Sprint Put Volume Peaks as Stock Soars

FCC Chair Pai threw support behind a Sprint-T-Mobile merger

FCC Chair Pai threw support behind a Sprint-T-Mobile merger

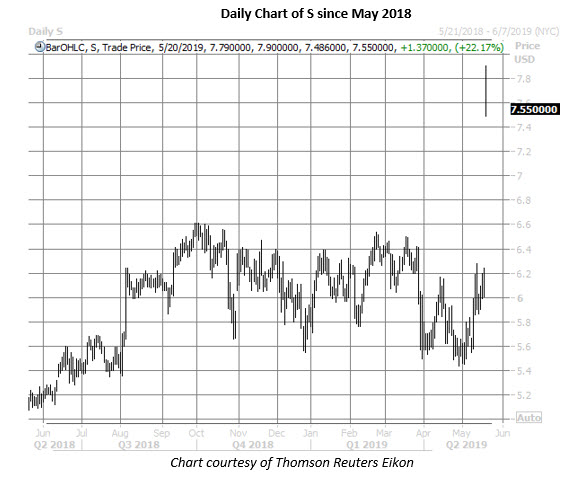

Sprint Corp (NYSE:S) is having a breakout session, with the telecom stock last seen trading up 22.2% at $7.53 -- fresh off a 19-month high of $7.90. Sparking the bull gap is news Federal Communications Commission (FCC) Chief Ajit Pai threw support behind a Sprint-T-Mobile (TMUS) merger, in part due to the telecommunications giants' plans to build a 5G network that will cover 97% of Americans within three years of closing the deal, and agreed not to raise prices over that same time frame.

The $26 billion merger will still need the approval of both the full FCC and the Department of Justice (DOJ) to be finalized, and not even two months ago, Sprint stock sold off on reports the DOJ wasn't enthusiastic over the deal. The shares eventually found familiar support near $5.50-$5.60, near the equity's pre-bull gap levels from August, and are now boasting a nearly 30% year-to-date gain.

Options traders appear to be bracing for a quick retreat for S shares. Amid accelerated put volume -- the 115,8541 contracts traded so far is seven times what's typically seen, and a new annual high -- buy-to-open activity has been detected at the July and August 4 strikes. If this is the case, put buyers expect Sprint to retreat back below the $4 mark over the next few months.

Today's activity echoes the broader trend seen in Sprint's options pits in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio of 3.26 ranks in the 96th annual percentile.

While it's likely some of this activity is at the hands of traditional bears, it's also possible shareholders are initiating an options hedge to protect paper profits against downside risk. Whatever the motive, short-term S options are attractively priced at the moment, historically speaking. The security's Schaeffer's Volatility Index (SVI) of 96% ranks in the 7th percentile of its 12-month range, meaning near-term contracts are pricing in relatively low volatility expectations.