becomesmall cap stocks that are not very liquid. But they possess the same kind ofperiodic moonshot potential (kurtosis) that spot silver does.

Butyou have to be careful with miners. Do your homework.

Free Report: 5 Key ETF Trading StrategiesEvery Investor Should Know About

FromJared Dillian, former head of ETF trading at Lehman Brothers and renownedcontrarian analyst, comes this exclusive special report. If you’re invested in ETFs, orthinking about taking the plunge into the investment vehicle everyone’s talkingabout, then this report is a clever—and necessary—first step. Get it now.

By Jared Dillian

© 2019 Copyright Jared Dillian- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.