Silver's Coming Double Trigger Shotgun Price Explosion / Commodities / Gold & Silver 2020

David Smith - Even in the competitivehunting/shooting community, few enthusiasts know about an arcane rifle known asa "double trigger shotgun." Essentially, it's a double-barrel shotgunhaving a trigger for each barrel.

This was an early day'sdesign with the triggers located inside the trigger guard, back to front. Itwas possible to press both triggers at once, causing a double discharge, thoughfor the most part this was not a good idea – since it caused twice the recoil,and was hard on both the shotgun and the shooter – especially if notanticipated.

Though this essay is notabout shotguns, but rather silver, the above concept provides a perfect analogyfor what I believe is in store – a double discharge for both silver demand andprice in the reasonably near future!

In a recent talk, DavidMorgan succinctly summed up this evolving silver industrialdemand dilemma, saying:

More than gold, silver isvulnerable to supply shortages due to its crucial role in our high-techsociety. Consider the emerging technology of 5G phones. Most phones on themarket today are not equipped to handle 5G technology, but as the global trendshifts towards integrating 5G infrastructures, it will not be long before newphones are produced to accommodate it.

And these new phones willneed silver: approximately 88 Million ounces of it. Do not underestimate thedemand for silver just because its supply now appears to be plentiful.

As much as we hear thegold story, it truly is silver that keeps the economy running. Oil may be farmore important than silver, but that does not negate the fact that we needsilver to continue to operate in today’s world. The banking system cannot runwithout computers as there is silver in their computers. And we cannot exchangeinformation without the silver as it is required in all communication landlinesor wireless.

Silver is more criticalthan most people ever consider because it is ubiquitous. It is everywhere, in avery small amount. Every day, we handle little silver fragments, and we nevereven think about it—food for thought.

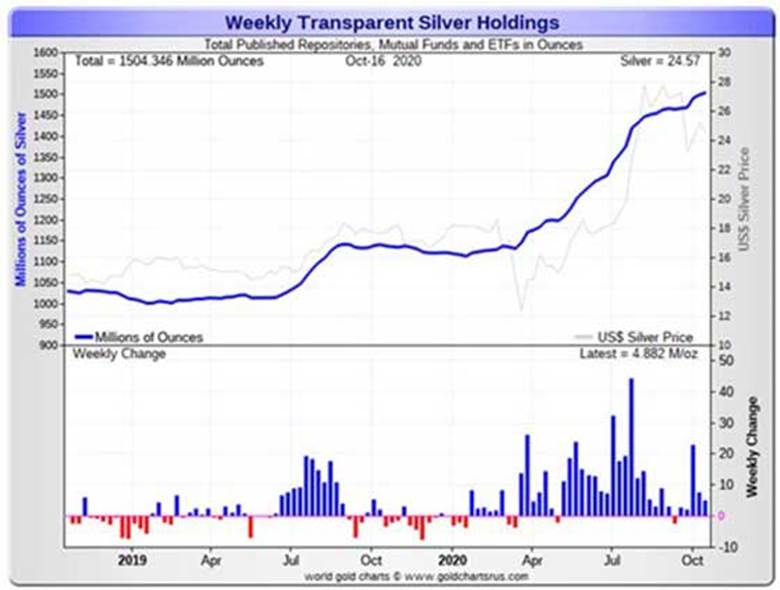

As the above chart ofSilver EFT Inflows shows, investor demand for silver is voracious.

At some point, industrialusers' demand-hoarding contributes to overwhelming supply disruption.

Industrial users with avariety of future metals' supply needs are already "taking positions"in mining producers to assure these needs. We have seen this with Tesla(nickel, lithium, cobalt), other auto manufacturers (copper, zinc), andinevitably will at some point, I believe, with silver).

This kind of backgroundpositioning usually goes on quietly, with a company either buying shares of aproducer or providing cash infusions for their ongoing operations, or eventaking an offtake stake in an exploration operation's ounces/pounds in theground.

The primary silverproducer universe of less than two dozen is so tiny, that a company like Appledeciding to swallow ALL them up would be less than a blip on its bottom line!Thus, pressure is now being placed on the other of these double silver demandtriggers.

Lessons from Ford's"Palladium Hoarding Experience"

In 2001, a rumor thatRussia, producer of most of the world's palladium, might stop producing, causedFord Motor company to aggressively stockpile this critical metal needed formanufacturing their catalytic converters near $1,100 per ounce - a price levelthat was not to be exceeded for another 20 years.

Soon thereafter, Russiastarted exporting again and the price collapsed to $140/ounce, forcing Ford totake a $1 billion write off on its stockpile.

Monetary demand is nowstarting to exceed that of industry. David Morgan again:

At some point, enoughpeople wake up and understand that their currency is becoming worth less andless, which means a tipping point will be reached. It could be achieved with anadditional one-percent of the investing/saving public, or it might be done withanother Berkshire Hathaway purchase or equivalent.

This year, 2020, has seenmore silver bought as – money, investment, safe-heaven, or hard assets than isused in industry, and we are just warming up for the final round of the mostsignificant move into things of value that the world has ever witnessed.

There is an infinitedemand for “money” because under the current system the debt can never berepaid, since the interest to pay the debt needs to be created. Moneyrepresents a lot of things- stored energy, stored labor, security, futureplanning, retirement funding, etc.

Most think of “money” assecurity for their future. When enough people see that they don’t have anymoney and come to realize they have a substitute that is actually a fraud, therun to real "honest" money (precious metals), will overwhelm the markets.

If you're a firearmsenthusiast, you understand the need to keep a few boxes of ammo on hand fortarget practice and otherwise.

But if you've beenignoring the demand issues bearing down on supply – especially this year – thenyou've probably been confronted with empty shelves for months! Where even asmall supply does exist (often with a 1 box limit) some customers have resortedto wearing a disguise in order to make a second purchase!

Don't be foolish and waitfor this happen to you when trying to get silver.

Act on silver (and gold) for your financialinsurance plan now, because when silver's double-trigger (price-supply) demandexplosion takes place, you don't want to be standing around empty handed!

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.