SSR Mining: Buy The Dip For Increasing Gold Production And A Solid Balance Sheet

The gold and silver miner is profitable, with a solid balance sheet and increasing production.

It raised its full-year gold output guidance and expects all-in costs to trend lower through 2021.

The company has a number of exploratory assets representing upside for reserves and long-term production targets.

SSR Mining Inc. (NASDAQ:SSRM), with a market cap of $1.8 billion, is a Canadian-based gold and silver miner with operations in North and South America. We think SSRM is an interesting pick in the precious metals space given its increasing production, current profitability, and a solid balance sheet. The stock has been a winner in 2019, up 24% year to date, while a pullback from highs may now represent a new buying opportunity. We remain bullish on gold and silver and think SSRM is well-positioned to benefit from the more supportive pricing environment. This article recaps the company's recent financial results and our view on where the stock is headed next.

(Source: Finviz.com)

Q2 Earnings Recap

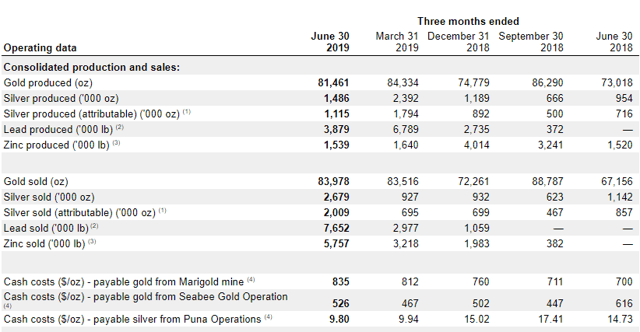

SSRM reported its fiscal Q2 earning on August 8th with non-GAAP EPS of $0.15, which beat expectations of $0.11. GAAP EPS was also positive at $0.09, driven by lower cash costs from its Seabee Gold and Puna operations. Revenues of $155.2 million in the quarter also beat consensus estimates, rising by 49% year over year, with this figure driven by the timing of sales from the company's Q1 inventory build. In particular, silver sold during the quarter reached 2.679 million ounces, up from 1.1 million last year. Gold production reached 81,461 ounces in Q2, up from 73,018 for the period last year. Overall, it was a positive quarter with higher income from mining operations and improved cash flow.

SSRM Q2 Operating Data

Source: Company IR

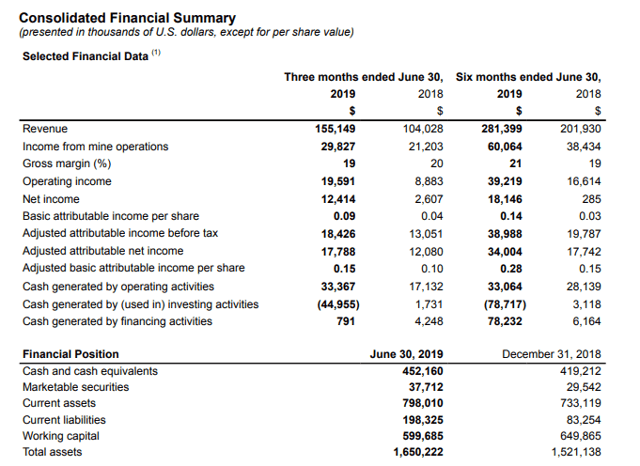

Year to date, revenues are up 39% to $281.4 million from $201.9 million in 2018. Management highlighted that the move higher in gold and silver prices this year largely began in the back half of the second quarter, so the favorable pricing environment is set to continue through its Q3 results. The company's cash position ended the quarter at $452 million, up from $419 million at the end of 2018. The current ratio is 4.0x.

SSRM Q2 Financial Results

Source: Company IR

Currently, SSRM has three mining operations between its Marigold mine in the U.S. state of Nevada, its Seabee Gold operation in Saskatchewan, Canada, and a 75% interest in a silver operation in Argentina known as Puna. Approximately 80% of the company's gold equivalent production is in gold from its U.S. and Canadian mines, while the Puna mine primarily produces silver with smaller quantities of industrial metals like lead and zinc.

The company has historically been active in M&A activities, and this quarter announced its plan to acquire the remaining 25% of its Puna mine in Argentina from Golden Arrow Resources (OTCQB:OTCQB:GARWF) for $34 million. Management is bullish on the opportunity to consolidate ownership of the mine and sees the deal closing by Q4. It's also worth noting the SSRM owns a large undeveloped high-grade silver project in Durango, Mexico, known as Pitarrilla, which is expected to begin drilling in the second half of 2020 pending approvals. The company sees further exploratory and development opportunities in its existing asset portfolio.

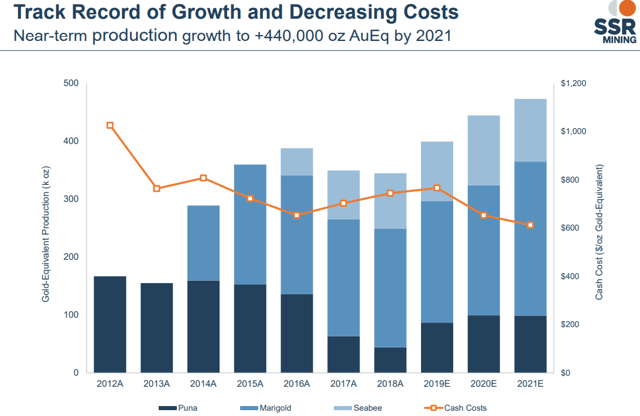

SSRM is on track for higher production for the full year compared to 2018, and this quarter increased its production guidance to 400,000 gold equivalent ounces between its three operations. Management estimates production reaching 440,000 equivalent gold ounces by 2021, while the cash cost is expected to trend lower towards a company record low near $600 per gold equivalent ounce by next year.

(Source: Company IR)

SSRM Analysis and Forward-Looking Commentary

In contrast to many other small- and mid-cap miners in the gold and silver space, we like SSRM because it's profitable with growing production and a relatively solid balance sheet. In our view, this is the trifecta of what investors should be looking for in terms of mining companies that will be able to withstand market volatility and benefit from higher prices. SSRM has a history of meeting production targets and increasing reserves with an experienced management team. The upside to expectations besides higher metals prices are more exploratory discoveries and the potential for better-than-expected margins.

(Source: Company IR)

Taking a step back, it's clear that the performance of SSRM will be dependent on the next move in gold and silver prices, while the recent weakness since September may have shaken the confidence of some investors. Indeed, the stock is down 16% from its recent highs, while the spot price of gold is now below $1,500. Still, from a macro perspective, we think the bull market for precious metals remains intact with a view that prices can move higher irrespective of the broader equity market or financial market conditions.

The main driver we see is the global trend of easing monetary policy from central banks, including the Fed, that remains the base case for the year ahead. Given ongoing global growth concerns, including cyclical weakness from China, gold stands to benefit as a store of value for its "flight to safety" qualities. On the other hand, in the case that global central banks are successful in averting a deeper slowdown, a "renaissance" of global growth from here could lead to a sharp rise of inflation expectations, which would also be bullish for gold and commodities in general. We view the risks to global macro conditions as tilted to the downside considering a host of bearish trends, including geopolitical considerations between the Middle East and the still-unresolved U.S.-China trade conflict that may extend through the 2020 U.S. election. For these reasons, we are staying invested in gold and silver, and view SSRM as a quality pick among junior miners.

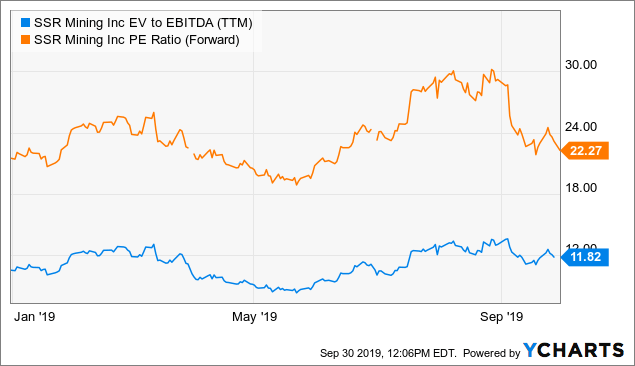

In terms of valuation multiples, SSRM currently trades at an enterprise value of 11.8x EBITDA and at a forward P/E ratio of 22.3x. The forward P/E multiple traded as high as 30x as recently as August, which in part reflects a move higher in the consensus estimates for 2019 earnings. The company is expected to earn $0.65 per share for the full year 2019 based on an average of 9 estimates.

Data by YCharts

Data by YCharts

Takeaway

SSRM, along with the broader precious metals mining sector, has traded with increasing levels of volatility in recent weeks given some improved macro data globally. We think the long-term trend for gold and silver remains bullish and favor high-quality miners with a strong financial position and growing production figures. SSRM is an interesting junior miner in the space with a consolidated operating profile between three main mines that are currently profitable. We see upside as its high-quality asset portfolio presents the opportunity for new discoveries while benefiting from the supportive pricing environment.

Risks beyond downside top gold and silver prices include weaker-than-expected production figures. While the reporting date for the company's Q3 results has not been confirmed, they are expected in the early part of November. Investors should monitor all-in sustaining costs in support of financial margins. Our price target for SSRM is $17.50 for the year ahead, representing about 20% upside from the current level, which would take it back to highs reached in early August.

Disclosure: I am/we are long SSRM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Investing includes risks, including loss of principal.

Follow BOOX Research and get email alerts