Silver Volume Extreme as in April 2013 / Commodities / Gold and Silver 2018

Duringyesterday’s session silver moved back and forth in a volatile manner on volumethat was the highest since April 2013. There were a few volume spikes in themeantime, but none as big as what we saw yesterday. The silver market is beingvery loud. But are you listening?

Itmay be hard to notice silver’s signs with all that’s happening in the USD Indexand given the rally in gold stocks, but it’s definitely worth it. Let’sinvestigate (charts courtesy of http://stockcharts.com).

The volume in silver was epic. One couldsay that it’s because there was no regular session on Monday, but during theprevious years there were also other cases when there were market holidays andin no other case was the volume this big. In other words, the volume is extremeeven if we take the above effect into account.

However,it is most important that the volume was extremely big – not that it broke afew records. History tends to repeat itself, so the key question is what silverdid after previous sessions when it traded on huge volume.

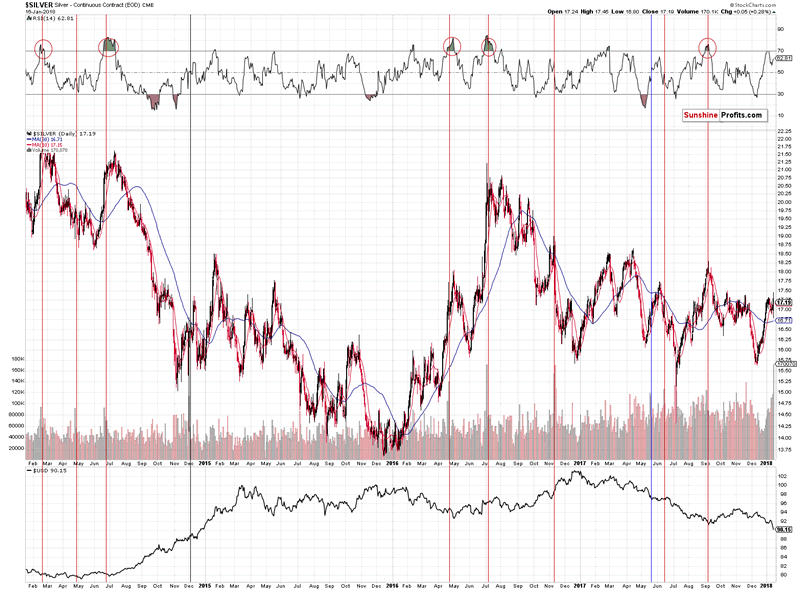

Itusually declined. We marked the similar sessions with vertical lines and weused the red color for the cases when a bigger decline followed eitherimmediately or shortly. The black line represents the session that was notfollowed by anything specific and the blue session was followed by highersilver prices in the short term.

Thered sessions dominate, which makes the current session bearish. However, whatmakes it very bearish is considering the above together with the RSI indicator.The latter shows the status of the market when the huge-volume upswing wasseen.

Wheneversilver moved higher on huge volume when the RSI was above 60, itmeant that a top was in or at hand. We marked those situations with redellipses. The RSI closed at 62 yesterday, which makes the current combinationof signals very bearish.

Hassilver topped based the extreme volume reading? It could be the case, but thisis not what the above chart is saying. It’s saying that a big decline is justaround the corner and paying a lot of attention to bullish signs might bemisleading.

Summingup, there are some bullish signs that catch the gold investor’s eye (the goldstocks’ rally) and we discuss them thoroughly in today’s alert, but they should not betaken at their face value. Silver’s extreme volume reading is not somethingthat should be ignored and it paints a quite bearish picture for the followingweeks.

If you’d like to receive follow-ups to the aboveanalysis, we invite you to sign up to our gold newsletter. You’ll receive ourarticles for free and if you don’t like them, you can unsubscribe in just a fewseconds. Signup today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.