Since the Gold Rally Has Stopped, Can a Reversal Be Expected? / Commodities / Gold and Silver 2022

Gold’s rally was just stopped by theresistance provided by its previous high and its 60-week moving average. Willgold now reverse?

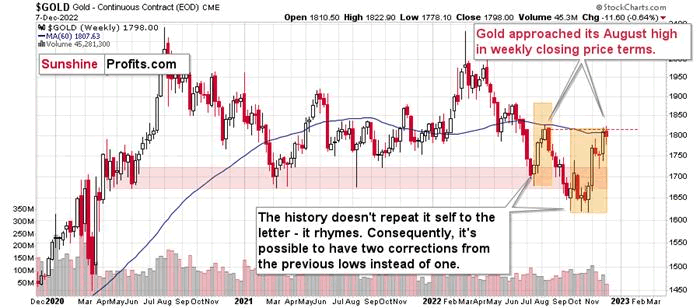

Theabove chart features gold prices in terms of weekly candlesticks. As you cansee, it just approached its August high.

Andgold failed to move above it.

Last week, I wrote:

Theresistance is provided by the weekly closing prices, and since the current weekends today (Dec. 2), it’s likely that gold’s rally was just stopped or that itwill be stopped today.

Theresistance held.

This week is not yet over, so don’t letthe small size of this week’s volume fool you – it’s most likely not the casethat gold is simply taking a breather. Zooming in provides extra details.

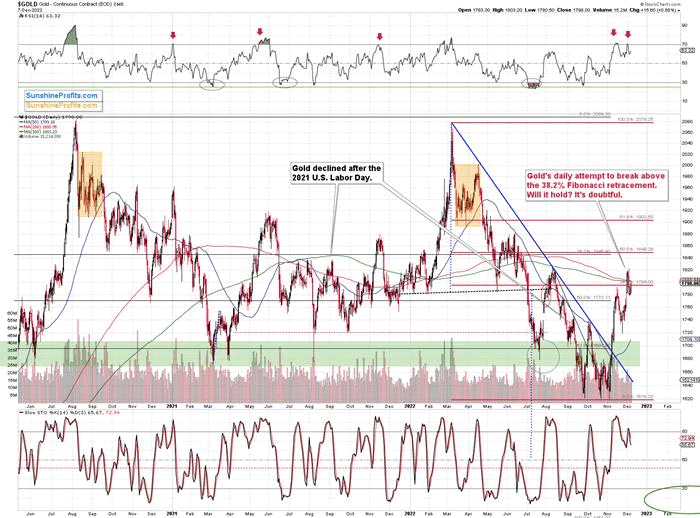

Gold, just like many other markets (i.e., stockprices), recently corrected slightly more than 38.2% of its previousmove. And then it invalidated this small breakout.

During yesterday’s session, gold movedabove this level once again, but only insignificantly so, and given the recentinvalidation, it’s unlikely that gold would be able to rally further.

If you click on the above chart and zoomit, you’ll see that right after the August top formed, gold also made alow-volume attempt to move higher. That was right before the start of the near$200 downswing.

The above happened even without the priorsell signal from the RSI indicator, and since we just saw the latter, a bearishoutcome is even more likely.

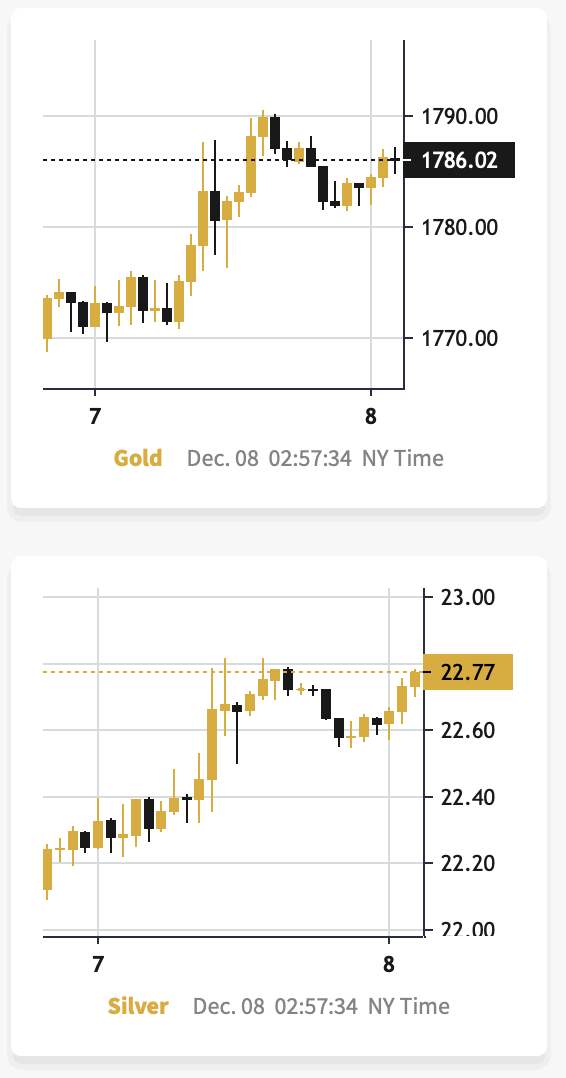

Not to mention another signal from thesilver-to-gold link (chart courtesy of https://goldpriceforecast.com/).

Silver, moved to its yesterday’s intradayhigh, while gold didn’t.

Silver once again moved higher to a much bigger extent than gold did in today’spre-market trading, and while the size of both moves is not huge, it’s somethingthat confirmed the previous indications, and it’s a bearish sign.

Why would silver’s outperformance be a bearishsign?

First of all, because the history showsthat it worked numerous times.

Second, the silvermarket is much smaller, and it’s much more popular with individualinvestors / investment public. The institutions simply can’t buy a lot ofsilver without moving the market, so they are not that interested in it –besides, it hasn’t performed well in the past decade. Individual investors,however, can usually freely enter the silver market, and due to multiplereasons, they often do.

The thing is that the investment publicis often the last to the party – individual investors often buy close to tops,and they sell close to bottoms.

And you can see this in the pricemovement – silver soars relative to gold close to tops in their prices.

Since we just saw it in today’spre-market trading, it serves as a bearish confirmation.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.