Stock Futures Buoyed by ECB Stimulus News

Productivity and labor costs data hit the Street bright and early

Productivity and labor costs data hit the Street bright and early

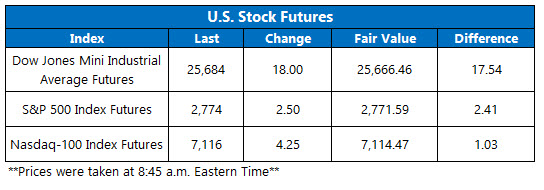

The Dow Jones Industrial Average (DJI) is fresh off a three-day losing streak, but futures on the blue-chip index are cautiously higher today, propped up by the European Central Bank (ECB) decision to leave interest rates unchanged through the end of 2019 -- longer than previously forecast -- and launch a newlonger-term loan stimulus program for banks. As far as economic data, U.S. productivity rose 1.9% in the fourth quarter, while unit labor costs increased 2%. And oil prices are set to climb, too, with April-dated crude futures up 0.9% at $56.75 per barrel.

Continue reading for more on today's market, including:

2 travel stocks flashing buy signals.Options bears piled on GE after a CEO shocker.This weed stock has options on sale.Plus, American Eagle sinks on weak guidance; a big bull note for Constellation Brands; and Allergan under pressure after depression drug data.

5 Things You Need to Know Today

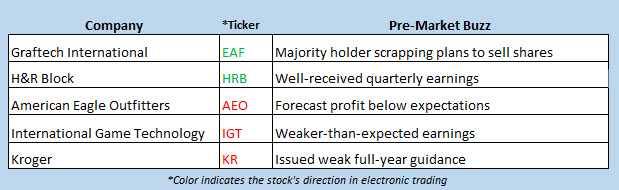

The Chicago Board Options Exchange (CBOE) saw 991,028 call contracts traded on Wednesday, compared to 697,993 put contracts. The single-session equity put/call ratio climbed to 0.70, and the 21-day moving average rose to 0.61. American Eagle Outfitters (NYSE:AEO) stock is down 2.9% in electronic trading, after the retailer's fourth-quarter revenue fell short of expectations. The company's current-quarter earnings guidance also came in lower than expected. AEO gapped 4.4% higher yesterday, but encountered familiar resistance near its 320-day moving average.Constellation Brands, Inc. (NYSE:STZ) is up 1.6% ahead of the bell, after Credit Suisse initiated coverage on the beer maker with an "outperform" rating and $230 price target. Since falling to a nearly two-year low of $150.37 on Jan. 9, STZ has added 10%, but the overhead $175 level still lurks. Shares of Allergan plc (NYSE:AGN) are struggling in electronic trading, after the drugmaker's depression treatment failed three late-stage studies. Six price-target cuts have come through, including one to $155 from $161 at Credit Suisse. As of yesterday, AGN was clinging to its year-to-date breakeven level, and staring up at its 50-day moving average.Today's slate is highlighted by weekly jobless claims, the Fed's balance sheet, and consumer credit report. Plus, American Outdoor Brands (AOBC), Barnes & Noble (BKS), Burlington Stores (BURL), Costco (COST), El Pollo Loco (LOCO), Eventbrite (EB), GNC Holdings (GNC), H & R Block (HRB), and Marvell Technology (MRVL) all step into the earnings confessional.China's Shanghai Composite Win Streak Hits 5

Stocks in Asia failed to generate much momentum, as traders continued to await more clarity on a U.S.-China trade deal. Still, China's Shanghai Composite managed to extend its daily win streak to five, edging out a 0.1% gain on the day. Meanwhile, China's finance minister said that despite the country's new fiscal policies, it will not open a "floodgate" of stimulus, according to Reuters. Elsewhere, Hong Kong's Hang Seng fell 0.9%, and a pullback in chip stocks pushed Japan's Nikkei down 0.7%. South Korea's Kospi joined the losers with a 0.5% retreat.

European benchmarks are hovering near breakeven today following the ECB's decision to provide new loans for banks as a way to stimulate the eurozone economy. London's FTSE 100 has come off its early lows, but remains off 0.2% on the day. Germany's DAX is also trying to push into positive territory, last seen down 0.04%, while France's CAC 40 is up 0.07%.