Silver Price Trend Forecast Summer 2020 / Commodities / Gold & Silver 2020

Formulating a Trend Forecast

It is clear that Silver is NOT Gold, so NOT to make the mistake of looking at what Gold has done and thinking Silver will replicate that move, it rarely does! At best Silver tends to play catchup towards the end of precious metals bull trends.

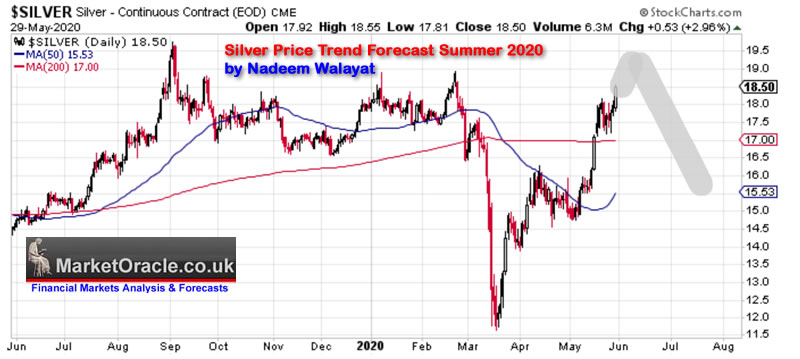

Silver is in a strong bull trend off the March low that is targeting resistance at $19 and then $20, beyond which lies $21. The big question mark is can Silver break above resistance or not. Balance of evidence suggests Silver's going to correct before it is able to clear resistance.

Therefore the Silver price could top out at any point between $18.50 (last close) and $20, maybe reach $19.30 before weakening.

On the plus side, Silver is CHEAP relative to Gold which should contain any declines i.e. we are unlikely to see Silver revisit $11.64. UNLESS the Gold price takes a huge tumble at the same time.

What does my January forecast conclusion say for Silver?It says the forecast rally began in Mid March rather than Mid May, and thus the trend higher could terminateduring late June rather than late August.

Therefore I am finding it very difficult seeing Silver sustain a breakout higher anytime soon.

Silver Price Trend Forecast Conclusion

Therefore my forecast conclusion is for an imminent peak in the Silver price, probably before Silver breaks above $20, though it is a volatile critter so could gave a false break to the upside before turning lower. Nevertheless, I don't see much upside in Silver after which the price is likely to revisit the $16.3 to $15 area as my forecast graph illustrates.

The bottom line is that Silver is in a 6 year long trading range of between $21 and $14. And we are all waiting for the breakout higher. For which there is a low probability of happening during 2020 as I stated in my January update. However, my long-term expectations remain of being invested for a spike to $35+.

So the strategy is to invest in Silver rather than to trade Silver, to accumulate when cheap and given the gold / silver ratio of 95, Silver is technically still cheap today relative to Gold. Just remember Silver tends to under perform Gold during most of the precious metal bull markets, and tends to outperform towards the end of powerful bull runs when retail investors start waking up and jumping on board, hence expect a series of spikes higher through resistance levels over the coming years, but not this year.

Disclaimer, I am invested in Silver (SLV)

The whole of this extensive analysis that concludes in a detailed trend forecast for the Silver price was first made available to Patrons who support my work: UK and US Corona Catastrophe Trend Analysis, Stock Market State and Silver Price Trend Forecast Summer 2020

UK Corona Catastrophe Trend AnalysisFEEDING THE INFLATION MEGA-TREND US Corona Catastrophe Trend AnalysisThe Corona Riots of 2020 Have Begun!Stock Markets Failing to Give Another AI Mega-trend Buying OpportunitySilver vs Gold TrendGold Silver RatioSilver Long-term Trend AnalysisSilver Trend AnalysisFormulating a Trend ForecastSilver Price Trend Forecast ConclusionSo for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Including my extensive analysis that concludes in a detailed 15 year trend forecast for AI Stocks - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Why Investors Should Buy Deviations against the Bull Market HighsThe AI Mega-trend - Moores Law is NOT Dead!QUANTUM COMPUTERSThe Quantum AI EXPLOSION!Capitalising on the AI Mega-trendAI Stocks Mega-trendFormulating a AI Stocks Mega Trend ForecastAI Stocks Mega-tend 15 Year Trend Forecast ConclusionDow Quick Technical TakeGetting Started with Machine LearningBlack Lives Matter Protests To trigger 2nd Covid-19 Wave?And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.