SPDR Gold Trust ETF: A Regime Change For Gold

Gold trades inversely to real interest rates, the opportunity cost of holding the metal over cash/short-term bonds.

Real interest rates have peaked and are trending lower.

The best scenario for gold is a situation of lower interest rates and rising inflation, thus lower real interest rates.

A Regime Change For Gold

Over the past several weeks, there has been a regime change for the price of gold which is starting a bullish move for the precious metal and its popular ETF counterpart, the SPDR Gold Trust ETF (GLD). I wrote two research notes on GLD which you can find here and here, the first one dating back to August, in which I made the argument for patience on buying GLD and to watch the Federal Reserve for your cue on buying precious metals. In my premium research service, EPB Macro Research, the allocation to GLD was increased over a month ago as this regime change has developed. Over the past few months, I have been getting increasingly bullish on GLD as this regime change has unfolded in the marketplace.

The regime change I am referring to is the trending direction of real interest rates. Real interest rates are the primary driver of the trending direction of gold and the popular GLD ETF that tracks gold, and what I use to gain exposure to the metal. The idea of holding physical gold is great, has many reasons supporting it and is likely a sound investment principle for the masses in some quantity, but this analysis will be for GLD and simply gaining exposure to the price changes in physical gold.

Real interest rates, or nominal interest rates minus inflation expectations, are the opportunity cost of holding gold. If the real short-term interest rate is 0%, or -0.5%, as an example, the opportunity cost of holding gold as money is low as the alternative is a 0% or negative real yield. As real interest rates increase, the opportunity cost of holding gold over short-term interest rate bearing cash or short-term bonds rises, thus lowering the price of gold and GLD.

One very important point to consider throughout this note is that the price of gold and GLD does not correlate to a level of real interest rates but rather the direction of real interest rates. Are real interest rates moving higher or lower? Is the opportunity cost of holding gold increasing or decreasing?

In early 2018, I cut my exposure to GLD before it dropped 10% based on the opposite trends that are occurring today.

In this note, we will discuss the primary drivers of the price of gold and GLD including the Fed, inflation and interest rates, as well as debunk a few common myths along the way.

GLD, The Fed, Inflation & Real Interest Rates

As mentioned above, gold trades inversely to real interest rates. Real interest rates are equal to nominal interest rates minus the inflation rate (or inflation expectations). It is not the level of real interest rates that matters but the rate of change in direction of real interest rates.

If real interest rates are 10%, there is nothing to be done with that information unless you know where real interest rates were before, 15% or 5%?

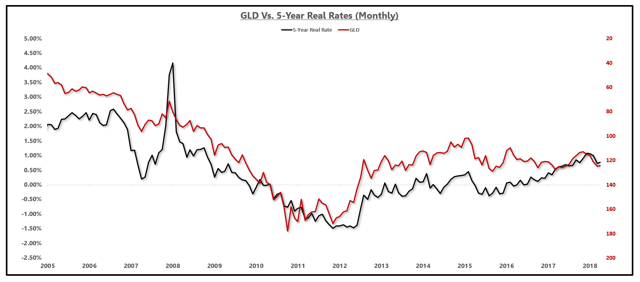

Below is a chart of 5-year real interest rates and GLD (inverted) in which the correlation can be clearly seen.

GLD Vs. Real Interest Rates (Inverted): Source: Federal Reserve, YCharts, EPB Macro Research

Source: Federal Reserve, YCharts, EPB Macro Research

Real interest rates rise when nominal interest rates are rising faster than inflation expectations or when inflation expectations are declining slower than nominal interest rates.

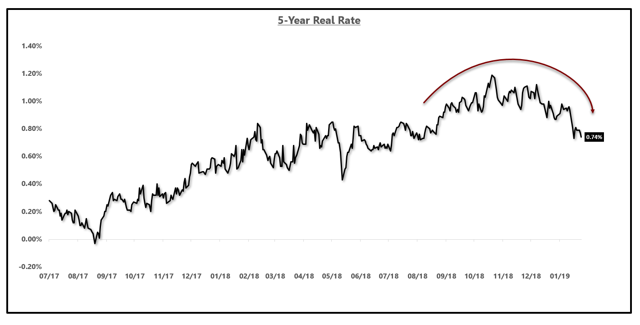

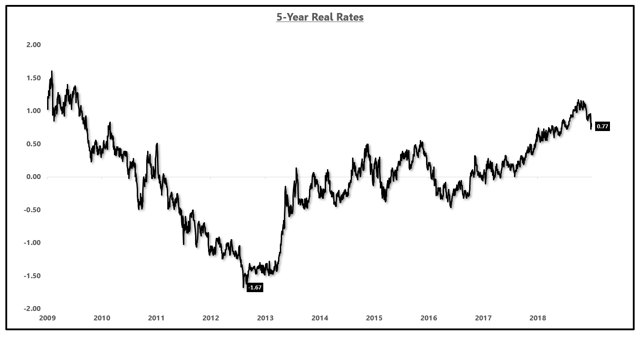

The chart below shows the 5-year real interest rate. Real interest rates were rising throughout 2017 and most of 2018 while the Fed was raising interest rates at a faster pace than inflation expectations were rising.

Now that the Fed has pivoted and the market is confident nominal rates on the short end of the curve are not going higher, real interest rates have rolled over and are heading lower; a very bullish scenario for GLD.

5-Year Real Interest Rates:

Source: YCharts, EPB Macro Research

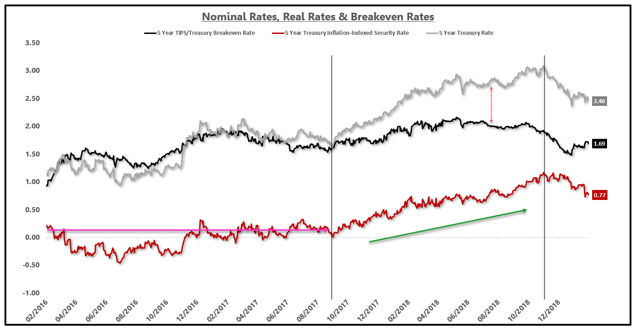

Below is a chart that shows the 5-year nominal interest rate, the 5-year breakeven inflation rate (expectations of inflation) as well as the 5-year real interest rate or the difference between nominal rates and inflation expectations.

The chart is broken into a few distinct phases. First, inflation expectations were rising nearly perfectly in line with nominal interest rates, resulting in real interest rates that moved sideways. In the second time period, interest rates started to rise faster than inflation expectations, resulting in an increase in real interest rates. Today, nominal interest rates are falling faster than inflation expectations resulting in lower real interest rates.

Nominal Rates, Real Rates, And Breakeven Rates:

Source: YCharts, EPB Macro Research

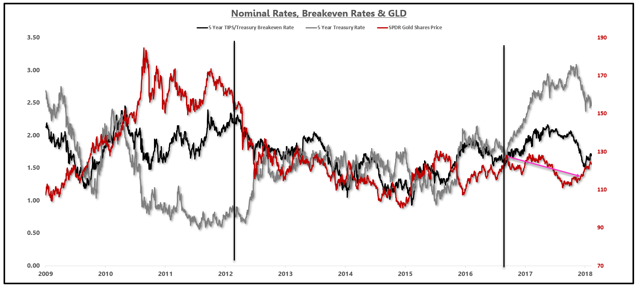

Below is a chart that I presented in the last research note on GLD which breaks this economic cycle into three distinct time periods, updated with the most current data. The chart below compares the moves in nominal rates, inflation expectations, and GLD.

In the first section, inflation expectations (black line) were rising faster than nominal interest rates, creating an environment of falling real interest rates. GLD soared during this time period. In the second phase of this economic cycle, nominal interest rates and inflation expectations moved exactly in-line, resulting in flat real interest rates and GLD moved sideways.

As the Federal Reserve started to aggressively raise interest rates, nominal rates rose faster than inflation expectations, resulting in higher real interest rates and a decline in GLD.

GLD did not reverse until nominal rates started to fall faster than inflation expectations on the dovish pivot from the Fed, resulting in lower real interest rates.

Nominal Rates, Breakeven Rates & GLD:

Source: YCharts, EPB Macro Research

Short-term real interest rates have several moving parts including short-term nominal interest rates which are highly influenced by the expectation of future monetary policy and inflationary expectations.

If we assume that the Federal Reserve is not going to raise rates nor cut rates and the short-term nominal rates stay exactly flat, then inflationary expectations will be the marginal mover of GLD. As short-term rates are dynamic, not constant, the direction of GLD is determined by how interest rates and inflationary pressures move together and the differences in the rate of change.

The idea that rising inflation is good for gold and GLD is a common misconception that I will address below before moving on to discussing the Fed and what to expect.

The Myth - Gold & Inflation: Not Correlated In Insolation

Many investors like to invest in GLD or gold as an inflation hedge but in isolation, GLD and inflation are not correlated, evident by the chart below.

The chart takes the 5-year Treasury rate, inflation, and GLD. From 2016 through the middle of 2018, inflation rose from roughly 1% to nearly 3% but yet GLD traded lower.

If GLD protects you from inflation, then why did GLD fall during a period of rising inflation?

GLD, Inflation & Interest Rates:

Source: Bloomberg

The answer lies in the data above. Inflation was rising, but interest rates were rising faster creating a situation of rising real interest rates and thus, lower prices of gold and GLD.

Inflation is only one part of the equation when investing in gold or GLD. You need to understand the trending direction of both inflationary pressures and short-term interest rates to have a strong ability to forecast gold.

The most powerful force driving short-term interest rates is the Federal Reserve. Unlike long-term interest rates, which the Fed cannot control, the Fed can move short-term interest rates by setting the Federal Funds Rate and also by jawboning about future rate increases. Let's take a look at what the outlook for the Fed is today.

Outlook For The Fed & Short-Term Interest Rates

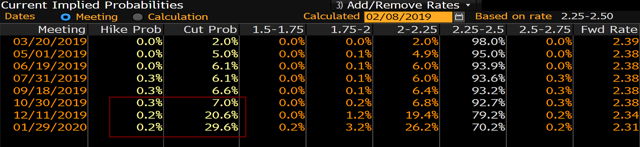

Based on the interest rate probability table below from Bloomberg, which assesses the implied probability of an increase in interest rates by the Fed via Fed Funds futures, there is essentially 0% chance of a rate hike all the way out to January 2020.

The market is actually pricing in a higher chance of a rate cut towards the end of 2019 compared to a rate hike.

Rate Hike Probabilities:

Source: Bloomberg

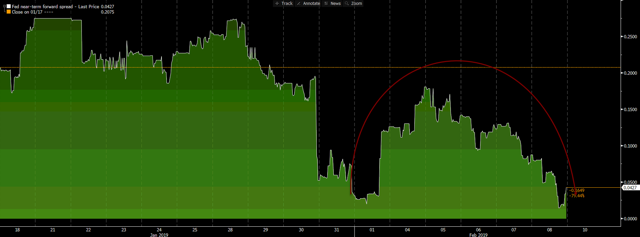

Another measure of monetary tightening expectations is the Fed Near Term Forward spread or the difference between the Treasury rate maturing in six quarters and the Treasury rate maturing in one quarter.

This spread is a good proxy for where the market thinks the 3-month Treasury rate (FF rate) will be one year from today. This spread is only 4 basis points indicating no monetary tightening at all over the next year.

Fed Near Term Forward Spread:

Source: Bloomberg

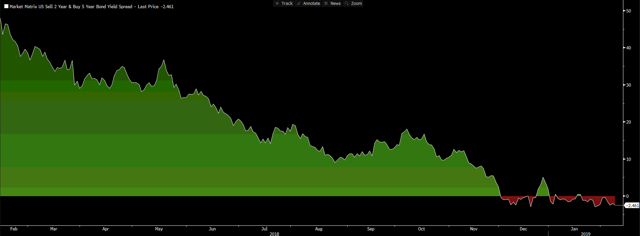

One last measure of monetary tightening expectations is the spread between the 5-year Treasury rate and the 2-year Treasury rate or commonly known as the 2s5s spread.

The 2s5s spread is negative as the 5-year Treasury yield is less than the 2-year Treasury yield.

Rather than looking at this as an indicator, we should consider why the market is giving a 5-year bond a lower yield than a 2-year bond. If you could roll 1-year paper or 2-year paper for five years at a rate higher than the 5-year Treasury bond, who would be buying 5-year Treasuries?

The market does not expect the 2-year rate to stay at this level for long. This is an explicit signal from the market that the Fed Funds rate will be lowered in the near future.

2s5s Spread:

Source: Bloomberg

All of these signs are suggesting that the short-term rates, at the very least, will not be moving higher over the next year and have a higher probability of moving lower.

Short-term rates staying flat or moving lower are bullish, on the margin, for GLD.

If the short-term rates stay flat, GLD will rise from even the smallest increase in inflationary expectations.

If short-term rates are lowered, which there is a strong expectation that they will be in the next year, then for GLD to rise, inflation expectations just need to fall less than short-term rates.

I am not investing in GLD for a short-term trade. This is a cyclical call.

Real interest rates have likely topped out for this economic cycle as the Federal Reserve is no longer going to raise interest rates.

If the Federal Reserve starts to ease monetary policy again, and over the next 2-4 years brings rates back down to 0%, that would be a 250 basis point decrease in short-term rates.

That means inflation expectations would have to decline more than 250 basis points for GLD not to perform well in that environment. Given that 5-year inflation expectations are roughly 1.70% today, that would mean that inflation expectations would have to move into negative territory, or outright deflationary expectations for GLD not to have a positive tailwind from real interest rates.

This is a cyclical call.

The US Dollar? Not The Biggest Factor But Don't Ignore It

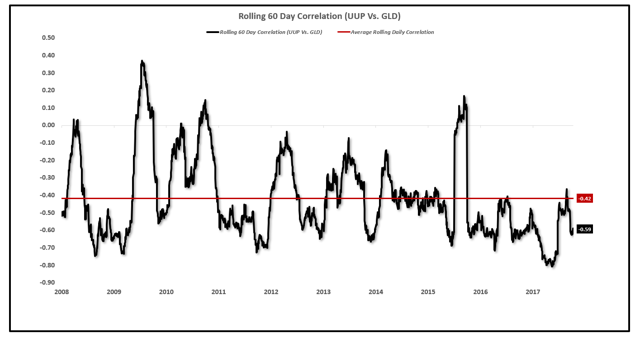

The US Dollar also plays a roll in the direction of gold as the US Dollar and gold, on average, have an inverse correlation. A rising US Dollar has the potential to bring down inflation which can raise real interest rates. A declining dollar is not the biggest factor, but it certainly can help the price of gold. Since 2008, the US Dollar (UUP) and GLD have had roughly a 0.4 inverse correlation with periods of time lower and periods of time with a positive correlation.

60 Day Rolling Correlation (US Dollar Vs. Gold): Source: YCharts, EPB Macro Research

Source: YCharts, EPB Macro Research

The direction of the US Dollar is not as impactful to the price of gold as interest rates are.

If the dollar moves materially, the price of gold may adjust, but small moves in the dollar are not likely to move gold like the direction of real rates will.

One of the major reasons that the US Dollar and GLD have an inverse correlation is due to the dollar's ability to lower inflationary pressures and thus keep real interest rates high. A lower dollar will increase inflationary expectations and thus, all else equal, decrease real interest rates and boost the price of gold.

Conclusion

Gold and GLD thrive with declining real interest rates. Real interest rates are a function of nominal interest rates and inflationary expectations.

Given that the Federal Reserve is not going to raise interest rates anymore and the most probable outcome is that monetary policy shifts to easing rather than tightening, declining inflationary pressures are the only thing to worry about when buying GLD.

If inflation expectations collapse and the Fed does not lower interest rates, GLD will decline because real interest rates will be soaring and thus the opportunity cost of holding GLD is increasing. Investors will shift money into short-term bonds.

If the Fed is done with monetary tightening for this economic cycle, and you have the patience to wait for the easing cycle, short-term rates likely have more room to fall compared to inflation expectations.

Real interest rates were 0% and negative in some cases earlier in this economic cycle.

Real Interest Rates:

Source: YCharts, EPB Macro Research

Look how far real interest rates can decline. Not coincidentally, the peak in GLD and (SLV) was near the bottom in real interest rates.

There has been a regime change in the Fed and in real interest rates. If over the next 2-3 years, real interest rates fall back towards the zero bound, GLD has a massive upside.

There has been a regime change in gold. GLD may not start rising immediately but the cyclical call is that real interest rates have peaked for this economic cycle and thus the downside for GLD is limited while waiting for real rates to move back towards the zero bound.

In order to forecast gold, you need a macro outlook to understand where inflation is going and where short-term interest rates are going.

I was patient on GLD, avoiding the decline for most of 2018. Now is the time to start accumulating GLD for a new cyclical move in GLD over the next couple of years as monetary policy shifts towards easing rather than tightening and real interest rates move back towards the zero bound.

My Full Asset Allocation For 2019

EPB Macro Research uses macroeconomic data to identify inflection points in the economy and provides two asset allocation models that are best suited for the current environment so that your portfolio is always protected from the next downturn.

If you would like to see the complete asset allocation model with exact percentages, consider joining EPB Macro Research.

There is no risk in trying EPB Macro Research for a free two weeks.

Be prepared for the next major market move.

Click Here To Start Your No-Risk Free Trial

Disclosure: I am/we are long GLD, SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Eric Basmajian and get email alerts