Speculators Continue To Short Silver At Historical Levels, But Should Investors Buy?

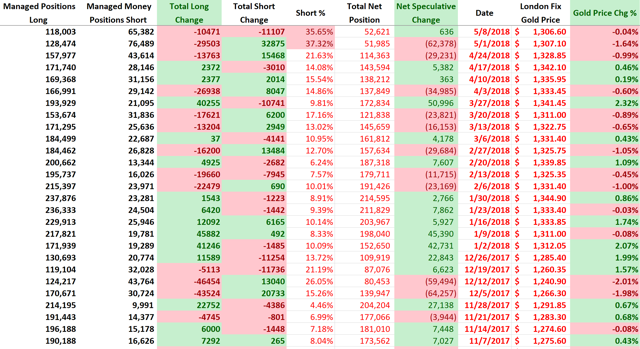

Gold speculative longs cut back positions for the third straight week.

Silver speculative longs increased positions by around 4,000 contracts on the week.

Silver speculators remain short silver by around 20,000 contracts, which is extreme by historic measures.

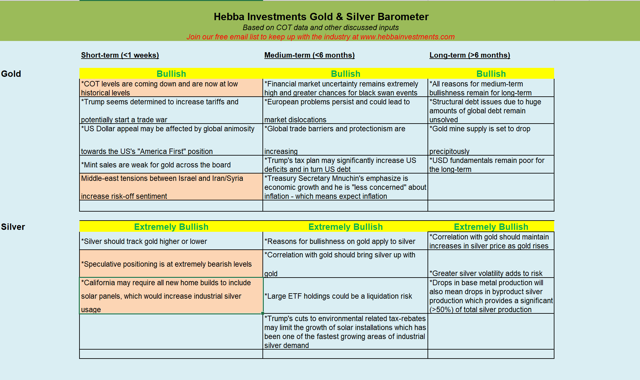

Based on speculative positioning, we remain bullish on gold and extremely bullish on silver.

The latest Commitment of Traders (COT) report showed gold speculators continue their reduction in their long positions as they cut back for the third straight week. Speculative gold shorts also joined the action as they cut their own positions by 11,000 contracts. In silver, which has been our most attractive precious metal, we saw longs increase their net position by 4,000 contracts on the week. But despite this, silver speculators are still net-short by around 20,000 contracts - extremely high by historical standards and why we still are bullish silver.

We will get more into some of these details, but before that let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued it has already missed a large amount of trading activity.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them), so we won't claim to be the experts on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

*Gold price data reflects the COT week (Tues-Tues) not a standard week (Mon-Fri)

For the week, speculative longs decreased their positions by 10,471 contracts for the third straight week, while speculative shorts increased their own positions by 11,107 contracts. Gold closed the COT week (Tuesday) at $1,306.60, which is not far from where it stands for the Friday close, so the COT trader positions are probably very similar to market close positions.

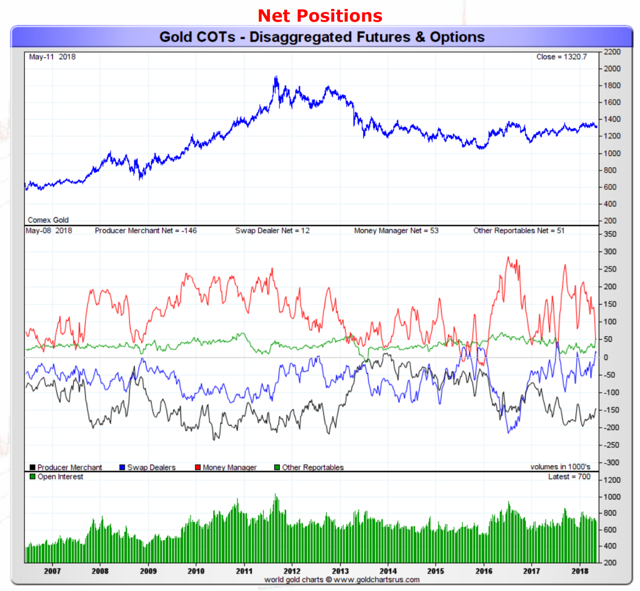

Moving on, the net position of all gold traders can be seen below:

Source: GoldChartsRUS

The red line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, we saw the net position of speculative traders remain around the same levels at 53,000 net speculative long contracts. In terms of the historical range, the speculative positions are now standing at some of the lower levels on the 10-year chart.

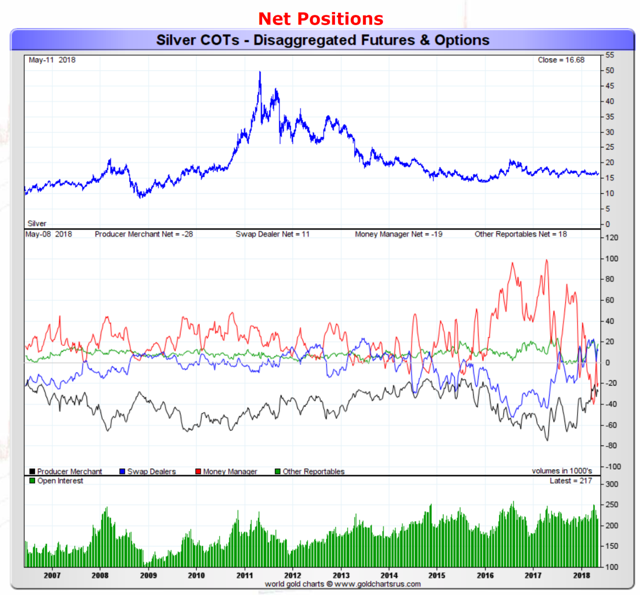

As for silver, the week's action looked like the following:

Source: GoldChartsRUS

The red line, which represents the net speculative positions of money managers, showed the speculative position increase by around 4,000 contracts in silver as speculative longs added to their positions while shorts essentially held their current levels.

Our Take and What This Means for Investors

As we have stated in the past, the biggest value for our trading in the COT report is the view into speculative trader positioning, as they tend to be a quality contrarian signal. This makes sense as they are the traders that are usually the most agnostic regarding their positioning - and thus the quickest to change positioning when momentum changes.

Additionally, this week we saw tensions between Israel and Iran/Syria erupt into violence that rattled investors. While the odds of this turning into a back-and-forth shooting war are low, considering the consequences of something like that, there needs to be a little bit of a risk premium built into investments - which adds to investor interest in precious metals.

Thus, we remain Bullish on gold and Extremely Bullish on silver as we expect silver to outperform gold on a relative basis simply due to the extreme speculative positioning.

We think it is time for investors to consider adding to their gold positions and certainly adding to silver positions through some of the ETFs (SPDR Gold Trust ETF (NYSEARCA:GLD), iShares Silver Trust ETF (NYSEARCA:SLV), Sprott Physical Silver Trust (NYSEARCA:PSLV), and ETFS Physical Swiss Gold Trust ETF (NYSEARCA:SGOL), etc).

Disclosure: I am/we are long SGOL, SIVR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Hebba Investments and get email alerts