Stock Futures Climb on Huawei Reprieve

The 10-year Treasury yield continues to bounce back

The 10-year Treasury yield continues to bounce back

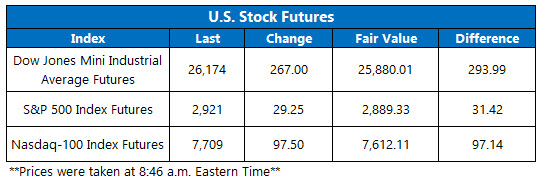

Dow Jones Industrial Average (DJI) futures are signaling a strong start to the week, pointing to a 293-point burst out of the gate for the blue-chip index. The 10-year Treasury yield -- which helped fuel a late-week rally on Friday -- continues to bounce back, climbing to 1.61%, at last check. But the big driver this morning is news that the U.S. agreed to extend a grace period to Huawei, which will allow the Chinese tech giant to buy supplies from U.S. companies for the next 90 days. This follows comments from President Donald Trump and his top economic adviser Larry Kudlow, who on Sunday insisted they don't see a recession on the horizon.

Continue reading for more on today's market, including:

Goldman: This drone stock could soar 44%.Options bulls have piled on Baidu stock ahead of earnings.This Chinese streaming stock just picked up a pre-earnings downgrade.Plus, MasterCard eyes crypto foray; Deckers upgraded; and Microsoft taps Nvidia for Minecraft tech.

5 Things You Need to Know Today

The Cboe Options Exchange (CBOE) saw 1.18 million call contracts traded on Friday,compared to 800,064 put contracts. The single-session equity put/call ratio pulled back to 0.67, while the 21-day moving average remained at 0.70.Mastercard Inc (NYSE:MA) stock is up 1.4% in electronic trading, after a New York Post report indicated the credit card company was forming a cryptocurrency team. Mastercard already is involved with Facebook's Libra cryptocurrency. MA scored a record high of $283.33 on July 29, and is up 45% year-to-date through Friday's close at $274.36.Deckers Outdoor Corp (NYSE:DECK) stock is up 1% ahead of the bell, after Pivotal Research upgraded the footwear retailer to "buy" from "hold." The analyst in coverage favors the company's valuation and upcoming weather trends in the fall/winter. DECK has shed 26% since its July 1 all-time high of $180.65, and is clinging to its year-to-date breakeven point, based on Friday's close at $134.29.. Fresh off an impressive quarterly report, the shares of Nvidia Corporation (NASDAQ:NVDA) are up 2.8% in electronic trading. In addition to sector tailwinds stemming from the Huawei news, Microsoft (MSFT) agreed to use Nvidia's "ray tracing" technology for its "Minecraft" video game. Despite all the recent buzz, NVDA is still down 38% year-over-year through last week's close at $159.59..Data on e-commerce retail sales is on the docket for today, along with earnings from Estee Lauder (EL) and Red Robin Gourmet Burgers (RRGB).

Asian Stocks, European Markets Get PBOC Boost

It was a positive finish in Asia today, after the People's Bank of China (PBOC) announced key interest rate reform over the weekend in order to lower borrowing costs. Trump's upbeat comments on U.S.-China trade talks also boosted investor sentiment. By the close, China's Shanghai Composite was up 2.1%, Hong Kong's Hang Seng gained 2.2%, while Japan's Nikkei and South Korea's Kospi each added 0.7%.

European markets are getting a lift from PBOC's interest rate announcement, as well, as stimulus chatter from German Finance Minister Olaf Scholz, who said the country has the ability to "counter [an economic] crisis with full force." At last check, the German DAX is up 1.5%, the French CAC 40 is 1.3% higher, and London's FTSE 100 is boasting a 1.2% lead.