Silver Weekly: Expect Strength In Near Term

Silver has underperformed the precious metals group so far this year.

The speculative community seems to be inclined to reduce their outright long positions.

Investor sentiment toward silver is the most negative across the precious metals complex, Fastmarkets shows.

But the macro backdrop is friendly and seasonal patterns for silver are bullish for the first two months of the year.

Therefore, expect strength in silver to resume in the near term.

Finding Strength, Todd Clark (Saatchi Art)

Introduction

In this brief report, I wish to discuss my views about the silver market through the Aberdeen Standard Physical Silver Shares ETF (SIVR). SIVR is directly impacted by the vagaries of silver spot prices because the fund physically holds silver in London.

To do so, I start by analysing the changes in speculative positions in Comex silver futures contracts (based on the CFTC statistics) and ETF holdings (based on FastMarkets' estimates) in order to draw some interpretations about investor and speculator behavior. Then, I will discuss my global macro view and the implication for monetary demand for spot silver prices and SLV. I will conclude the report by sharing my trading positioning.

Speculative positions on the Comex

The CFTC statistics are public and free. The CFTC publishes its Commitment of Traders report (COTR) every Friday, which covers data from the week ending the previous Tuesday. In this COTR, I analyze the speculative positioning, that is, the positions held by the speculative community, called "non-commercials" in the legacy COTR (which tracks data since 1986).

It is important to note that speculative activity rarely involves physical flows. In fact, it is very uncommon for speculators who trade silver futures contracts to take delivery of the physical on the futures contracts they trade. Speculative activity can have a significant impact on spot silver prices due to the great use of leverage taken by speculators. The changes in speculative positions in silver futures contracts tend to be much greater than the changes in other components of silver demand like industrial demand although the latter accounts for roughly 50% of total silver demand.

Accordingly, the impact of speculative flows on silver spot prices tends to be relatively more important and volatile, which, in turn, affect the value of SLV because the latter physically holds the metal in vaults in London and therefore, have a direct exposure to spot silver prices.

Silver-ETF positions

The data about silver ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex. FastMarkets tracks on a daily basis a total of 15 silver ETFs, whose silver holdings represent the majority of total silver ETF holdings. The largest silver ETF tracked by FastMarkets is the iShares Silver Trust ETF (SLV), whose holdings represent roughly 50% of total silver ETF holdings.

Speculative positioning

Due to the US government shutdown, the CFTC has temporary stopped the publication of its Commitment of Traders report (COTR) since December 21, 2018.

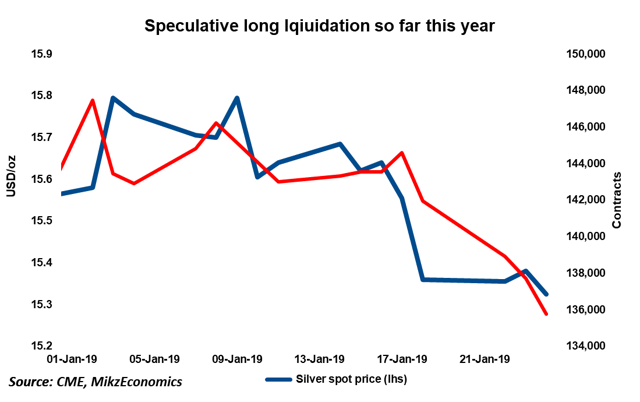

However, let's take at a look at the fluctuations of open interest since the start of the year to conjecture about the speculative community's behavior.

Source: MikzEconomics

The chart above shows that the open interest has steadily fallen alongside lower silver spot prices. Last week (January 11-18), silver spot prices decreased 1.8% while open interest edged 0.7% lower. This implies that the driving force of last week's sell-off was long liquidation.

Investment positioning

Source: Fastmarkets

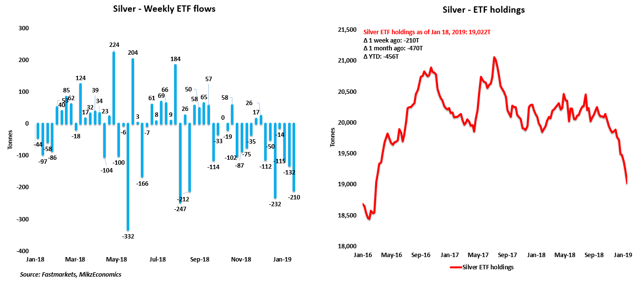

ETF investors continued to slash markedly their holdings last week, according to Fastmarkets' estiamtes.

ETF investors cut their silver holdings by a whopping 210 tonnes, marking a 7th straight week of outflows.

The selling pressure over the past month has totaled 470 tonnes.

And so far this year, ETF investors have liquidated 456 tonnes, marking a 2.3% decline in total silver ETF holdings.

ETF investor behavior toward silver comes in striking contrast with that toward the rest of the precious metals group. For PGMs, ETF investors are neutral although I note a pick-up in ETF inflows into platinum. For gold, ETF investors are bullish, judging by the ~37 tonne-increase in gold ETF holdings so far this year.

This leads me to think that ETF investors are likely to change positively their view toward silver in the very near term. The macro outlook for the precious metals group is likely to be more constructive this year than last year. As I wrote in my latest article on gold (see: Gold: I Stick To My Guns Despite The Seeming End Of Market Turbulence, January 23, 2019):

The degree of US monetary policy tightening seen last year is unlikely to be sustained . While the Fed has guided the market toward a pause in its hiking cycle, it has also stressed the importance of a flexible approach regarding the unwinding of its balance sheet.

Therefore, the dollar and US real rates are likely to move lower in the coming months. And similarly to gold spot prices, silver spot prices tend to exhibit a strong negative co-movement with the dollar and US real rates This means that silver spot prices should move higher in the course of 2019.

Seasonality

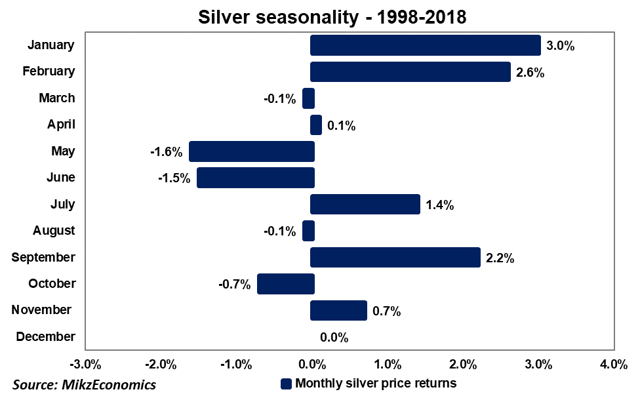

Finally, seasonal patterns are quite friendly for silver in the first two months of the year.

Source: MikzEconomics

the past 20 years, silver has returned an average gain of 3.0% in January and 2.6% in February.

Trading view

Long-term investors, looking to capture silver's attractive value, may consider ETFS Physical Silver ETF - SIVR

The ETFS Physical Silver ETF - SIVR - Review

Long-term investors, looking to capture silver's attractive value, may consider ETFS Physical Silver ETF - SIVR

SIVR is an ETF product using a physically backed methodology. This means that SIVR holds physically silver bars in HSBC vaults.

The physically-backed methodology prevents investors from getting punished by the contango structure of the Comex silver forward curve (forward>spot), contrary to a futures contract-based methodology.

SIVR has $323 million in assets under management while the average daily volume is $1.7 million. Its average spread (over the past 60 days) is 0.08%, which allows financial markets to get in and out of their positions at a cheap cost. Its median tracking difference (over the past 12 months) is -0.28%, which is fairly accurate.

For long-term investors, SIVR seems better than its competitor SLV, principally because its expense ratio is lower (0.30% for SIVR vs 0.50% for SLV), which is key to make profit over the long term.

For the sake of transparency, I will update my trading activity on my Twitter account.

![]()

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts