Sirius seeks $2bn in government-backed debt for Britain's biggest fertilizer mine

British company Sirius Minerals (LON:SXX), the company building a huge polyhalite mine beneath a national park, is looking to raise up to $2 billion in government-backed debt to finish building its fertilizer project in North Yorkshire.

Delivering preliminary results for 2017, the company said its main focus this year will be securing up to $3bn from banks, including roughly $2bn under the government's Infrastructure and Projects Authority, where discussions are ongoing.

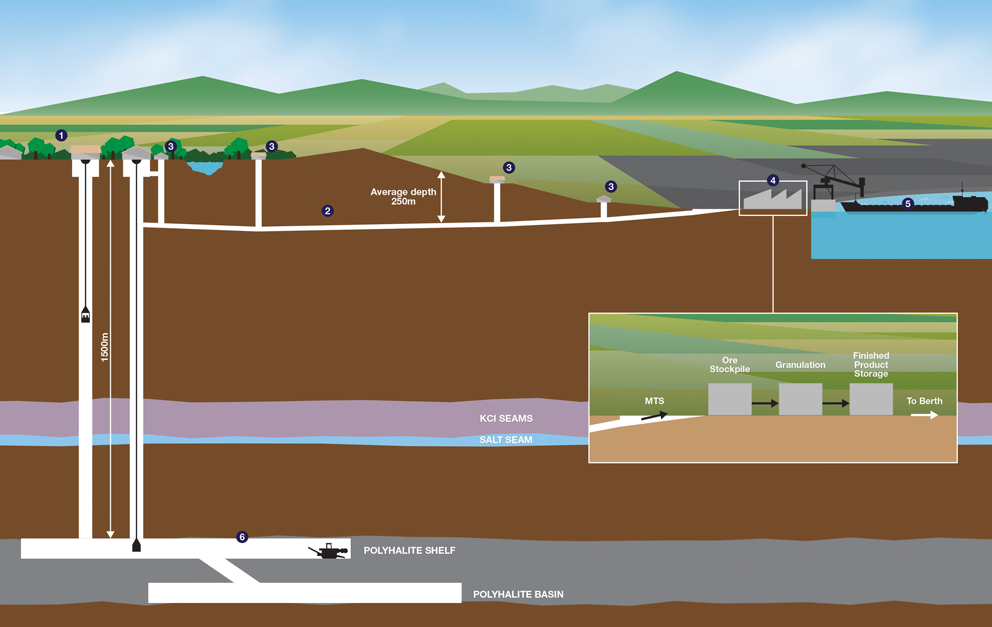

Sirius, which plans to sink two 1,500m deep shafts in the Yorkshire moors this year, expects to close those agreements in the second half of 2018.

Chief executive Chris Fraser said the company already has deals to sell 4.4 million tonnes of the fertilizer a year and is seeking "similar arrangements" with northwest Europe and Brazil. The goal to increase that figure to between 6 million and 7 million tonnes this year.

This is how Sirius plans to extract polyhalite. (Courtesy of Sirius Minerals.)

Britain's departure from the European Union would also open up more direct negotiation with China, where Sirius has already signed supply contracts, he added.

The York mine, poised to be one of the world's largest in terms of the amount of resources extracted, is set to generate an initial 10 million tonnes per year of polyhalite - a form of potash that is used in plant fertilizers -, before it enters a second phase that will double that production to 20 million tonnes a year.

The operation will create about 1,800 jobs during construction and 1,000 permanent positions once it opens, in May 2021.

Sirius reported an operating loss of ?24 million ($33.4m) for 2017 on Tuesday, versus ?16.9m ($23.5m) the previous year, as it began to build its flagship mine.

Potash prices remain depressed due to a global oversupply, but Sirius believes demand for fertilizers will continue growing as farmers look to boost crop yields in order to feed a growing population.