Silver Weekly: Bulls Are Scared

Silver is selling off as bulls are weak.

Speculators covered massively their shorts over April 10-17, the CFTC shows.

ETF investors took advantage of the rally to exit their long positions, FastMarkets estimate.

The rally is delayed but it is still coming.

I continue to consider a long position in SIVR.

Home Alone

Introduction

Welcome to my Silver Weekly.

In this brief report, I wish to discuss my views about the silver market through the ETFS Physical Silver Trust ETF (SIVR).

To do so, I start by analyzing the changes in speculative positions on the Comex (based on the CFTC statistics) and ETF holdings (based on FastMarkets' estimates) in order to draw some interpretations about investor and speculator behavior. Then I discuss my global macro view and the implication for monetary demand for silver. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about silver ETF holdings is from FastMarkets, an independent metals agency that tracks ETF holdings across the precious metals complex.

Speculative Positioning

Source: CFTC

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers were less bearish for a second straight week over the reporting period (April 10-17), during which spot silver prices strengthened 1.0% from $16.69 per oz to $16.77.

Silver's net short fund position - at 2,092 tonnes as of April 17 - dropped a substantial 3,169 tonnes or 60% from the previous week (w/w). This was primarily driven by short-covering of 2,310 tonnes and reinforced further by long accumulation of 818 tonnes. This marked the largest weekly increase in net long positions in silver since December 26, 2017-January 2, 2018 (+3,259 tonnes).

Although the recent move by the speculative community has been violent, money managers remain very bearish in the sense in which they continue to hold a net short fund position.

In this context, I expect the bout of short-covering to have much more room in the coming weeks and months. That said, volatility is to be expected. The recent silver price action is consistent with this view.

Investment Positioning

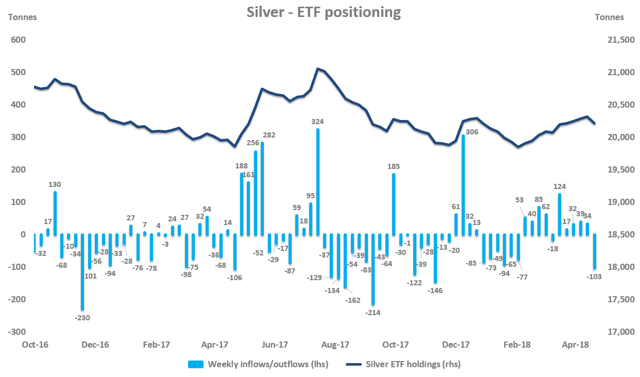

Source: FastMarkets

ETF investors sold ~104 tonnes of silver over April 13-20, during which silver prices rallied 3.8% from $16.47 per oz to $17.09.

This was the first weekly net outflow in 6 weeks. This was the largest weekly outflow since November 3-10, 2017 (a drop of ~146 tonnes).

Silver ETF outflows were concentrated in the iShares Silver Trust (NYSEARCA:SLV), whose outflows totaled ~108 tonnes over the reporting period, corresponding to a drop of 1.1% in SLV holdings.

ETF investors are now net sellers of ~31 tonnes of silver since the start of April after buying a solid 215 tonnes in March.

ETF investors are marginal buyers of ~6 tonnes of silver in the year to date after leaving their holdings broadly unchanged (-2 tonnes) in 2017.

As of April 20, 2018, silver totaled 20,214 tonnes, according to FastMarkets' estimates.

Global Macro View On Silver

In my last week's report (Silver Weekly: Shorts Game Over), I showed that the main force behind the latest silver spike was short-covering, judging by the remarkable fall in the open interest. And this came despite a neutral macro backdrop, that is, no meaningful moves in the dollar and US real rates.

Source: CME, Mikz Economics

According to CME data, open interest in Comex silver dropped a significant 19,627 contracts or 19% last week, during which silver prices rallied 2.8%. This suggests that shorts were forced to close out their positions.

Unfortunately, however, the re-emergence of an increasingly negative macro environment for the precious metals complex, characterized by a solid appreciation in the dollar and a surge in US real rates, has made silver bulls weak, resulting in a sharp wave of long liquidation.

On April 23, silver prices witnessed a sharp sell-off of 3%, during which open interest tumbled 21%, thereby suggesting substantial liquidation from longs. And ETF investors were not present to buy the dips; rather they liquidated roughly ~39 tonnes of silver on that day, which is reflective of the presently cautious investor sentiment toward the shiny metal.

This comes in contrast with my expectations. I have been of the view that the bout of short-covering would give way to fresh buying. But it seems that the combination of a stronger dollar, higher US real rates, and an overall lower investor interest in have-related trades has undermined (for the time being) my friendly outlook for silver.

Nevertheless, it is important to note that silver's spec positioning remains materially stretched on the short side, which suggests that more short-covering is likely in the weeks ahead. And bulls could start extending their positions instead of taking profit, which would exacerbate the silver rally.

Trading Positioning

I will focus here on the ETFS Physical Silver ETF.

While I do not have a position in this ETF (yet), I think this is the best investment product to take advantage of the (likely) rally in silver prices. As a matter of fact, the SIVR is much cheaper to hold than the SLV, judging by the expense ratio (0.30% for SIVR vs. 0.50% for SLV).

What's the SIVR technical chart telling us?

Source: TradingView

SIVR has failed to sustainably break above its key resistance of ~$16.50, which corresponds to the downtrend line from the 2016 high (red line).

As a result, it is presently retesting its 20 weekly moving average, a weekly close below it could produce a negative sentiment and push SIVR lower toward its uptrend line from the 2016 low (blue line).

Against this backdrop, a bit of patience seems to be warranted at this juncture. Although my technical analysis suggests that a breakout to the upside is very likely in the course of Q2, I do think it is safer to wait a bit more until a clearly bullish configuration emerges.

To sum up, a weekly close above $16.50 is needed in order for SIVR to enjoy a sustainable rally.

Be patient, the SIVR rally is just delayed though on its way.

Final Note

My dear friends, thank so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

![]()

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts