Starting to look a lot like Christmas: Is the Fed about to blink?

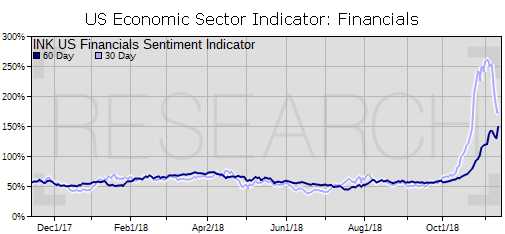

American insiders in the Financials sector sniff change is in the air. Our sector indicator has hit 150% this week which means there are 1.5 stocks in the sector with key insider buying for every one stock with key selling. At this point, the indicator appears to be peaking. An indicator peak implies peak insider buying which often happens around the establishment of significant market support levels.

Our Financials Indicator has not been this high since it peaked in February 2016 when the Fed was in tightening mode. On December 16th, 2015, Janet Yellen had just administered the first Fed funds rate hike (a hefty 0.25%) since the financial crisis. Markets did not like it one bit. Stocks tumbled into the New Year, fretting over the prospect of higher rates going forward. As a chill set over the S&P 500, the Fed got cold feet. Financials insiders started to buy in droves in early February 2016, sensing that the Fed would have a change of heart. And so it did. The Fed put its rate hikes on ice until December 2016. The Financial Select Sector SPDR (XLF) put in a low mid-February of that year and never looked back.

The similarities today with late 2015 and early 2016 are striking. Three years ago we had a Fed in tightening mode. The 2018 Fed is also in tightening mode. However, there is one notable difference: today's Fed is determined to remove, or at least lower, the value of the implied "Fed Put" which is more or less the perceived insurance policy that the Fed provides by standing by to ease financial conditions should the stock market tumble. The question is whether or not they have gone far enough, at least for now, to accomplish their objectives. Since the December 2016 rate hike, there have been 6 additional hikes, three under current Chairman Jerome Powell.

Financials insiders seem to be betting the Fed will pause, and we can understand why. Should the stock market continue to unravel at the current pace, holiday shopping season, which starts a week from Friday, could flop. That could put the Fed's inflation target in jeopardy given that consumer spending makes up about 70% of the US economy. Tack on plunging oil prices, and it's more than Houston that has a problem.

We may have had our first clues of Fed backtracking on Monday when Reuters reported that San Francisco Federal Reserve Bank president Mary Daly said it is too soon to know if a rate hike will be needed next month. That type of statement would be more meaningful if it came from a permanent member of the FOMC. We may get our chance on Wednesday after Fed Vice Chairman Randall Quarles delivers congressional testimony on regulation at 10 AM (live stream via CNBC). While the topic is bank regulation, we would be surprised if he does not get a question about the Fed's take on current stock market conditions. Normally, the Vice Chairman for Supervision does not weigh in on monetary policy. If he delivers some dovish comments Wednesday, it will not be by accident.

If the Vice Chairman does not deliver a dovish message Wednesday morning, Chairman Jerome Powell will have his chance later in the afternoon when he attends a Dallas Fed forum on the global economy starting at 4 PM local time (live streamed).

There is also a significant chance that the Fed is not ready to show its cards just yet. That may help explain why our broad market US Indicator has not yet peaked. In addition, many growth stocks remain relatively expensive. Insiders in those companies may still be more interested in taking profits than taking on more market risk given Fed and trade policy uncertainties.

If the Fed does not send a message that it is considering a slowdown in its tightening plans, we would expect more stock market weakness in which case insiders in the Financials sector may get another unexpected buying opportunity. That said, insiders in the sector have a pretty good read on the Fed which we believe puts the odds of a monetary policy backtrack this week at slightly better than 50%.

This article first appeared in the US Market INK Report on November 14, 2018.