Stock Futures Flat with Bank Earnings in Focus

JPMorgan's results impressed investors

JPMorgan's results impressed investors

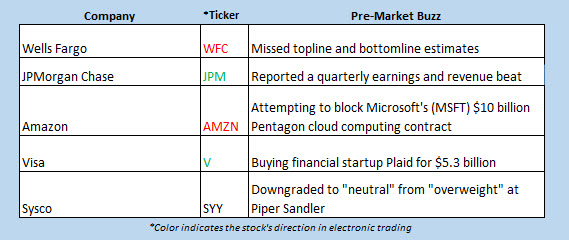

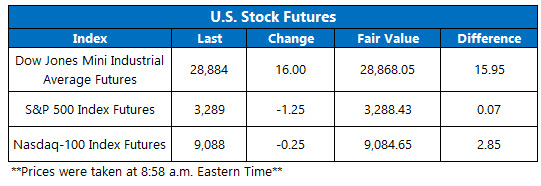

U.S. stock futures are trading near fair value this morning, signaling a flat start to the day for equities as earnings season gets underway with reports from the big banks. Most notably, Dow Jones Industrial Average (DJI) component JPMorgan Chase (JPM) is set to gain thanks to record annual profits, while sector peer Wells Fargo (WFC) is moving in the other direction after its quarterly report. Against this backdrop, futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are also signaling a tepid open.

Continue reading for more on today's market, including:

Why puts popped on EXACT Sciences. A signal saying Signet Jewelers could shine. Plus, Beyond Meat keeps soaring; weed stock slips; and JPMorgan's big morning.

5 Things You Need to Know Today

The Cboe Options Exchange (CBOE) saw 1.59 million call contracts traded on Monday compared to 753,352 put contracts. The single-session equity put/call ratio moved down to 0.47 while the 21-day moving average was 0.52.Beyond Meat Inc (NASDAQ:BYND) is set to add to yesterday's Snoop Dogg-induced upside, rising 10.2% before the open. Another win would be a fourth straight for BYND, with the stock yesterday topping its 100-day moving average for the first time since Oct. 1. BYND, which closed at $114.34 yesterday, was trading below $74 as recently as Jan. 6. Another name making moves this morning is Aphria Inc (NYSE:APHA), down 8.1% following the company's quarterly results. APHA has essentially been in a relentless downtrend for the past year, but received a "top pick" designation at the start of 2020. JPM shares are set for a 0.9% at the open, as earnings per share of $2.57 easily topped estimates thanks to more strength from the company's trading business. Call traders were hammering JPM before earnings, with the 10-day call/put volume ratio of 2.67 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranking in the 90th annual percentile. The NFIB small business optimism index and core consumer price index (CPI) both due out. Another double dose of Fed speeches are on the schedule, one from New York Fed President John Williams, and the other from Kansas Fed President Esther George. On the earnings docket is Citigroup (C), Delta Air Lines (DAL), and IHS Markit (INFO).Global Markets Mixed

Asian markets were a mixed bag today. China's yuan-denominated imports rose in December, but it wasn't enough to push Chinese markets higher, with the Shanghai Composite and Hong Kong's Hang Seng both closing with losses of 0.3% and 0.2% respectively. Elsewhere in the region, Japan's Nikkei added 0.7% with tech giant Softbank leading the charge, while South Korea's Kospi tacked on 0.4%.

Over in Europe, stocks are struggling for direction at midday. London's FTSE 100 is 0.03% higher, with bank stock Old Mutual a notable winner after a favorable court ruling. The French CAC 40 and German DAX are both 0.1% lower, with the latter weighed down by chemicals company Evonik.