So, Where Is Gold's Corrective Upswing? / Commodities / Gold and Silver 2021

Can the precious metals move lowerbefore a short-term correction, and after correcting, will they continue theirmedium-term downtrend?

Gold & silver reversed yesterday(Mar. 2) and the GDX rallied after bottoming right in my previous target area,but it’s still unclear if the bottom is in.

Let’s check what’s happening in thecharts.

Figure1 – COMEX Gold Futures (GC.F)

In short, gold reversed yesterday after touching the upper border or my target area. Can thetemporary bottom be in? Yes. Is it likely to be in? Not necessarily. Mostlikely it’s not in yet, because gold still hasn’t moved to its strong supportlevels.

The size of the first part of the movesometimes tends to be identical or near-identical to the size of the finalmove. The size of the initial, August decline was almost just like the Novemberdecline. Now, copying the January 2021 decline to the current situation (blue,dashed lines), provides us with the target at about $1,675.

The above price area coincides with theprevious 2020 lows, and it’s also slightly below the 61.8% Fibonacciretracement based on the entire 2020 upswing. Gold would be likely to at leastreach this retracement before forming the temporary bottom.

Consequently, it would not be surprisingto see gold suffering another ~$50 decline before finding a short-term bottom.More importantly though, if the initial move lower coincides with an S&P500 correction, it would be likely to push mining stocks and silver lower in amore visible way.

On the bullish front, the shape ofyesterday’s candlestick does indeed look like an intraday reversal. And we sawthe same kind of intraday reversal in silver.

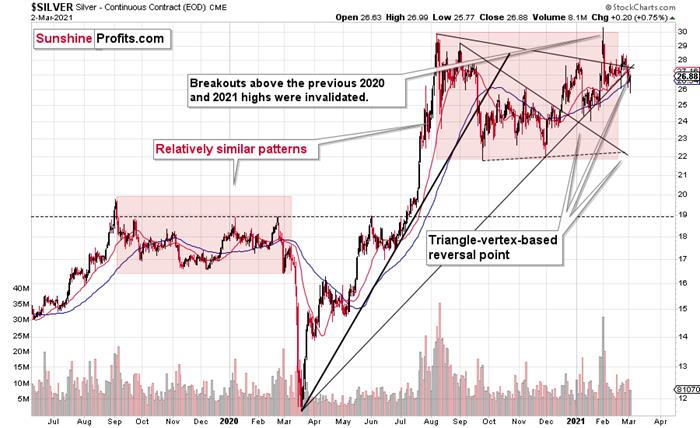

Figure2 – COMEX Silver Futures

The fact that silver’striangle-vertex-based reversal is approximately today / was approximatelyyesterday (it’s unclear) further validates the scenario, in which preciousmetals move higher in the short term.

I previously wrote that silver is likelyto catch up with the decline at its later stage, while miners are likely tolead the way. That’s exactly what we’ve been seeing in the last few months.Silver is still likely to catch up with the declines when silver investorspanic – just as they tend to do close to the end of given price moves (sellingclose to the bottom and buying close to the top). So far, miners remain theasset of choice for trading, but sometime during the next downswing, we mightmove to silver in order to magnify gains from both declines. As a reminder,please consider what happened on March 13 and March 16, 2020 and consider thatthe GDX ETF bottomed (in terms of the daily closing prices) on March 13. Thatwas when silver was only in the middle of its decline.

Speaking of mining stocks, let’s take alook at the GDX ETF chart.

Figure3 - VanEck Vectors Gold Miners ETF (GDX)

The GDX moved higher shortly after wesuccessfully exited our short positions, relatively close to the bottom. But isthis rally about to take miners much higher before they turn south once again?It’s unclear at this time.

It could be the case that we see animmediate move lower once again as gold declines to $1,675 or so, but it couldalso be the case that miners correct to $33 - $34 now, and then move to newlows later.

All in all, it seems that we are alreadyseeing the corrective upswing, or one is about to start after another veryshort-term downswing. Once this corrective upswing is over, the downtrend islikely to resume.

Why would this be the case? There aremyriads of reasons and I’m going over most of them each week in my flagship Gold &Silver Trading Alerts , but to name just a few, it’s gold’sinvalidation of the breakout above its 2011 high, despite having an extremelypositive fundamental picture, gold’s weak performance relative to the USDIndex, miners’ relatively weak performance compared to gold, and themedium-term breakout in the USDX.

And speaking of the USD Index, let’s takea look at its chart.

Figure4

While the medium-term breakout continuesto be the most important technical development visible on the above chart (with important bullish implications forthe following months), there is one factor that could make the USD Indexdecline on a temporary basis.

This factor is the similarity to the mid-2020price pattern. I previously commented on the headand shoulders pattern that had formed (necklines are marked with dashed lines), but that I didn’t trust.Indeed, this formation was invalidated, but a bigger pattern, of which thisformation was part, wasn’t invalidated.

The patterns start with a broad bottomand an initial rally. Then it turns out that the initial rally is the head of ahead-and-shoulders pattern that is then completed and invalidated. This isfollowed by a sharp rally, and then a reversal with a sizable daily decline.

So far, the situations are similar.

Last year, this pattern was followed by adecline to new lows. Now, based on the breakout above the rising medium-termsupport line, such a bearish outcome doesn’t seem likely, but we might see thepattern continue for several more days, before they disconnect. After all, thistime, the USD Index is likely to really rally – similarly to how it soared in2018 – and not move to new lows.

What happens before the patternsdisconnect? The USD Index could decline temporarily.

This means that the temporary bottom inthe preciousmetals and miners could have already formed, but it’s far from beingcrystal-clear.

All in all, markets tend to reverse onlyafter reaching important support or resistance levels, which means that PMs andminers might still move lower before their short-term corrective upswing, butit could also be the case that the latter is already underway. Depending on howmany confirmations we get of the bullish outlook, it might or might not be agood idea to enter temporary long positions here. After all, the medium-termdowntrend started in August 2020 and it remains intact – thus, quick longpositions are against the trend and thus riskier.

Thank you for reading today’s free analysis. Its full version includes details ofour currently open position as well as targets of the upcoming sizable moves ingold, silver and the miners. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Sign up for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.