Silver Prices Are Showing Signs of Breakout Potential

Although gold headed mostly higher last week, it was a tale of two directions for silver prices…

Silver first headed lower after a strong performance the week prior. But as the dollar extended its run higher, silver followed along, bouncing back with fervor.

It reached levels it hadn't seen for three weeks, as the U.S.-North Korea summit appeared to collapse.

Even more impressively, silver continued to rise as the dollar itself was hitting highs not seen since December.

But later, as news came that the U.S.-North Korean summit was back on, the dollar headed higher still, this time weighing on the silver price performance as profit-taking set in.

Although the dollar's advance appears overbought in the near term, other indicators suggest its current run could still have legs. That might weigh on silver prices.

But if other factors intervene – like rising geopolitical tensions – the price of silver could head higher alongside the dollar.

Here's how the dollar and silver prices interacted last week, as well as why it supports my higher silver price target over the short term…

Why the Dollar Boosted Silver Prices

Silver started out last Tuesday (May 22) on a high note that would not last, as pressure from a rising U.S. dollar caused silver to sell off.

The gray metal lost nearly 2% from its Tuesday high when it hit its Wednesday (May 23) low at $16.33.

You Must Act Now: America is headed for an economic disaster bigger than anything since the Great Depression. If you lost out when the markets crashed in 2008, then you are going to want to see this special presentation…

But then silver reversed and shot higher in concert with the dollar's gains. It was a sight to see.

Silver bounced back to peak at $16.68 early on Friday (May 25), when profit-taking and another dollar surge were too much for silver. The metal's price dropped suddenly and settled at $16.47 before heading into the long U.S. Memorial Day weekend.

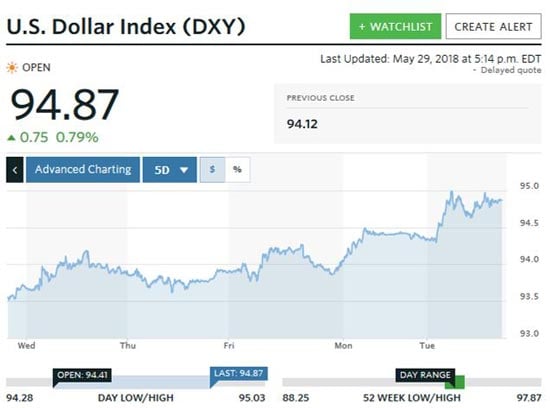

Take a look at how the U.S. Dollar Index (DXY) jumped heading into the weekend…

On Monday (May 28), the dollar rose further, aided by news the U.S.-North Korea summit was back on, so silver gave back a little. And on Tuesday (May 29), as the DXY hit five-month highs as fallout from Italy's insolvency spread, silver sold off further, to $16.33, by the close.

But here's where things get interesting…

Silver's ability to rise alongside the dollar is a bullish sign, even though silver prices flagged by the end of the week. Coupled with the other catalysts I'm seeing, silver could be reaching a breakout point soon…

Peter Krauth

Peter Krauth