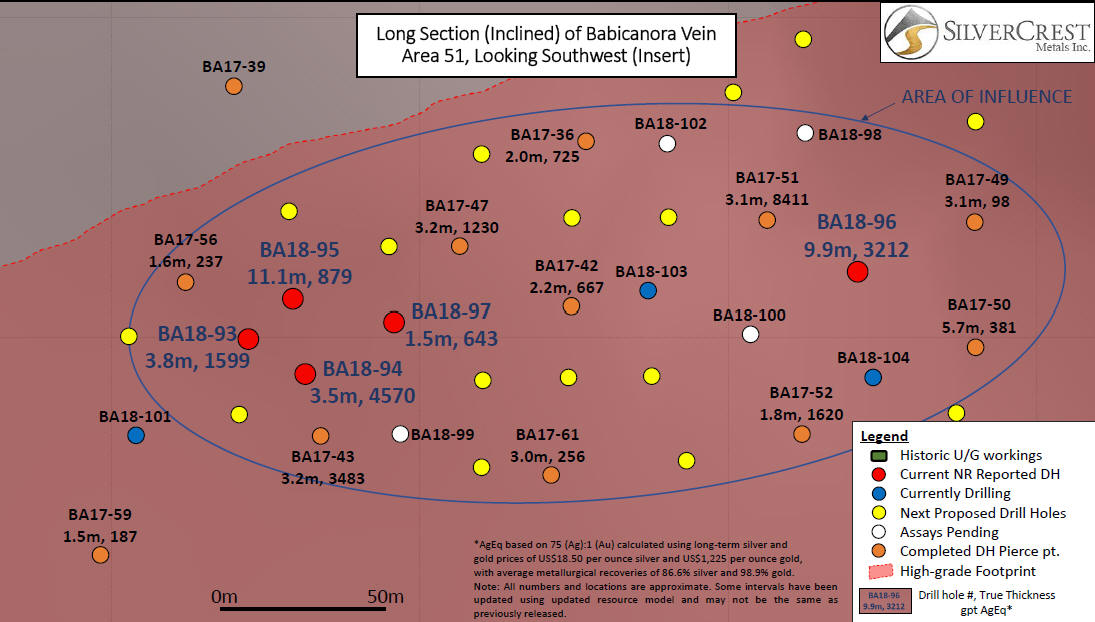

SilverCrest Reports Best Drill Hole Intercept to Date, More High-Grades at Las Chispas; 9.9 Metres Grading 3,212 gpt AgEq, 3.5 Metres Grading 4,570 gpt AgEq, 11.1 Metres Grading 879 gpt AgEq

Note: all numbers are rounded.* AgEq based on 75 (Ag):1 (Au) calculated using long-term silver and gold prices of US$18.50 per ounce silver andUS$1,225 per ounce gold, with average metallurgical recoveries of 86.6% silver and 98.9% gold.**UB signifies an underground core hole. BA is a surface core hole.

All assays were completed by ALS Chemex in Hermosillo, Mexico, and North Vancouver, BC, Canada.

Holes BA18-93 to 97 contain variable amounts of coarse argentite, native silver, electrum and free gold. (see Figures)

A comparison of the weighted average grade (uncut, undiluted) and true widths of the previous drill hole results in the "Area of Influence" (see attached Figures) versus the combined previous and new drill hole results shows an increase of 35% in width and 13% in AgEq grade based on the following:

?EUR? Weighted average for previous drill results (10 holes): 2.9 metres grading 9.06 gpt Au and 980.5 gpt Ag, or 1,661 gpt AgEq.?EUR? Weighted average for new drill results (5 holes, table): 6.0 metres grading 11.41 gpt Au and 1,368.9 gpt Ag, or 2,224 gpt AgEq.?EUR? Weighted average for previous and new drill results (15 holes): 3.9 metres grading 10.33 gpt Au and 1,189.8 gpt Ag, or 1,964 gpt AgEq.

This general comparison is based on the first five in-fill holes to be reported in the Area 51 zone. Further in-fill drilling is underway, and initial results may not be indicative of additional future results.

The Company continues its Phase III exploration program with eight (8) drills operating on site, seven on surface and one underground. Drills are focused on expanding mineralization for inclusion in the next updated resource anticipated in Q1, 2019, and in-fill drilling (estimated 25 metre spacing) to reclassify Inferred Resources to Measured and Indicated. An additional 15,000 to 20,000 metres of drilling are planned for inclusion in the next updated resource. Other ongoing site work includes PEA work, final design work for the Area 51 decline, an extensive metallurgical test program, drilling large diameter wells for site water, and permitting for various additional work.

Figure 1: Long Section (Inclined) of Babicanora Vein Las Chispas Property, Looking Southwest

To view an enhanced version of Figure 1, please visit:https://orders.newsfilecorp.com/files/1467/40776_sc2.jpg

Figure 2: Long Section (Inclined) of Babicanora Vein Area 51, Looking Southwest

To view an enhanced version of Figure 2, please visit:https://orders.newsfilecorp.com/files/1467/40776_sc4.jpg

Figure 3: Las Chispas District with Babicanora Plan Map, October 2018

To view an enhanced version of Figure 3, please visit:https://orders.newsfilecorp.com/files/1467/40776_sc6.jpg

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier, CPG, P.Eng, and CEO for SilverCrest, who has reviewed and approved its contents.

ABOUT SilverCrest Metals INC.

SilverCrest is a Canadian precious metals exploration company headquartered in Vancouver, BC, that is focused on new discoveries, value-added acquisitions and targeting production in Mexico's historic precious metal districts. The Company's current focus is on the high-grade, historic Las Chispas mining district in Sonora, Mexico. SilverCrest is the first company to successfully drill-test the historic Las Chispas Project resulting in numerous discoveries. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.