Slowing China tops global executive fears for the first time

McKinsey and Co's March survey of nearly 2,800 executives shows the mood of those in charge of global corporations taking a decidedly dark turn in the new year.

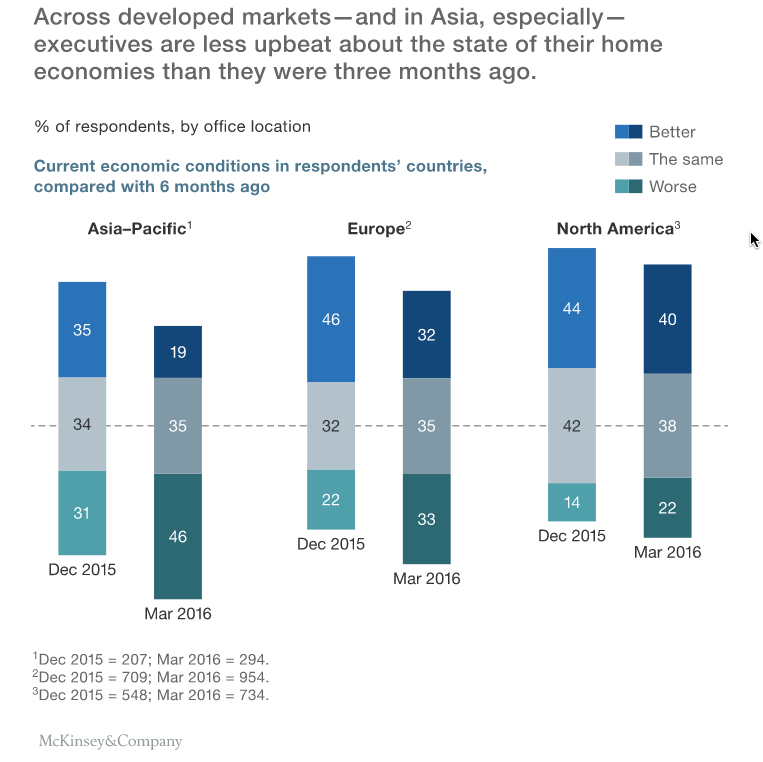

Compared with the previous survey in December, when opinions were buoyant, respondents are now "more likely to report negative than positive views on both global and domestic economic conditions" says the management consultancy.

The notion that things were going pear shaped was most pronounced in Asia-Pacific with nearly half the executives in the region reporting worse conditions over the past six months. In China the mood is most sour with 57% of executives bearish and only 12% noticing an improvement in business conditions.

McKinsey said there was a notable shift in expectations within China a year ago and the gloominess persisted through the year.

Despite the negative sentiment executives in China are keeping the faith in terms of Beijing's GDP growth target of 6.5% in 2016. Fifty-eight percent of respondents there predict the country's economy will expand at this clip. Outside the country there's widespread skepticism with 37% believing targets will be met.

Source: McKinsey & Company

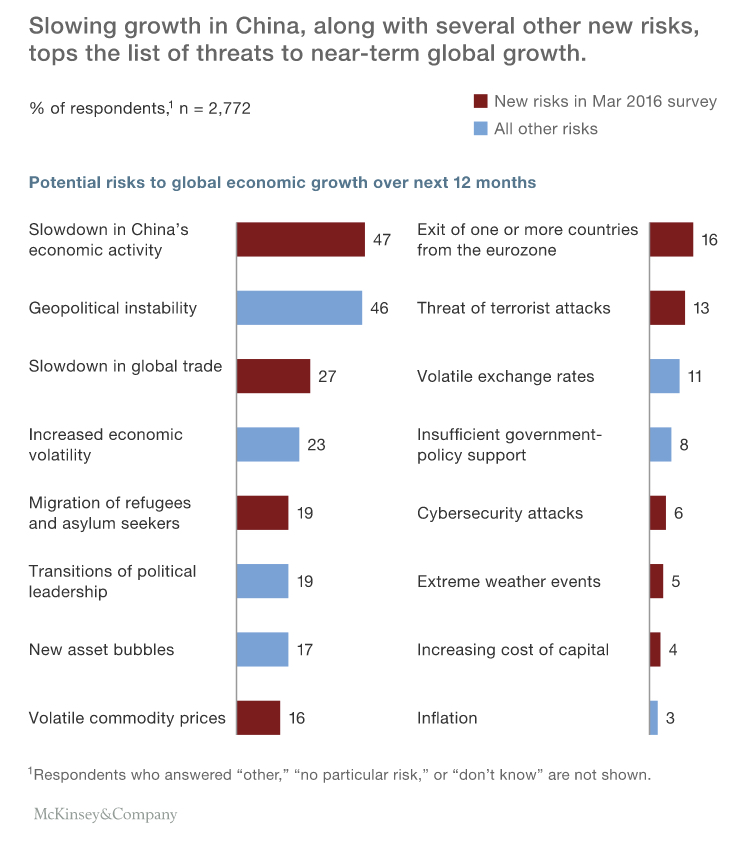

Asked to identify potential risks to global growth in the next year, respondents are "likeliest to cite the slowdown in China-it's cited most often in every region but Europe-followed closely by geopolitical instability", which topped the list of global risks in McKinsey's past eight surveys. Not surprisingly in developed Asia 61% worry about the impact of a slowing China on their domestic economies. Around the world a full quarter of executives said they fear the impact of a break on growth in China on their own economies.

According to the authors when executives consider the longer run, responses differ more by region. "For respondents in developed economies, the likeliest threats to global growth over the next decade are instability in the Middle East and North Africa and debt defaults, while their peers in emerging markets more often point to the withdrawal of foreign investments and the volatility of oil prices."

Source: McKinsey & Company