Silver Weekly: Rally Set To Intensify

Despite its year-to-date gain, silver underperforms its complex.

Speculators express a strong buying interest in Comex silver.

ETF investors resumed their buying last week. But they remain net sellers on the year.

I expect the rally in silver prices to intensify in the near term.

Rally 1, Marino Chanlatte (Saatchi Art)

Introduction

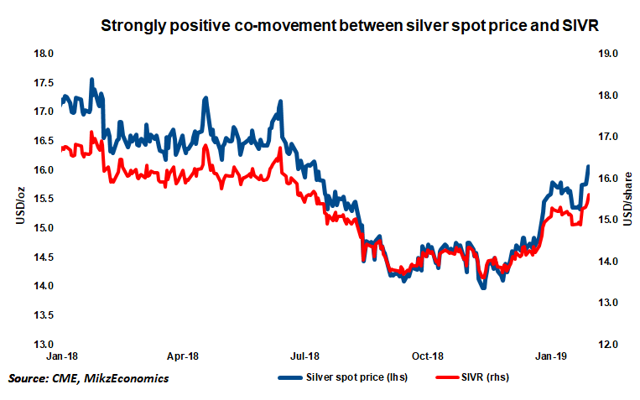

In this brief report, I wish to discuss my views about the silver market through the Aberdeen Standard Physical Silver Shares ETF (SIVR). SIVR is directly impacted by the vagaries of silver spot prices because the fund physically holds silver in London.

To do so, I start by analysing the changes in speculative positions in Comex silver futures contracts (based on the CFTC statistics) and ETF holdings (based on FastMarkets' estimates) in order to draw some interpretations about investor and speculator behavior. Then, I will discuss my global macro view and the implication for monetary demand for spot silver prices and SLV. I will conclude the report by sharing my trading positioning.

Speculative positions on the Comex

The CFTC statistics are public and free. The CFTC publishes its Commitment of Traders report (COTR) every Friday, which covers data from the week ending the previous Tuesday. In this COTR, I analyze the speculative positioning, that is, the positions held by the speculative community called "non-commercials" in the legacy COTR (which tracks data since 1986).

It is important to note that speculative activity rarely involves physical flows. In fact, it is very uncommon for speculators who trade silver futures contracts to take delivery of the physical on the futures contracts they trade. Speculative activity can have a significant impact on spot silver prices due to the great use of leverage taken by speculators. The changes in speculative positions in silver futures contracts tend to be much greater than the changes in other components of silver demand like industrial demand although the latter accounts for roughly 50% of total silver demand.

Accordingly, the impact of speculative flows on silver spot prices tends to be relatively more important and volatile, which, in turn, affect the value of SLV because the latter physically holds the metal in vaults in London and, therefore, have a direct exposure to spot silver prices.

Silver-ETF positions

The data about silver ETF holdings are from Fastmarkets, an independent metals agency which tracks ETF holdings across the precious metals complex. Fastmarkets tracks on a daily basis a total of 15 silver ETFs, whose silver holdings represent the majority of total silver ETF holdings. The largest silver ETF tracked by Fastmarkets is the iShares Silver Trust ETF (SLV), whose holdings represent roughly 50% of total silver ETF holdings.

Thesis

Source: Thomson

While silver has appreciated by nearly 3% since the start of the year, it has underperformed its peers, with gold up nearly 4% over the corresponding period.

As a result, the gold/silver ratio - at 84 - has pushed higher since year-start although it remains below its last year high of 86.

Considering its historical average of 60, I am of the view that silver is attractive from a value vantage point. Its performance could surprise to the upside in the course of 2019.

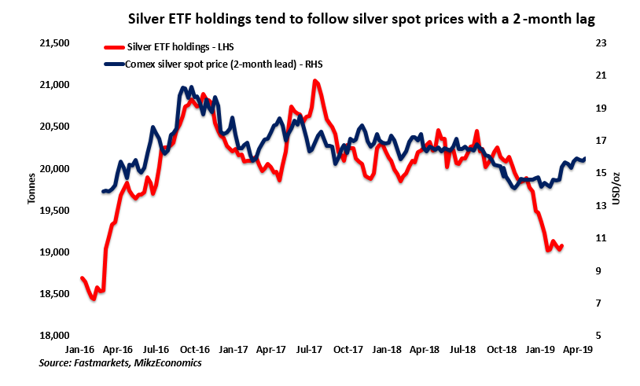

While ETF investors have preferred to liquidate their holdings so far this year, speculators have expressed an increasing buying interest.

Because ETF investors are likely to resume their silver buying in the near term and the speculative community is likely to continue to extend its net long positioning, I expect the rally in silver prices to intensify in near term, which will benefit SIVR, given the strongly positive co-movement between the Fund and silver spot prices, as the chart below illustrates.

Source: CME

The rationale makes sense. Because the Fund holds physical silver bars, any appreciation in the silver spot price produces a concurrent appreciation in the value of SIVR.

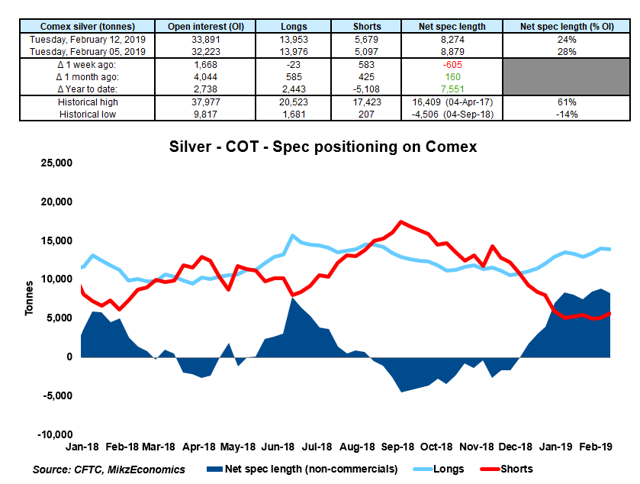

Speculative positioning

Source: CFTC

According to the latest CFTC data (released on February 26), the net speculative length in Comex silver has increased significantly by 7,551 tonnes in the year to February 12.

This has been primarily driven by short-covering (7,551 tonnes) and further reinforced by long accumulation (2,443 tonnes).

Currently, at ~24% of its open interest, the net spec length in Comex silver remains far below its historical high of 61% of its open interest established in May 2002. This, therefore, means that there is plenty of dry powder for deployment by the speculative community.

I expect further speculative buying in the remainder of H1 until silver's spec positioning becomes stretched on the long side.

This wave of silver's speculative buying should push Comex silver spot prices much higher, thereby supporting the value of SIVR.

Investment positioning

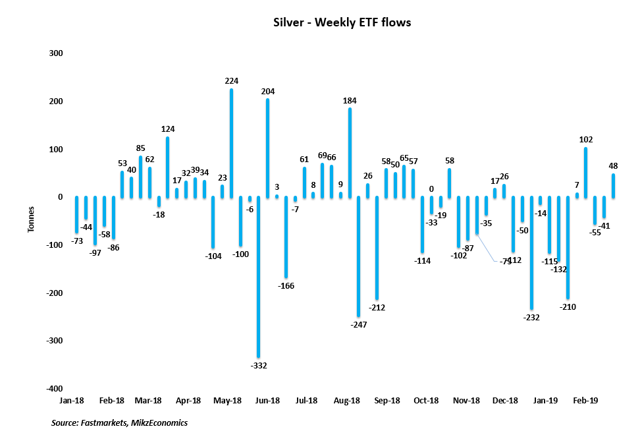

Source: Fastmarkets

ETF investors were net buyers of 48 tonnes of silver last week, for the first time in three weeks.

This confirms my view according to which silver ETF investors will show an increasing buying interest in favor of silver in the near term.

In my previous note (see: Silver Weekly: Rally Has Room To Run, February 19, 2019), I noted:

ETF investors are likely to resume their buying imminently because the positive performance of Comex silver spot prices in January (+4%) should give them conviction that the outlook for silver prices is set to be constructive this year.

The same pattern occurred late in 2015/early 2016. Silver spot prices started to rebound late in 2015 and ETF investors started to resume their silver buying a few months later in 2016. Silver ETF investors are, therefore, trend-followers.

As silver spot prices continue to push higher, the divergence between silver spot prices and ETF net inflows, which has deepened meaningfully since year-start, should narrow in the near term.

Source: Fastmarkets

As ETF investors boost their silver buying, the silver spot price will appreciate, which, in turn, will boost the value of SIVR.

Trading view

Long-term investors, looking to capture silver's attractive value, may consider ETFS Physical Silver ETF - SIVR

The ETFS Physical Silver ETF - SIVR - Review

SIVR is an ETF product using a physically backed methodology. This means that SIVR holds physical silver bars in HSBC vaults.

The physically-backed methodology prevents investors from getting punished by the contango structure of the Comex silver forward curve (forward>spot), contrary to a futures contract-based methodology.

SIVR has $323 million in assets under management while the average daily volume is $1.7 million. Its average spread (over the past 60 days) is 0.08%, which allows financial markets to get in and out of their positions at a cheap cost. Its median tracking difference (over the past 12 months) is -0.28%, which is fairly accurate.

For long-term investors, SIVR seems better than its competitor SLV, principally because its expense ratio is lower (0.30% for SIVR vs. 0.50% for SLV), which is key to make profit over the long term.

For the sake of transparency, I will update my trading activity on my Twitter account.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts