Silver Price Target during the Next Bull Market / Commodities / Gold & Silver 2019

It is time to explore the details of ourGold vs. Silver ratio research and to start to understand the potential forprofits within this move in precious metals. The firstpart of our research article highlighted the Gold vs. Silver ratio andwhy we believe the “reversion process” that is taking place in price could bean incredible opportunity for traders.

It is time to explore the details of ourGold vs. Silver ratio research and to start to understand the potential forprofits within this move in precious metals. The firstpart of our research article highlighted the Gold vs. Silver ratio andwhy we believe the “reversion process” that is taking place in price could bean incredible opportunity for traders.

Historically, when the Gold vs. Silver ratio reachesan extreme level, and precious metals begin to rally, a reversion within theratio takes place, which represents a revaluation process for silver pricescompared to gold prices. This typically means that the prices of Silver willaccelerate to the upside as the price of gold moves higher – resulting in adecrease in the ratio level.

This reversionprocess related to precious metals pricing is an opportunity for traders totake advantage of an increased pricing advantage to generate profits.

For every drop of 5.0points in the gold/silver ratio, the price of Silver should increase by 6.5% to7.5% to the price ofGold.

This research isbased on our belief that Gold and Silver will continue to rally and potentiallyenter a parabolic upside price advance soon. If this takes place andprecious metals begin to skyrocket higher, the ratio level will react in ahyperactive “reversion process” where Silver may move higher at a rate that issubstantially faster than Gold. This is the process that we are exploringand our researchers are attempting to shed some insight into this event.

I believe a reversionprocess has already begun to take place within the precious metalsmarket. We believe this reversion process is about to explode as adramatic revaluation event unfolds over the next 12+ months. This processwill become more evident to traders as the price of Gold continues to rallytowards the $1750+ level and as the price of Silver explodes higher in largerand larger advances.

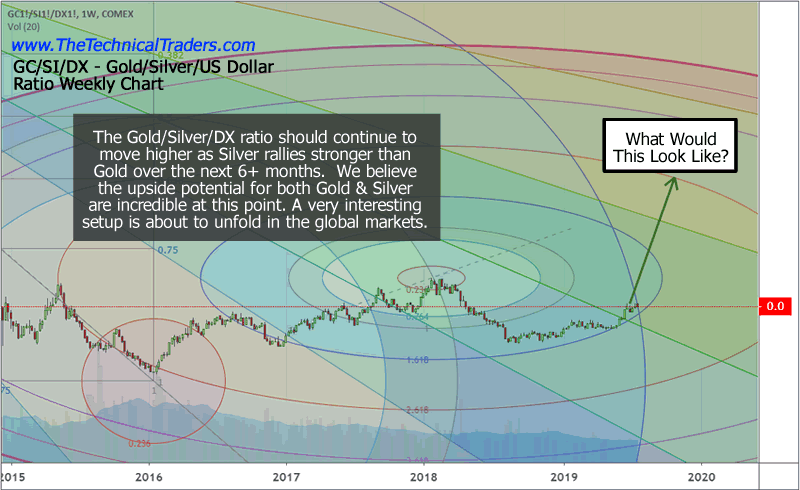

Gold/Silver/US Dollar ratio chart

This Gold/Silver/US Dollar ratio chart isthe basis of our analysis for the reversion process event and the associatedrevaluation event. Our previous analysissuggests Gold will attempt a move to levels above $1650 to $1700 on the nextbreakout move higher. This next upsideprice move will expose the price reversion event for all traders to witness andwe have mapped out the expected Silver price advantage for all traders goingforward.

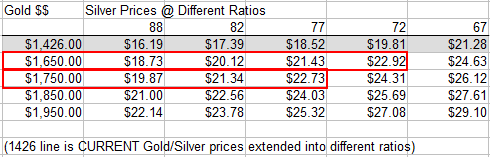

Gold/Silver Ratio – Silver Price vs Ratio Level

We put together this reference table toassist all traders in understanding just how important this move could be tothem. This reference table shows thecurrent Gold/Silver price levels (in GREY) as the ratio levels change from 88to lower levels.

If the price of Gold were to stay at thesame $1426 level while Silver rallied to prompt an 82 or 77 ratio level, theprice of silver would move from the current price of $16.19 to $17.39 or $18.52in order to reflect this decreased ratio level. That represents a 7.5% to 14.3% price increase.

Yet if the price of Gold advances to $1650or $1750 while the ratio level drops to the 82 or 77 ratio level (becauseSilver advances fast than Gold), then the price of Silver would move from thecurrent price of $16.19 to $20.12 to $22.73. That move represents a 24.2% to 40.3% price increase in Silver when Goldincreased only 15.7% to 22.7%.

What If Silver Advances Quicker Than Gold?

If Silver advances even faster than our“what if” scenario, above, and Gold continues to advance as we expect, theincreased price reversion process taking place in Silver as a process of thisrevaluation event could result in a 70% to 110% fast price advance in Silverthan the price advance that takes place in Gold.

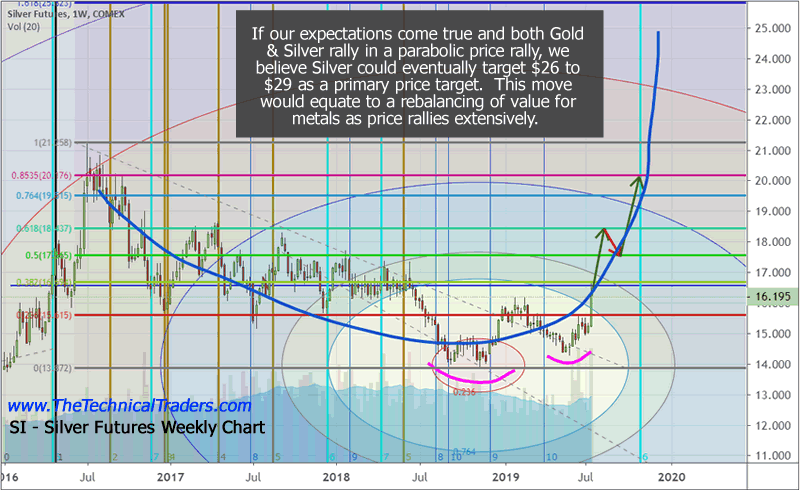

We believe the next upside price leg inSilver will target $19.50 to $22.75. This target range supports the highlighted area on our Ratio table(below). In other words, we believe theratio level will attempt to quickly move toward the 70 to 77 level as Goldprices rally over the next few months. This would push silver up into the $22.50 to $25 price level veryquickly.

What If Gold Rallies Faster Than Silver?

If Gold were to rally above $1950 on anextended upside price advance before August or September, we believe thereversion process would become extremely hyperactive in nature and the price ofSilver could push well above $29~34 per ounce – may be even higher.

This declining ratio level acts as aturbo-boost for the price of Silver as Gold continues to advance. The recent rotation to the downside suggeststhe ratio relationship between Gold and Silver has already stated a reversionprocess – the only question is “where will it end?”. Our researchers believe it will stop where itstops and we believe the 65 level on the Ratio chart is just the initial targetfor this first upside leg.

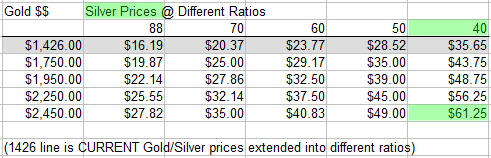

Imagine where Silver could go if theratio level fell to levels below 40 and goldrallied to $2500 or more? Ok, stopimagining and take a look at this second extended ratio table.

Pay attention to the fact that Silver couldrally more than 300% if Gold moves up above $1750 and the Gold/Silver ratiodrops below the 55 level. If Gold wereto continue to rally and the Gold/Silver ratio continued to fall, Silver couldrally well above $50 over the long run.

Silver Price Range As Gold/Silver Ratio Move To theAverage

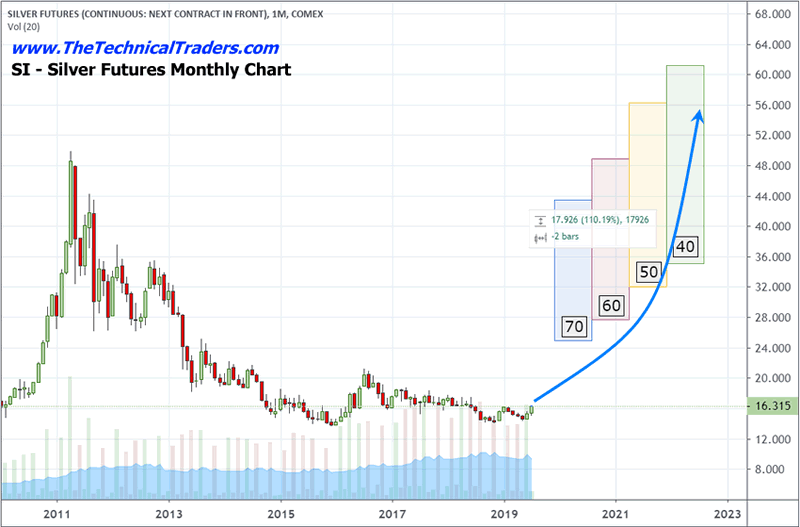

We’ve attempted to graph the ranges of theexpected move in Silver into segments based on the Gold/Silver ratio to assisttraders in understanding just how powerful this setup really is. Imagine what it would take for Gold to moveup to levels above $1750 (which is our expected target for the next leg higher)and for Silver to rally into the 55 to 65 ratio level. If that happens, the expected target pricefor Silver would be somewhere between $30 and $40 – more than 100% higher thanthe current price of Silver.

If you think $50 is unimaginable orunrealistic, we’ve just shown you why it is possible these levels could bereached before the end of 2019 or in 2020. If you have not grasped the reality of what is likely to unfold over thenext 6 to 12+ months in the global markets and that precious metals are thesetup of the decade, then pay attention to the fact that gold and silver arepoised for moves ranging from 40% to 240% over the next 12+ months depending onthe scale and scope of this move.

Our current objectives for the ratio levelsare still 55 to 65 within this next move higher where Gold will target$1750. Beyond that level, we’ll have toupdate you as the price continues to explore new highs.

CONCLUDING THOUGHTS:

In short, don’t miss the trade of thedecade. These opportunities for skilled technical traders over the next 16+months is incredible. Huge price swings, incredible trends, big rotationsand we could see nearly 300%+ profits to be had if you know what to trade andwhen. These types of opportunities are perfect for skilled technicaltraders like us and we want to help you prepare for and trade theseopportunities.

This bear market for stocks and the new bull market for metals has been along time coming, but finally, almost all the signs are showing that it’s aboutto start. As a technical analyst since 1997 having lost a fortune and making afortune from bull and bear markets I have a good understanding of how to bestattack the market during its various stages.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months – most traders/investors have simply not been looking for it.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

FREE GOLD & SILVER WITH MEMBERSHIPS

So kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.