Silver Previous Trend Forecast Recap / Commodities / Gold and Silver 2021

My last in-depth Silver analysis:

29th Jan 2020 - Silver Price Trend Forecast 2020

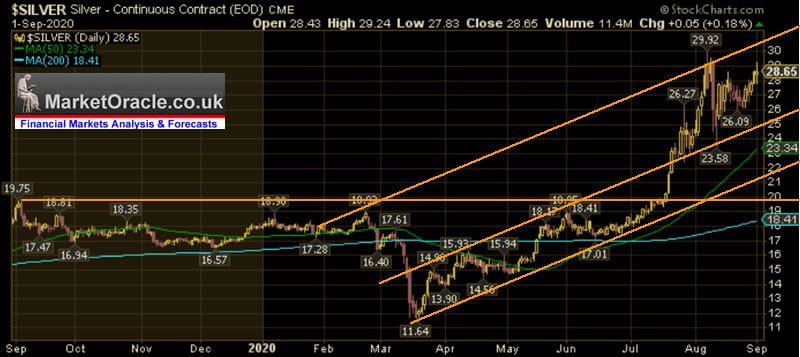

Initially I am expecting a very volatile trading range between a low of $16.50 to a high of $19 for the next 3 months or so, following which the Silver price 'should' respond to aGold price rally and follow the yellow metal higher. The trends not going to be pretty but I expect Silver to trade above $20, and likely reach a peak near $21 later in the year as the forecast graph illustrates.

The bottom line is that Silver is in a 6 year long trading range of between $21 and $14. And we are all waiting for the breakout higher. For which there is a low probability of happening during 2020. However, my long-term expectations remain of being invested for a spike to $35+, which on the current price would represent a gain of 100%.

So the strategy is to invest in Silver rather than to trade Silver, to accumulate when cheap and given the gold / silver ratio of 89, Silver is still cheap today relative to Gold. Just remember Silver tends to under perform Gold during most of the precious metal bull markets, and tends to outperform towards the end of powerful bull runs as retail investors start waking up and start jumping on board, hence expect a series of spikes higher through resistance levels over the coming years.

With the trend pattern proving accurate after allowing for the pandemic panic crash of March 2020.

And I briefly touched upon Silver in my Gold analysis of September 2020 - Gold Price Trend Forecast into Mid 2021, Is Intel Dying?, Can Trump Win 2020?

Silver New All Time High?

Gold has traded to a new all time high so why has not Silver? That will be because Silver is MORE volatile and LESS predictable in terms of trend and timing which is why my approach to Silver is SIMPLE, invest when cheap and then wait for the SPIKE to materialise to cash in on.

The bottom line is that Silver has been playing catchup to Gold, it was dirt cheap, now not so cheap when considering valuations of the past 10 years, so I doubt we will see a similar push higher as we saw from $11 to $30, instead intoFeb 2021, $37.5 to $40 is probable.

The rest of this extensive analysis that maps out a trend of rthe Silver Price into Mid 2022 has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work forjust $3 per month that is set to increase to $4 per month this week for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

Silver Price Trend Forecast October 2021 to May 2022, CHINOBLE!AI Stocks Buying Plan

UK Inflation Soaring into the Stratosphere, Real rate Probably 20% Per AnnumThe 2% Inflation SCAM, Millions of Workers take the Red PillSilver Previous Forecast RecapGold Price Trend Implications for Silver Silver Supply and DemandSilver vs US DollarGold / Silver RatioSILVER Trend AnalysisLong-term Trend AnalysisFormulating a Trend ForecastSilver Price Trend Forecast October 2021 to May 2022Silver Investing StrategySIL ETF - What About Silver Mining Stocks?Gold Price Trend BriefWhy the CCP is Living on Borrowed Time and Needs a WarUnderstanding the Chinese Regime and What it is Capable OfGuanxiChinese People do NOT Eat Dogs NewspeakCHINOBLE! Evergrande Reality Exposes China Fiction! AI Stocks Portfolio Investing StrategyAI Stocks Portfolio AmendmentsAI Stocks Portfolio Current StateOctober Investing PlanHIGH RISK STOCKS INVEST AND FORGET PORTFOLIOWhy China Could Crash Bitcoin / Crypto's! My Next AnalysisAlso my recent latest extensive analysis on the prospects for the stock market into Mid 2021 see - Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

Contents:

Stock Market Forecast 2021 ReviewStock Market AI mega-trend Big PictureUS Economy and Stock Market Addicted to Deficit SpendingUS Economy Has Been in an Economic Depression Since 2008Inflation and the Crazy Crypto MarketsInflation Consequences for the Stock MarketFED Balance SheetWeakening Stock Market BreadthWhy Most Stocks May Go Nowhere for the Next 10 Years!FANG StocksMargin DebtDow Short-term Trend AnalysisDow Annual Percent ChangeDow Long-term Trend AnalysisELLIOTT WAVES AnalysisStocks and 10 Year Bond YieldsSEASONAL ANALYSISShort-term Seasonal TrendUS Presidential Cycle Best Time of Year to Invest in Stocks2021 - 2022 Seasonal Investing PatternFormulating a Stock Market Trend ForecastDow Stock Market Trend Forecast Sept 2021 to May 2022 ConclusionInvesting fundamentalsIBM Continuing to Revolutionise ComputingAI Stocks Portfolio Current StateMy Late October Stocks Buying PlanHIGH RISK STOCKS - Invest and Forget!Afghanistan The Next Chinese Province, Australia Living on Borrowed TimeCHINA! CHINA! CHINA!Evergrande China's Lehman's MomentAukus RuckusIncluding access to my recent extensive analysis updating AI stocks buying levels as we head towards the window for a significant correctioneven a possible stock market crash.

Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

FOMO Fumes on Negative EarningsCathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big MistakeINTEL The Two Steps Forward One Step Back CorporationAMD Ryzen 3DNew Potential Addition to my AI Stocks PortfolioWhy is Netflix a FAANG Stock?Stock Market CRASH / CorrectionHow to Protect Your Self From a Stock Market CRASH / Bear Market?Chinese Tech Stocks CCP Paranoia VIES - Variable Interest EntitiesCCP ParanoidBest AI Tech Stocks ETF?Best UK Investment TrustAI Stocks Buying Pressure Evaluation AI Stocks Portfolio Current StateAI Stocks Portfolio KEYWhat to Buy Today?INVEST AND FORGET HIGH RISK STOCKS! High Risk Stocks KEYBitcoin Trend Forecast Current StateCrypto Bear Market Accumulation Current StateCrazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month now before the price hike. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 15% doneHow to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.US Dollar and British Pound analysisGold Price Trend Analysis - 10%Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI data preprocessing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.