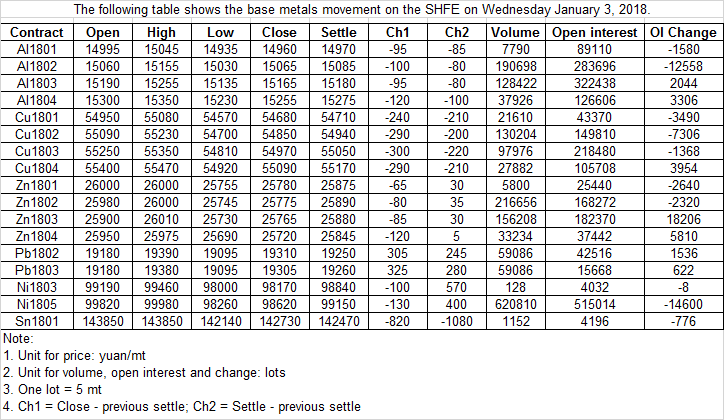

SMM Evening Comments (Jan 3)

SHANGHAI, Jan 3 (SMM)? 1/4 ? Nonferrous metals mostly moved lower today although lead was up 1.6%.

The ferrous complex saw mixed trading with coking coal leading the gain with 2% rise and coke edging up. Rebar, hot-rolled coil and iron ore all dropped close to 1%.

Copper: LME Copper dropped today and is expected to test support at the 10-day moving average. The US ISM manufacturing index in December may set the tone tonight.

Aluminium: SHFE aluminium is expected to move lower in the short term with support of moving averages.

Nickel: SHFE nickel saw an outflow of funds today amounting to 138 million yuan. We expect prices to remain weak tonight when investors would also look out for the US ISM manufacturing index.

Zinc: SHFE zinc traded at high levels today but the bullish sentiment was weaker as physical demand remained sluggish. The contract is expected to trade in a narrow range tonight.

Tin: SHFE tin is set to see some correction following three days or rise as pressure at 145,000-145,800 yuan/mt looms. We see trading range at 144,000-146,000 yuan/mt.

Lead: SHFE Lead price moved above all moving averages and is expected to rangebound at current level tonight. It is also likely to go up towards 19,400 yuan/mt driven by its LME counterpart.

For editorial queries, please contact Daisy Tseng at daisy@smm.cn

For more information on how to access our research reports, please email service.en@smm.cn