Stock Futures Up on China Trade Exemptions

Beijing said it would exempt pork and soybeans from additional tariffs

Beijing said it would exempt pork and soybeans from additional tariffs

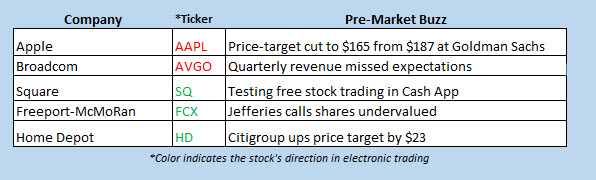

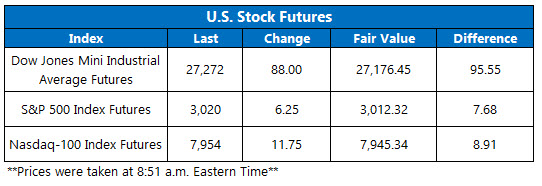

Dow Jones Industrial Average (DJI) futures are signaling a higher start, building on the momentum that sent the blue-chip index to its longest winning streak in 16 months yesterday. Upbeat trade headlines continue to drive the positive price action, with China's Commerce Ministry saying earlier it will add pork and soybeans to a list of U.S. products exempt from additional tariffs. Wall Street is also digesting this morning's retail sales data, which rose a more-than-expected 0.4% in August on robust auto sales. Futures on the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) are up, too, with stocks poised to close in on new record highs.

Continue reading for more on today's market, including:

Caterpillar stock flashes warning signs.RH call traders won big on a pre-earnings rally.Plus, a bouncing drug stock; Etsy gets a big upgrade; and Baker Hughes is indicted.

5 Things You Need to Know Today

The Cboe Options Exchange (CBOE) saw 1.10 million call contracts traded on Thursday, compared to 610,116 put contracts. The single-session equity put/call ratio rose to 0.55, while the 21-day moving average remained at 0.67.Catalyst Pharmaceuticals Inc (NASDAQ:CPRX) withdrew its plan for an eight-million share offering, representing around 8% of the drugmaker's float, saying the "current market price of the common stock is not in the best interest of the company and its stockholders." Initial news of the offering had CPRX stock settling at $6.13 on Thursday -- down 20% from Wednesday's record high of $7.67 -- but the shares are up 10.6% ahead of the bell today.Wedbush upgraded Etsy Inc (NASDAQ:ETSY) to "outperform" from "neutral," with the brokerage firm waxing optimistic over the online marketplace's pre-holiday season launches of Etsy Ads and free shipping. ETSY stock is 3.8% higher in electronic trading, set to open around the $57 per-share mark -- just below its Aug. 2 bear gap.Baker Hughes A GE Co (NYSE:BHGE) was indicted by a grand jury in Alaska on allegations the energy firm exposed workers to toxic chemicals, though the company denied the charges. BHGE stock closed last night at $22.64, off 8.5% since a recent rejection at its 200-day moving average.Import and export prices, consumer sentiment, and business inventories are due. This busy batch of economic data comes ahead of next week's Fed meeting.U.K. Stocks Struggle as Pound Strengthens

The stimulus deal in Europe and easing tensions between the U.S. and China sent stocks in Asia higher today. Japan's Nikkei was up almost 1.1%, hitting a four-month high on big gains for Yahoo Japan and SoftBank Group, while Hong Kong's Hang Seng nearly eked out a 1% win on a boost from life insurance issue AIA. China's Shanghai Composite and South Korea's Kospi were both closed for holiday.

Stocks in Europe are mostly higher at midday, as bank stocks advance following yesterday's European Central Bank (ECB) stimulus announcement. The French CAC 40 is up 0.3%, while the German DAX has added 0.6%. London's FTSE 100 is hovering right below breakeven, however, off 0.03% as blue-chip stocks falter in the face of a strengthening pound.