Stock Futures Slip Ahead of Black Friday Session

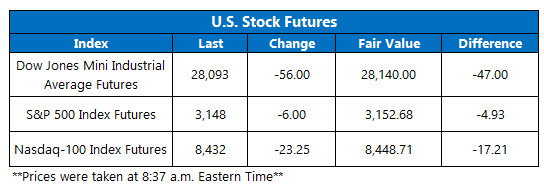

Dow futures are trading below fair value after a record-setting month

Dow futures are trading below fair value after a record-setting month

Stock futures are in cool-down mode ahead of today's shortened session, following this month's string of fresh highs. Despite this, major equity benchmarks are eyeing impressive monthly gains, with the S&P looking to clock its biggest one-month percentage jump since June. The retail sector is in focus as the Black Friday shopping event rears its head, with early data from Adobe suggesting online sales hit a new record on Thanksgiving.

Continue reading for more on today's market, including:

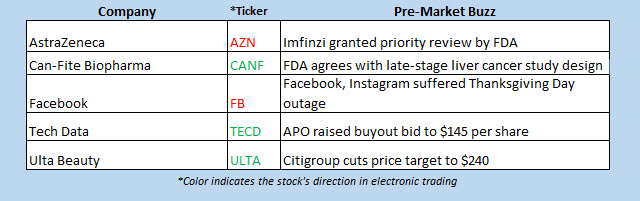

How drug stock options bears could double their money by Christmas. One bullish analyst isn't shaken by Under Armour's SEC probe. Plus, PCG set to slide again; TECD stock soars on buyout offer; and CVX eyes an exit from Nigeria.

5 Things You Need to Know Today

The Cboe Options Exchange (CBOE) saw 980,600 call contracts traded on Wednesday, compared to 572,674 put contracts. The single-session equity put/call ratio moved up to 0.58, while the 21-day moving average came in at 0.58. Utility stock PG&E Corporation (NYSE:PCG) is set to drop again, this time after the company lost a legal challenge that means it's liable for damage from California wildfires. PCG shares hit a new low last month, and are trading down 2.4% before the open. Tech Data Corp (NASDAQ:TECD) is up 11.9% to trade at $144.30 before the open on news Apollo Global Management raised its buyout offer for the company by $15 per share to $145, valuing TECD at $5.14 billion (excluding debt). The move comes after another suitor stepped up with a competing bid, and CNBC is reporting that was in fact Warren Buffett's Berkshire Hathaway (BRKA). The shares of blue chip name Chevron Corporation (NYSE:CVX) are inching higher this morning, up 0.9% in electronic trading, after the company confirmed a Reuters report that it's planning to sell its stakes in two separate Nigerian offshore oil and gas blocks. Chevron is looking to exit the theft-prone Nigerian market in favor of focusing on its U.S.-based production business, per the report.Today's shortened session will feature the Chicago purchasing managers index (PMI). The focus stays on consumer discretionary stocks next week, as retail earnings and Cyber Monday sales numbers are set to hit Wall Street.Hong Kong Tensions Slam Asian Markets

Stocks in Asia were lower across the board to end the week, as escalating tensions over Hong Kong threaten to dampen prospects of a U.S.-China trade agreement. Beijing accused the U.S. of "sinister intentions" after President Donald Trump on Wednesday signed a bill in support of Hong Kong protesters. Hong Kong's Hang Seng gave back 2% as health insurer AIA took on heavy losses, while China's Shanghai Composite shed 0.6%. Rounding out the region, South Korea's Kospi fell 1.5% after the Bank of Korea decided to keep interest rates steady, and Japan's Nikkei lost 0.5%.

Markets are mixed in Europe, as investors weigh the U.S.-China trade headlines alongside economic data. London's FTSE 100 is down 0.2%, at last check, after November consumer confidence fell to its lowest point since 2013. Elsewhere, the French CAC 40 is up 0.2% after third-quarter gross domestic product grew in line with estimates, while the German DAX is also up 0.2%.