Silver - What A Difference A Week Makes

Silver looked bullish for a week.

The dollar ruined the bullish party.

Silver goes back into hibernation.

Technical support and resistance levels are narrowing.

The path of least resistance for silver is in the hands of the U.S. dollar.

Silver tends to provide market participants with many head-fake moves over time. Silver is typically the precious metal that displays the highest level of price volatility. Therefore, the silver futures market often acts as a magnet for speculators, traders, and investors looking for price trends and action. Volatility creates a paradise for nimble traders, and silver has been the Garden of Eden for many at times over the past four decades. In 1980, the price rose to highs of over $50 per ounce creates a frenzy of speculative activity as the notorious Hunt Brothers tried to corner the market and made a small fortune, from a large one.

In 2011, the price of silver moved to just under $50 per ounce setting off another round of speculative activity. Since then, the price corrected significantly reaching a low of $13.635 in December 2015. After a recovery to just over the $21 level in July 2016 following the shock of the Brexit referendum in the U.S., the price of the metal has gone into hibernation. Each time silver rallies, many market participants become all excited that the next big bullish move will emerge. However, that move never seems to come, and many have blamed the subsequent downside corrections on nefarious forces who artificially suppress the price of the precious metal with targeting short-selling. I do not buy into the conspiracy theories that always surround the silver market. It seems to me that silver's habit of disappointing longs is more of a game of musical chairs; when the buying stops, the last buyer is left without a chair and the price cascades to the downside.

Silver looked bullish for a week

April 19, 2018, now seems like years ago when it comes to the silver market.

Source: CQG

As the daily chart of July COMEX silver futures highlights, the price of the precious metal broke out to the upside on April 18 as it moved significantly above the $17 per ounce level for the first time since early February of this year. Silver looked like it was off to the races on the upside and it traded to a peak at $17.425 on April 19 on its way to a challenge of the next level of technical resistance at the late January high at $17.875 per ounce.

In a case of easy come, easy go for the silver futures market, the dollar threw cold water on the rally, and the price declined over the following sessions. By Tuesday, May 1, silver was trading at the lowest level of 2018 as the dollar index broke out to the upside.

The dollar ruined the bullish party

The dollar is the world's reserve currency and the benchmark pricing mechanism for most commodities. Precious metals tend to be most sensitive to moves in the dollar and exhibit an inverse price relationship. When the dollar moves higher, it typically causes the prices of gold and silver to move to the downside. Over recent days and weeks, the dollar has recovered and broke out to the upside causing silver to move below the bottom end of its trading range in 2018.

Source: CQG

As the chart of the June dollar index futures contract illustrates, the greenback had been making higher lows since reaching a bottom at 87.83 on February 16. On May 1, the index broke above its level of critical technical resistance at the January 9 highs at 92.02 and is trading at the highest level of this year. The dollar index moved to a peak of 92.37 on the June contract on the first day of May, and the next technical level stands at the December 12 high of 93.48. On the continuous futures contract, critical resistance for the bear market that began in early 2017 in the dollar is at 95.07, the early November 2017 peak in the dollar index. The dollar ruined the bullish party in the silver market, and now the metal is in danger of going back into a period of extended slumber, and a pattern where is returns to making lower lows.

Silver goes back into hibernation

2018 has been a sleepy year for the silver market as it has traded in a range from $16.00 to $17.705 on the continuous futures contract.

Source: CQG

As the weekly chart shows, open interest has declined from 243,411 contracts on April 2 to its current level at 193,383 as of April 30. Open interest is the total number of open long and short positions in the COMEX silver futures market, and the decline is a sign that market participants are looking for opportunities in other markets these days. Additionally, price momentum has shifted to the downside after the price failure over the past two weeks. The silver market looks like it is going back into hibernation and the false break to the upside has led to a break on the downside which occurred on May 1. Time will tell if the current weakness in the precious metal is yet another false technical signal. The price of silver made a marginal new low for the year on Tuesday and closed a bit above that level. Silver looks as bad on the lows of May 1 as it looked good on the highs on April 19.

Technical support and resistance levels are narrowing

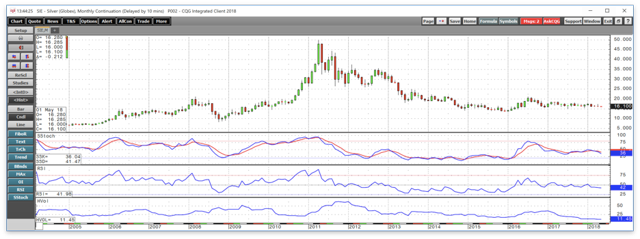

The monthly chart for COMEX silver is a picture of a market that is sleeping.

Source: CQG

Silver is searching for direction on a long-term basis these days, it looks great on rallies and awful on dips. The technical metrics on the daily chart are in neutral territory when it comes to both price momentum and strength. However, monthly historical volatility has dropped to 11.45 percent, which is the lowest level since 2001 when the price of the metal was below $5 per ounce. The price range in silver since late 2015 has been from $13.635 to $21.095, but since the start of 2017, it has narrowed to $15.15 to $18.64 per ounce. The $7.46 range has narrowed to $3.49 as interest in the silver market has declined.

The path of least resistance for silver is in the hands of the U.S. dollar

Silver follows both the price of gold and the dollar which is also highly sensitive to moves in the U.S. currency. On May 1, the yellow metal also fell to its lowest level of the year when it traded at lows of $1302.30 per ounce. Both precious metals are likely to take directional clues from the dollar over coming sessions, and the trend in the greenback has turned higher. However, currencies rarely move dramatically on a percentage basis, and the medium-term trend in the dollar has been bearish since reaching a high of 103.815 in early January 2017. It is likely that rising interest rates in the U.S. and static short-term interest rates on the euro currency are causing the rebound in the dollar. However, the U.S. administration has not been shy about their desire for a weaker dollar to enhance the competitive advantage of U.S. multinational companies on the global landscape. My bet is that the dollar will run out of upside steam sooner, rather than later and that will lead to a rebound in the prices of both gold and silver. Silver, the more volatile of the two, is likely to move the most on a percentage basis.

Source: Barchart

USLV is the triple leveraged silver ETN product that magnifies the price moves in the COMEX futures market and the SLV ETF vehicle. I have been a buyer of USLV on price weakness and will continue to add to my position so long as silver remains above its lows since the beginning of 2017 at $15.15 per ounce. I believe that the silver market reached lows on May 1 in anticipation of hawkish comments from the FOMC at their monthly meeting which will come out on May 2. Silver and gold have typically moved lower coming into these meetings. However, I do not expect the central bank to increase the Fed Funds rate at today's gathering, and a rebound in the price of precious metals a dip in the dollar index could be the high-odds play.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. More than 120 subscribers are deriving real value from the Hecht Commodity Report.

Disclosure: I am/we are long USLV.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Follow Andrew Hecht and get email alerts