Silver's Apparent Recovery / Commodities / Gold & Silver 2020

Some might say “Silver’s performance over the past several weeks has been nothing short of phenomenal.” Others talk and act as if all of their wildly crazy price predictions have already come true.

The chart (source) below is a one-year history of daily prices for SLV (Silver ETF)…

As of this writing, SLV is up forty-eight percent since striking its most recent low of $10.86 two months ago. It would not be excessive to call it an impressive rally of magnitude.

There are, however, some items of note that might dampen one’s enthusiasm if you are looking for an infinite extension of the current rally.

The rally has come immediately on the heels of a nearly forty percent decline in silver over the preceding four weeks. As such, it is, at this point, merely a retracement of previously lost ground.

In addition, silver is still more than two dollars per ounce lower than it was when the price price peaked earlier this year. This means that silver needs to increase by another fourteen percent just to get back to its February price point just before it collapsed.

Let’s remember – when silver was at $18+ three months ago, we were being told it was last call to own silver below $20 per ounce; and the silver bullet train was supposed to be fueled by an impending stock market crash.

The stock market crashed; and silver crashed faster and harder. What will happen to silver prices when stocks crash again?

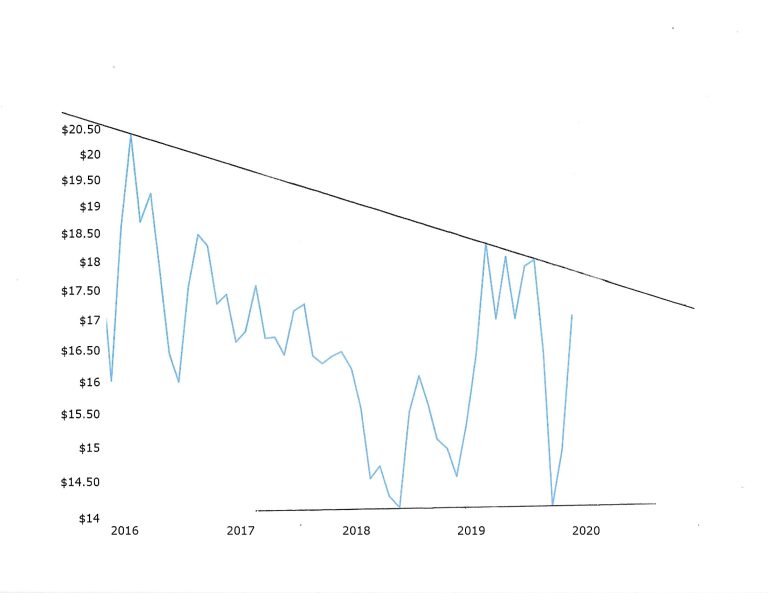

While you are thinking about that, lets look at two more charts (source) The first is a five-year history of physical silver prices…

As you can see, viewing silver’s recent move within the context of a longer-term time frame, alters our perception. The potential for additional volatility in the silver price is evident. However, the slope of the pattern, along with the overhead line of resistance, seems to indicate that the price of silver is well contained under $20 per ounce.

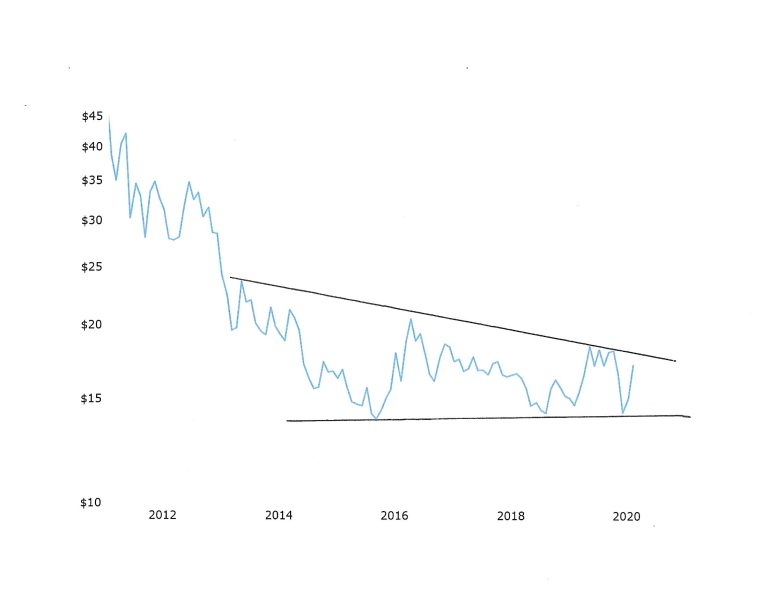

Finally, viewed within the context of a ten-year time frame, it would appear that silver’s recent rally is just a hiccup in its decade-long price decline since its peak in 2011…

In conclusion, not much has changed; silver’s potential for higher prices is quite limited.

With the winds of deflation howling ominously, it is more likely that the price of silver is headed lower.

As we have said before, it is prudent to own some silver coins (see my article on silver coin premiums) for exchange and barter against the possibility of a breakdown in the financial system and complete repudiation of the US dollar.

Other than that, your best bet for wealth preservation is gold; as long as you are not chasing the price.

(also see: Silver Loses Its Mettle)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.