Silver Short Squeeze?

Is there a silver short sqeeze coming? One has to really wonder after what happened the other day with some of the big silver mining companies. It's no secret that in the investment world that hedge funds along with the Comex have taken advantage of suppressing the price of silver along with the constant short and even naked short selling of some of the major silver miners. This is all happening at the same time that some large wall street hedge funds are on the verge of going bust to the tune of a few billion dollars and are seeking bail outs from other investment bankers.

It all started a few weeks back when a few individuals noticed that a hedge fund had about 85% of the stock in a company called Gamestop shorted. This prompted these individual traders to start buying the stock while telling about another 2.5 million other traders on various chat rooms and social media sites to start buying the stock and before you knew it the stock price of Gamestop was up over 1100% in a matter of days. Of course the hedge fund had to start buying back shares as fast as possible but in the end the one fund was out over 2 billion dollars in the hole.

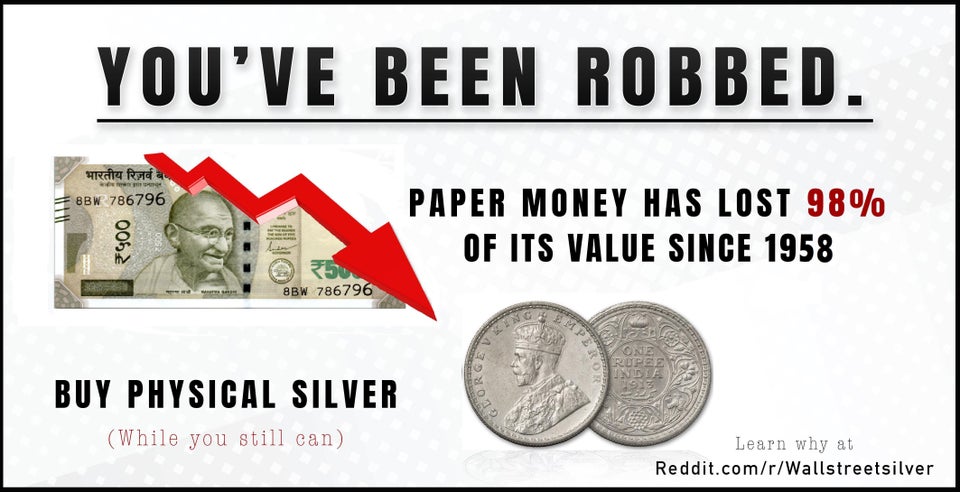

So what's that got to do with silver? Well it all started in the after hours on January 27th when traders started buying up shares in the silver ETF, SLV. This was followed by thousands of independant traders buying stock in First Majestic TSX-FR and Fortuna Silver TSX-FVI. The morning of January 28 saw these stock gapped up setting all new 52 week highs as traders with short positions were forced to buy and cover. Some small traders were talking silver from $25 to $1,000 as a way to crush the monopoly of the comex and get rid of the paper trading as there are over 100 ounces of paper contracts traded for every ounce of physical. This is the main reason why so many silver miners are just eeking by.

On a personal note I like what happened. It's kind of like making the hedge funds grab a taste of their own medicine for a change as gold and silver are some of the most manipulated commodities on the planet while regulators in the industry seem to turn a blind eye. Will silver actually start to rally up in the next while? We'll have to wait and see or else wait until the last bar of physical silver leaves the comex. When you can't buy the real thing, imagine what the price will be or better yet, try buiding solar panels or TV's with paper.

If you enjoyed this article, please feel free to share. When seeking out mining stocks always use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.