Slow Economic Recovery from CoronaVirus Unlikely to Impede Strong Demand for Metals / Commodities / Metals & Mining

Daily coronavirus casesmay be down in the United States, but that is no reason to be complacent,especially given that cold and flu season is only a few weeks away, says thenation’s top doctor.

In a roundtablediscussion Thursday at Harvard Medical School, Dr. Anthony Fauci warned that“we need to hunker down and get through this fall and winter, because it’s notgoing to be easy.” He compared the pandemic to the early days of HIV in termsof how quickly it escalated, and how it might continue to escalate, if currenttrends of low mask-wearing and social distancing continue. “We've been throughthis before,” he said. “Don't ever, ever underestimate the potential of thepandemic. And don't try and look at the rosy side of things.”

On Friday Dr. Fauci wentagainst President Trump, who in a White House newsbriefing Thursday told MSNBC’s Andrea Mitchell, “I really do believe we’rerounding the corner,” referring to new cases having declined substantiallysince July.

According to data fromJohn Hopkins University, over the past seven days the country has reported anaverage 35,200 cases per day, which is 12% lower than a week ago, and aroundhalf compared to 70,000 cases per day peak in late July.

“I’m sorry, but I have todisagree with that because if you look at the thing that you just mentioned,the statistics, Andrea, they’re disturbing,” he said. “We’re plateauing ataround 40,000 cases a day and the deaths are around 1,000.”

Regarding the latest hotspot, the MidWest, and the looming threat of another covid-19 wave, like what’shappening right now in France and Spain, Dr. Fauci warned, “it’s really quitefrankly depressing to see that because you know what's ahead.”

Tepid globalgrowth

What does lie ahead? As smart investors,always keeping an eye on the horizon, we need to know. In this article, we sumup the world’s condition, especially as it relates to metals demand. What wefind is a mixed bag, of good and bad news.

A recent survey published by NPR found that low-incomeminority households experienced the most financial hardship during thevirus-induced recession. No surprise there. “Racialized” individuals (the newmedia buzzword) ie. blacks, Latinos, Middle Eastern immigrants, etc., are farmore likely to be living in multi-family housing, and working jobs where they areunable to tele-commute.

The study showed amajority of low-income minority households had their savings wiped out,compared to white households and others with incomes over $100,000, whichmanaged to escape financial calamity. The recent expiration of $600 weeklystimulus checks, affecting tens of millions of Americans, has exacerbated thesituation. As Zero Hedge notes, With the economicrecovery stalling and the labor market deteriorating, much of the financialdistress, due to the virus pandemic, has been exerted onto the working poor.

If anything thecoronavirus crisis has exposed the widening gulf between the rich and the poorin the land of the free, home of the brave. As Zero Hedge points out, On one end of thespectrum you've got affluent borrowers locking in record-low rates, whilemortgage originations reached a record $1.1 trillion in the second quarter asrates on 30-year mortgages dipped below 3% for the first time in history inJuly, according to Bloomberg.

At the other end ofthe spectrum, mortgage delinquencies are up 450% from pre-pandemic levels, witharound 2.25 million mortgages at least 90 days late in July - the most sincethe credit crisis, according to Black Knight, Inc.

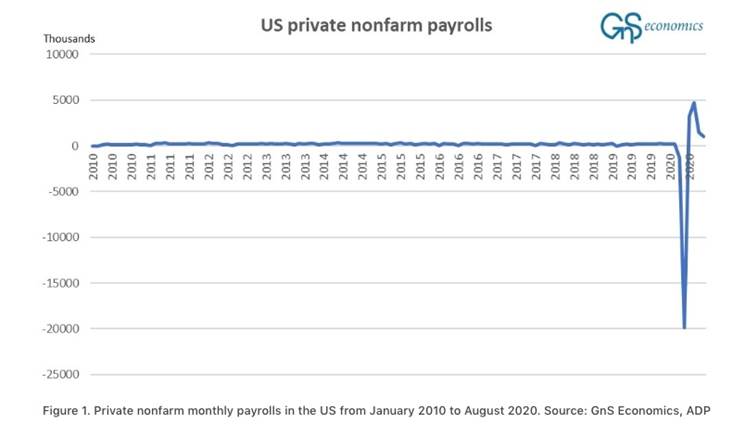

Recovery in the US ishobbled by persistent unemployment. Jobless claims last week were worse thanexpected, at 884,000 first-time filing compared to an anticipated 850,000. Thetotal of those claiming benefits through government assistance programs rose to29.6 million through Aug. 22. Nonfarm payrolls declined by some 22 million atthe onset of the crisis, and about half those jobs have been recovered, CNBC reported. Large corporatebankruptcies saw their largest-ever increase in August, making notableimprovements in employment unlikely.

The Trump Administration’strade war with China, meanwhile, is doing little to swing Trump’s base, andundecided voters, to his casus belli. According to research from the FederalBank of New York, quoted in the South ChinaMorning Post, nearly all the costs of higher import duties were borne by USfirms and consumers.

Moreover, despite takinga hard line on China, including bans on Huawei, TikTok and WeChat,recommendations to delist US-listed Chinese companies, and threats to canceltrade talks, 60% of respondents in the latest Gallup poll disapproved of thePresident’s handling of US-China relations, according to the Hong Kong-basednewspaper.

Beyond the United States,countries that initially recovered from the pandemic, by lifting lockdowns, arenow facing a long period of modest expansion, meaning it will likely take manymonths, if not years, for the global economy to bounce back to pre-pandemiclevels.

For example, the UKeconomy grew 6.6% in July from June, and is projected to gain 15% in the thirdquarter, but output is still 11.7% lower than February. Economists predict itwill take until 2022 for the British economy, which suffered the worst declineamong rich countries during the second quarter, to recuperate. It also won’t beuntil 2022 that the US economy recovers, economists say, following a 9.1%contraction in the three months to June, even though the economy is on track toexpand 7% in Q3 and 1.25% in Q4.

In the eurozone,industrial sentiment has collapsed, while in China, even growing at 4-5%,industrial production is expected to take until the end of the year before itreaches the level it was before the pandemic. Chinese retail sales haven’trecovered as expected, and actually declined in July. Problems in China’soverleveraged banking sector could impede its recovery.

The global economycontracted for a second straight quarter in Q3. Across the Group of 20 leadingeconomies, the 3.4% decline in output during the first quarter, was the largestsince records began in 1998, while the steep second-quarter drop was withoutprecedent since the end of World War Two.

The Wall Street Journalquotes Gilles Moëc, chief economist at the Axa insurance company,saying, “As long as the major economies do not need to get into generalizedlockdown, the economy should continue to mend, but cannot sustain thespectacular rebound seen upon reopening businesses a few months ago. The hardpart starts now.”

Of course, the scope andspeed of recovery is directly tied to the coronavirus, for which hundreds ofpharmaceutical companies are racing to develop a vaccine. IMF Chief KristalinaGeorgieva this week said that a full recovery is unlikely without a vaccine,and warned that the global economic crisis is “far from over.”

Brazil and the UnitedStates have topped the covid-19 charts for months, but India just knockedBrazil off its number 2 position. According to CTV News, India’s 90,802 casesadded Monday pushed its total past Brazil with 4.2 million cases, putting thecountry behind only the United States, where over 6 million people have beeninfected.

India’s economy shrankfaster than any other nation, nearly 24% in the second quarter, following aharsh lockdown in March. CTV states, When Prime Minister Narendra Modi ordered 1.4 billion Indians tostay indoors, the whole economy shut down within four hours. Millions losttheir jobs instantly and tens of thousands of migrant workers, out of money andfearing starvation, poured out of cities and headed back to villages. Theunprecedented migration not only hollowed out India's economy but also spreadthe virus to the far reaches of the country.

Stimulusfailure

Even before the coronaviruscrisis, central banks throughout the world were slashing interest rates tokickstart faltering economic growth. With covid, the floodgates were opened tocolossal levels of fiscal and economic stimulus, in the form of governmentspending and asset purchases by central banks, the latter meant to injectliquidity into flatlining economies.

However growth, anddemand, haven’t kept up with the torrent of “digital” money being created, ie.money-printing.

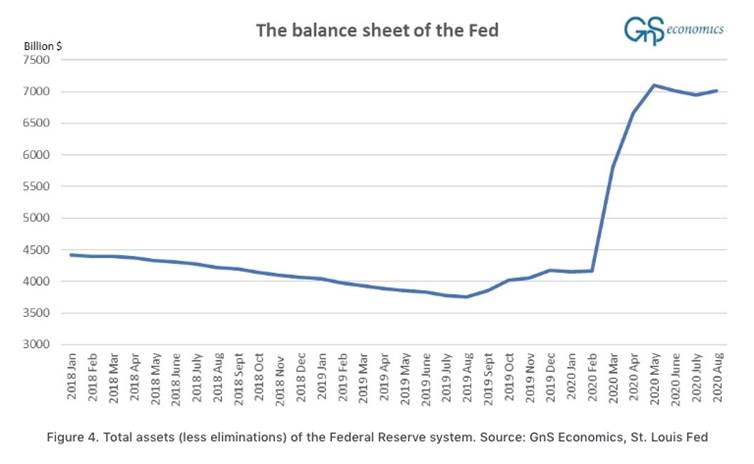

The U.S. governmenthas flooded over $2 trillion into the economy and the budget deficit isexpected to top $3.3 trillion in 2020, the largest deficit as a percentage ofGDP since 1945. The balance sheet of the Federal Reserve has also exploded fromlittle over $4 trillion to over $7 trillion in just a few months (see Figure4). There is just one word for such unprecedented actions: desperation.

Stimulus in Chinahas also broken records. By the end of July,’ the aggregate financing to thereal economy’ had reached an astonishing $3.3 trillion, easily topping theprevious record of $2 trillion set in 2019. In an economy that is alreadyextremely indebted, this is, naturally, completely unsustainable.

There is, quitesimply, no real economic recovery coming. On the contrary, we are headingdeeper into the crisis.

Lower forlonger

“Lower for longer” is the US FederalReserve’s new mantra for the economy which continues to struggle under theweight of the pandemic. This, of course, refers to its policy of low interestrates; the federal funds rate currently floats within a range of 0% to0.25%.

While the Fed normallytargets 2% inflation as a way of keeping the economy in the Goldilocks zone of“not too hot, not too cold,” the central bank recently said it will allowinflation to run hotter, (>2%) to support the labor market and the broadereconomy. This effectively means the Fed is less inclined to hike interest rateswhen unemployment falls, so long as inflation does not creep up as well.

In August the cost of USgoods and services rose sharply, for the third month in a row.

If inflation goes, say,above 3%, yet interest rates remain near zero, that would create bullishconditions for gold - negative real rates (interest rates minus inflation).When US Treasury bond yields turn negative, investors typically rotate theirfunds out of bonds, into gold.

Precious metalsbull

Indeed gold and silverhave been on a tear since mid-March. The factors behind the surges of bothmetals are worrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade and the SouthChina Sea, inflation expectations on the back of (seemingly) unlimited monetarystimulus, and low interest rates worldwide.

Bullion prices haveclimbed 25% year to date, as investors choose gold as a safe haven amid widespreadeconomic uncertainty created by the pandemic. They believe gold will hold itsvalue better than other assets such as stocks and bonds.

Silver in July gained anastonishing 35%, its best performance since 1979, as investors soughtshelter from pandemic turmoil and low or negative interest rates, whileindustrial demand for the metal recovered in some parts of the world.

Soaring debt

Gold is also being helpedby skyrocketing US debt levels, as the federal government scrambles to spendits way out of the pandemic. In a previous article we established thestrong correlation between gold prices and a country’s debt to GDP ratio.

Earlier this month theCongressional Budget Office said federal debt held by the public is projectedto exceed 100% of GDP, for the first time since World War Two (in 1946, US debtto GDP was 106%, after years of financing military operations to end the war).

Put simply, that meansfor every dollar of output, the United States goes $1 in debt, putting thecountry in the same dubious league as Japan, Italy and Greece - nations withdebt loads that exceed their economies.

Recently Alan Greenspanpointed the budget deficit as one of his biggest problems with the US economy.Through July, the federal government’s spending imbalance totaled $2.45trillion, an amount the former Fed Chair said was “getting out of hand.” “Weare if anything underestimating the size of the budget deficits that are downthe road,” he told CNBC’s “Squawkon the Street,” referring to ballooning entitlement spending like SocialSecurity, Medicaid and Medicare, due to “the extraordinary increase in the sizeof the retirement area.”

Copper

Certain industrial metals, despite lower demand, have done quite well in thenew covid-19 normal. Tight supply and strong demand from China have elevatedcopper prices above $3.00 a pound for the first time since 2018. The country’stotal unwrought copper imports this year climbed 38%, to 4.27 milliontonnes.

Physical purchases havebeen supplemented by futures buying. According to Reuters, positioning on theCME’s copper contract is the most bullish since the second quarter of 2018,with money managers lifting their collective bets on higher prices. In the weekto Sept. 1, net longs rose by 6,783 contracts to a fresh two-year high of69,783.

On the supply side,Chilean state-owned Codelco, the largest copper miner in the world, lost 4.4%of its production in July, as the coronavirus forced the company to scale backstaffing, slow projects and turn off a smelter.

As we have reported, without new capitalinvestments, Commodities Research Unit (CRU) predicts mine production will dropfrom the current 20 million tonnes to below 12Mt by 2034, leading to a supplyshortfall of more than 15Mt. Over 200 copper mines are expected to run out ofore before 2035, with not enough new mines in the pipeline to take their place.

Covid-related mineclosures, albeit temporary, are ringing alarm bells throughout the coppermarket and bidding up prices, as investors fret over whether the industry canmeet demand, especially now that China, which consumes 51% of the world’scopper, appears to be back on its feet.

Earlier this month Bloomberg wrote that The global coppermarket could be on the cusp of a historic supply squeeze as Chinese demand runsred hot and exchange inventories plunge to their lowest levels in more than adecade.

On Friday, red metalprices rallied to $3.05/lb, on predictions that Chinese scrap metal importscould fall by half, forcing the country to increase its shipments of concentrateand unwrought copper.

Iron ore

China also consumes vastquantities of iron ore, required for producing steel. The country’s demand forthe steelmaking commodity has driven 2020 price gains to over 40%. According toFastmarkets MB, benchmark 62% Fe fines imported to northern China surged to$129.92 per tonne on Sept. 3 - the highest level since 2014. The country’srecovery from the pandemic is reflected in a healthy Purchasing Managers Index,with the Caixin manufacturing PMI index rising to 53.1 in August, compared to52.8 in July. A reading above 50 indicates economic expansion.

Zinc

Another key industrialmetal, zinc, has benefited from strong Chinese metals demand. While prices fell17.3% during the first quarter owing to pandemic-related uncertainty, priceshave since recovered, with three-month zinc averaging $2,121 per tonne over thefirst eight months of the year. In fact Fitch’s country risk and researchdivision recently revised its forecastfor 2020 up from US$2,100 a tonne, to $2,200/t, driven by Chinesedemand.

US dollar woes

Pushing the commoditiescomplex higher is a weak US dollar. Since its mid-March high, the greenback hasfallen 10%, reversing almost half of the appreciation of the last decade, inonly a few months. The chief culprit has been the US Federal Reserve’s lowinterest rate policy, which has cut the demand for dollars flowing to safehavens like US government bonds.

Geopoliticaltensions

Along with a low dollar,near zero interest rates and forecasts for rising inflation, gold prices arealso driven by economic and political crises, and we are currently in noshortage of these.

Recently we reported onthe “new Cold War” heating up between theUS and China. We have written extensively on the escalating tensions in theSouth China Sea, where China holds historical claims despite internationaltreaties to the contrary (ie. the UN Convention on the Law of the Sea). Ongoingmaneuvers in the waters off its southern coastline demonstrate that Beijing iswilling to flex its muscles in a region it sees as strategically andeconomically critical. China has built man-made islands and constructed portfacilities, military buildings and even airstrips on them.

At the end of August,China launched four medium-range ballistic missiles into the South China Sea,amid broader military exercises by the People’s Liberation Army (PLA). A dayearlier, Beijing protested a flyover by a US spy plane. The Trumpadministration is reportedlystrengthening action against 24 companies that helped set upoutposts in the region.

The United Statessupplies weapons to Taiwan despite not having diplomatic relations with theisland and its government. China sees Taiwan as a breakaway territory that mustbe re-united with the Chinese Mainland; its independence is not recognized byBeijing. A forced reunification would almost certainly cause a war betweenChina and the US; the Americans would never allow Taiwan, a key tentacle of USinfluence in that part of the world, to be overtaken by the Chinese. Yet thereare increasing calls from China to end Taiwan’s independence by the 100thanniversary of the Chinese Communist Party in July, 2021.

On Wednesday andThursday, Chinese military aircraft entered Taiwan’s air defense identificationzone, prompting Taiwan to scramble fighter jets, according to an AlJazeera report.

Meanwhile China iscozying up to Russia, as it has done on numerous occasions historically. Thistime the rapprochement comes in the form of “Caucus 2020”, joint war games in southern Russia which will run in lateSeptember.

Infrastructurespending

One of the mostcompelling arguments for higher metals prices is a global infrastructure push,that could not only replace dangerously aging bridges, roads, sewers and thelike, but put millions of people to work in high-paying jobs. Infrastructurespending may even be the much-needed panacea to the coronavirus.

As we have discussed, inthe US there are two directions a national infrastructure program could take.One is spearheaded by Joe Biden, the Democrats’ nominee to take on Trump in theNovember presidential election. Biden recently announced a $2 trillion climateplan, seeking to boost clean energy and rebuild infrastructure.

Trump also hasinfrastructure on his mind, but it would likely be more black and grey thangreen, focusing on road & bridge replacement, new water/ sewerinfrastructure, public buildings, etc., with some funds set aside for 5Gwireless infrastructure and rural broadband.

The European Commissionhas released a €1.85 trillion recoveryplan focusing on “EU Green Deal” initiatives aimed at reaching the eurozone’s netemissions by 2050 target.

Beijing earlier this yearkicked off a widely anticipated program focused on “newinfrastructure” and “new urbanization”. The plan is expected togenerate $2 trillion in investment over the next five years, targetinghigh-tech infrastructure, including 5G, artificial intelligence, and theindustrial “Internet of Things” (IoT).

Chinesestockpiling

While on the subject ofChinese infrastructure spending, we recently reported on the fact that Beijing is apparently hoardingcopper and other raw materials.

In July, surges inChinese imports of copper and iron ore kicked up prices of those metals tomulti-year highs. Why is China stockpiling commodities? One possibility is thatBeijing is preparing for war.

Obviously we can’t sayfor sure, given China’s opaque statistics, but we suggest a good chunk of thematerials are going into bulking up the Chinese military, in particular itsnavy patrolling the South China Sea.

China began building upits military in the mid-1990s, with the goal of keeping its enemies at bay inthe waters off the Chinese coast.

Long seen to be inferiorto the powerful US Navy, including the Japan-based 7th Fleet, in just over twodecades the People’s Liberation Army has amassed one of the largest navies inthe world. According to an in-depth Reuters feature on the Chinese military buildup,

China now rules thewaves in what it calls the San Hai, or “Three Seas”: the South China Sea, EastChina Sea and Yellow Sea. In these waters, the United States and its alliesavoid provoking the Chinese navy.

This increasedChinese firepower at sea - complemented by a missile force that in some areasnow outclasses America’s - has changed the game in the Pacific. The expandingnaval force is central to President Xi Jinping’s bold bid to make China thepreeminent military power in the region. In raw numbers, the PLA navy now hasthe world’s biggest fleet.

Another intriguingpossibility is that China is using up its US dollar reserves, as a way ofaccelerating a shift to the yuan, cultivating monopolies, or exerting pressureon foreign governments.

Michael Every of Robabanksuggests this in a recent column that ran in Zero Hedge.Every points out that China has announced plans to boost its strategiccommodities reserves to assuage anxiety over energy and food security. Startingin 2021, officials say the country is expected to make “mammoth” purchases ofcrude, strategic materials and farm goods, to avoid a repeat of this year’ssupply disruptions owing to covid-19, or a deterioration of trade relationswith the US.

Actually, those inthe know know that this has already been happening across the board for sometime: China has been swallowing up raw materials and strategic goods far inadvance of what the economy needs right now. That means the drop in otherimports --which are still down y/y overall even including this commoditysurge-- is even larger. (And why aren’t FX reserves rising even as the tradesurplus soars…? Mmmm.)

What possibledisruption could be on the horizon that would require China to have a largeenough buffer of all conceivable inputs --in remote inland areas to boot-- thatit needs to use up its precious USD reserves in a bulk splurge now?

“Geopolitics”, aswe say euphemistically? That hardly suggests the benign, sunny uplands that ECBis going to try to sell today, with its eyes firmly on its own shoes,RBA-style.

It can’t be on*imminent* concerns of the US acting on China’s USD access because all thesepurchases will presumably still be made in those precious USD, even in vastsize,… right? Or is the idea with THAT much buying, a shift to CNY can beaccelerated? For commodity sellers, that’s something to consider. So is thatthis would be a multi-year bull-run – and then a very sharp stop.

Indeed,theoretically China would no longer have to worry about not having enough of X,or Y, or Z; and it could simply stop buying from industry/country X, or Y, or Zfor a year or two if prices were too high,….and watch them collapse,…untilprices were again amenable, or the asset was for sale, or the relevantgovernment ‘came to its senses’ on foreign policy.

Conclusion

As smart resourceinvestors, we want to be invested in metals, and companies, that are at theleading edge of a trend. At AOTH we see gold, silver and copper as THE bestmetals to own right now, considering the multi-trillion-dollar infrastructureprograms being promised by the two presidential candidates, the European Unionand China.

Palladium companies aregood to own too, considering that palladium prices, like gold prices, have heldup well during the pandemic.

As palladium continuesits multi-year run, amid supply constraints, new sources of palladium areneeded to meet demand for gas-powered auto-catalysts, in conventional andhybrid vehicles and thereby help achieve stricter air quality standards.

At the moment inflationisn’t a problem, but if multi-trillion-dollar infrastructure programs come topass, they will be hugely inflationary. The rise in food prices and gas pricesin the US may just be the precursor of what’s to come, when the printingpresses start churning out dollars like never before - far surpassing thequantitative easing programs that followed the financial crisis.

Inflation is good forgold and silver. Ditto for debt. The debt to GDP ratio is a reliable indicatorof gold prices. The ratio is certain to go higher, as more money is printed,expanding the Fed’s balance sheet, while economic growth continues to be pinneddown by the pandemic.

Fiscal and monetarystimulus will have to rise, just to keep people fed, housed and from taking tothe streets; to pay for the big infrastructure spend planned after theelection; and regular spending priorities. It will all be inflationary - greatfor silver and gold.

Interest rates are likelyto stay low for at least the next couple of years. Indeed with a debt to GDPratio over 100%, the government cannot afford to let interest rates rise tohigh – the interest payable on the debt would quickly become unmanageable. Lowinterest rates and rising inflation results in negative real rates – asure-fire catalyst for gold (and silver).

Meanwhile, silver andcopper are on an upward trajectory and will continue to do well under a Bidenor Trump infrastructure push. Clearly, copper with all its green energyapplications will be more in demand under Biden’s plan. Same with silver due toits application in solar panels (millions of them under Biden).

It is remarkable to see abullish case for all three metals, no matter who clinches the presidency inNovember. Owning gold, silver and copper, or better yet, the companies that areexploring for them and offer the best leverage against rising prices, is myinvesting strategy going forward.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.