Silver Tiny Volume Signal, Big Price Implications / Commodities / Gold and Silver 2018

TheUSD Index reversed in a quite clear way on Friday and gold rallied. It lookedlike a great bullish combination for the precious metals sector, but was itreally one? Gold moved higher on volume that was lowest since the beginning ofthe year and this means that Friday’s rally shouldn’t be taken at its facevalue, but instead it should be closely inspected. Moreover, silver just didwhat was previously followed by big and volatile price moves in all recentcases. What can we really infer from it?

TheUSD Index reversed in a quite clear way on Friday and gold rallied. It lookedlike a great bullish combination for the precious metals sector, but was itreally one? Gold moved higher on volume that was lowest since the beginning ofthe year and this means that Friday’s rally shouldn’t be taken at its facevalue, but instead it should be closely inspected. Moreover, silver just didwhat was previously followed by big and volatile price moves in all recentcases. What can we really infer from it?

Let’stake a closer look (charts courtesy of http://stockcharts.com).

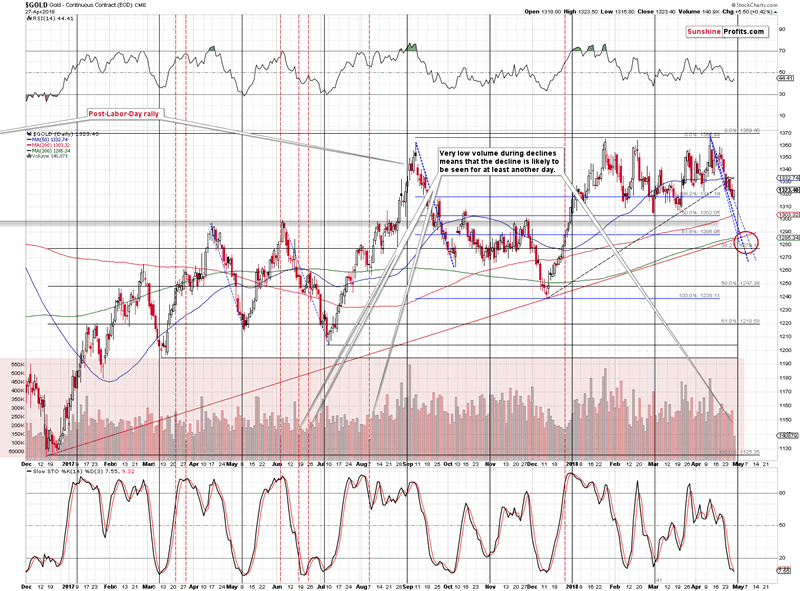

Theimplications of the low goldvolume are entirely different depending on the price action that preceded it and theabove chart shows it. In general, very low volume during an upswing is abearish signal, but before accepting what’s usually the case, let’s check ifthis is indeed the case for the gold market. After all, recklessly applying thegeneral rules like assuming that a rally insilver is bullish (as most analysts do) can be very misleading.

Wemarked all very-low-volume cases on the above chart with red dashed verticallines. Some of them were seen after a rally and some of them were seen after adecline. On average, nothing specific happened after the low-volume sessions butif you focus on the days when we saw very low volume after a decline, we see aspecific pattern. In all cases, golddeclined on the following day.

Therefore,the price-volume action that we saw onFriday supports the bearish outlook, at least for today. That’s important,because the cyclical turningpoint is just around the corner and thus one could expect some kind of rebound thisweek.

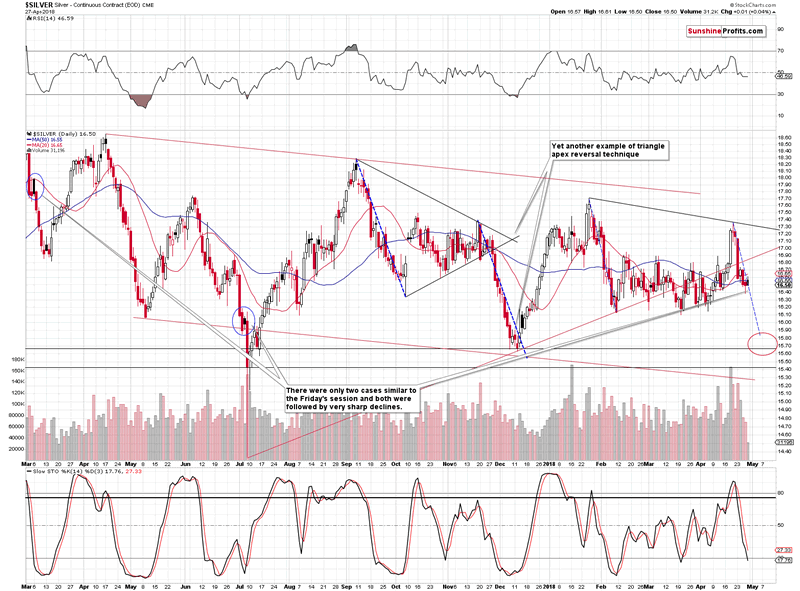

Thesession was even more specific in the case of the silver market.

TheSilver Similarity

Thewhite metal ended the session a bit higher than on Thursday (thus rallying onecent), but it also closed below Friday’s opening price (thus declining on anintraday basis). The Stockcharts website marks such sessions in black. Therewere only two situations in the recent past when the white metal formed similarcandlesticks immediately after a volatile decline: in early March 2017 and inearly July 2017.

In both cases, silver declinedvery significantly in the following days. In particular, in July, silver plunged several dollarsin just one day.

Theimplications are definitely very bearish for the very short term. The same goesfor the fact that neither gold nor silver reached important support levels andthus they should fall further before bouncing temporarily.

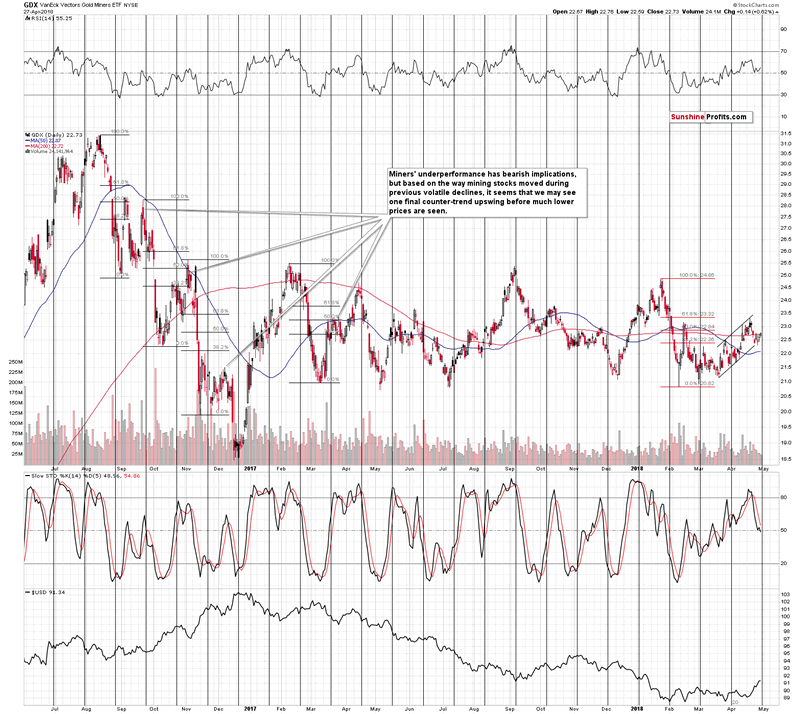

MiningStocks’ Strength

Goldminershave been quite strong recently, but this might actually have bearishimplications here. The reason that you see on the above chart is the cyclicalturning point. Mining stocks formed a very short-term bottom last Monday andthus the most recent move was up. This means that the turnaround that one mightexpect based on the turning point could be to the downside.

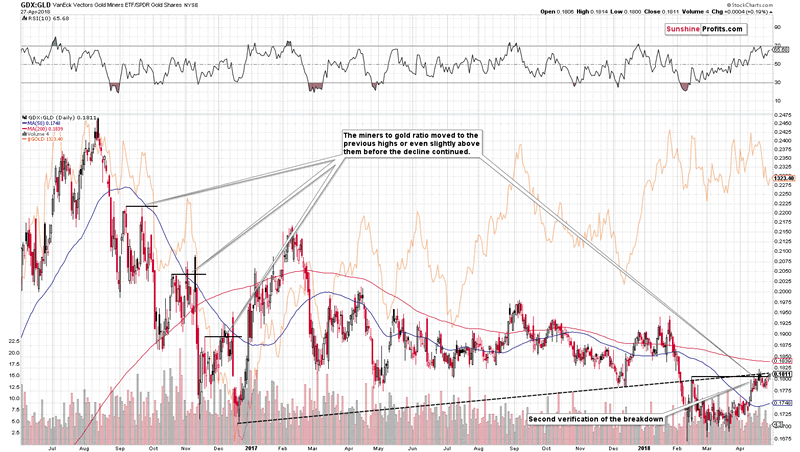

Theother reason is the action in the miners to gold ratio.

TheGDX to GLD ratio once again moved to the rising resistance line and themid-February high. There was no breakout, so the likely action from here –because of the resistance – is a decline. One of the tradingtips for the gold market is that the mining stocks togold ratio often indicates moves in the yellow metal. At this time, it suggeststhat one should focus on the upcoming decline, not a bigger rally.

Summary

Summingup, the situation in the USD Index and the Euro Index suggests that we’ll see acorrection, but due to the specific signals from gold and – especially –silver, it doesn’t seem that this will automatically translate into higherprecious metals values. It’s likely that we’ll see a corrective upswing in thePM sector shortly based on the cyclical turning points and theapex-based-reversal in the euro, but since no major support levels were reachedin gold and silver, it could be the case that the precious metals market willdrop further before forming a temporary bottom this week.

Please note that the above is based on the data thatwas available when this essay was published, and we might change our views onthe market in the following weeks. If you’d like to stay updated on ourthoughts on the precious metals market, please subscribe to our Gold & Silver Trading Alerts.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.