SPY Straddle Traders Pocket Big Gains as Stocks Sell Off

SPY's Bollinger Band width that was at an extreme low at the time of the recommendation

SPY's Bollinger Band width that was at an extreme low at the time of the recommendation

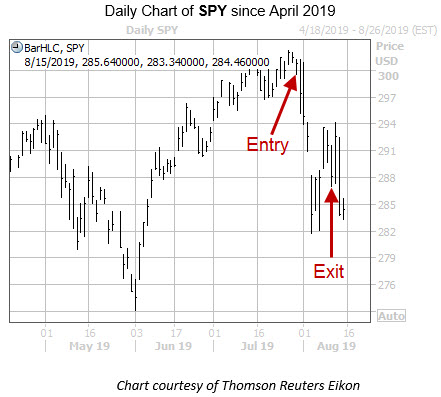

Subscribers to Schaeffer's Weekly Volatility Trader options recommendation service just scored a major profit on the SPDR S&P 500 ETF (SPY) weekly 8/12 301-strike put and call straddle. Below, we'll explain why we expected an outsized move for SPY, and how the winning options trade unfolded.

A straddle is an attractive options strategy when the underlying shares are expected to make a fast and aggressive move, regardless of direction. We initially recommended the SPY straddle to subscribers on Tuesday, July 30 -- ahead of a number of potential market-moving events, including a Federal Open Market Committee (FOMC) policy decision, the August jobs report, and Apple (AAPL) earnings. Major surprises from these events had the potential to spark volatility in the SPY.

Plus, SPY's Bollinger Band width was at an extreme low, which was occurring alongside a rising wedge. Both indicators signaled the possibility of a major move ahead for the shares.

Short-term SPY options were pricing in unusually low volatility expectations at the moment, too, ideal for straddle buyers, considering the two-legged strategy requires buying double premium (on the call and the put). This was per SPY's Schaeffer's Volatility Index (SVI), which ranked in the bottom 12th percentile of its annual range.

It was also encouraging that SPY's Schaeffer's Volatility Scorecard (SVS) registered at 93, out of a possible 100. This indicated the shares had tended to make bigger-than-expected moves in the past year, relative to what the options market had priced in.

Immediately following our late-July recommendation, SPY started making a beeline down the charts, plunging more than 1% on July 31, after Fed Chair Jerome Powell's post-rate cut comments were taken to be hawkish. We closed half of the put position on Aug. 2, to take a partial profit on the trade.

The downside continued into August, with the shares sinking 3% on Aug. 5, as U.S.-China trade tensions ramped up. And while stocks sold off on Aug. 12, as sinking Treasury yields spooked markets, the SPY plunged again. This allowed us to close the remaining half of the put position, and subscribers to lock in a total profit of 118% in just under two weeks.