Stock's Buy Signal Hasn't Been Wrong in 3 Years

Some analysts are still skeptical of the outperforming stock

Some analysts are still skeptical of the outperforming stock

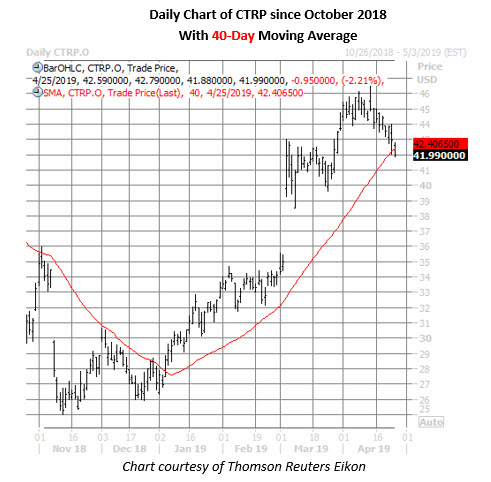

Chinese travel services stock Ctrip.com International, Ltd. (NASDAQ:CTRP) has put in a strong performance so far this year, up 55% to trade at $41.99 -- thanks in part to an early March post-earnings bull gap. More recently, the shares pulled back after hitting a nine-month high of $46.50, but are now trading near a trendline with historically bullish implications.

Specifically, CTRP stock has come within one standard deviation of its 40-day moving average. There have been four other times in the past three years the equity has tested support at this trendline after a lengthy stretch above it -- defined for this study as trading above the moving average 60% of the time in the last two months, and in eight of the past 10 sessions -- per data from Schaeffer's Senior Quantitative Analyst Rocky White.

Following these prior signals, CTRP was higher one month out each time, averaging a gain of 10.5%. Based on its current perch, another move of this magnitude would put Ctrip stock near that recent peak.

A round of bullish brokerage notes could fuel bigger gains for CTRP stock, too. Despite the equity's impressive year-to-date performance, five of 13 analysts still maintain a lukewarm "hold" rating, while the average 12-month price target of $42.14 is a slim premium to the security's present perch.

Meanwhile, Ctrip.com stock has been an attractive target for premium buyers over the past year. This is based on the security's elevated Schaeffer's Volatility Scorecard (SVS) reading of 98 (out of a possible 100), which shows CTRP has tended to make outsized moves over the past year, relative to what the options market had priced in.