Stocks Bring Daily Losing Streak to 3 After Data Dump

Wall Street heard updates on the U.S. trade deficit and private-sector payrolls today

Wall Street heard updates on the U.S. trade deficit and private-sector payrolls today

Early morning reports that President Donald Trump was pushing for a U.S.-China trade deal to boost the equities market ahead of the 2020 presidential election did little to lift stocks today. Instead, traders reacted to a round of uninspiring economic data, including a bruising update on the U.S. trade deficit and lackluster jobs data.

The mid-afternoon release of the Fed's Beige Book only added to the risk-off backdrop, with the report showing "slight-to-moderate" growth in 10 central bank districts and "flat economic conditions" in St. Louis and Philadelphia in late January and February, with half the districts pointing to "slower economic activity in some sectors" as a result of the government shutdown. By the close, the Dow, S&P 500, and Nasdaq were all down for a third straight day.

Continue reading for more on today's market, including:

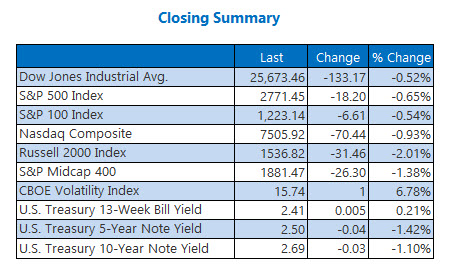

Thebiotech that surged 160% today.History suggests this blue chip could be a bargain right now.RBC: Intelsat stock dip is a "great buying opportunity."Plus, this weed stock has cheap options; GE put volume spikes; and another bear note for CVS Health.The Dow Jones Industrial Average (DJI - 25,673.46) shed 133.2 points, or 0.5%. Walgreens Boots Alliance (WBA) led 21 Dow stocks lower with its 3.6% drop, while DowDuPont (DWDP) paced the nine advancers with its 1.5% gain.

The S&P 500 Index (SPX - 2,771.45) closed down 18.2 points, or 0.7%, while the Nasdaq Composite (IXIC - 7,505.92) surrendered 70.4 points, or 0.9%.

The Cboe Volatility Index (VIX - 15.74) gained 1 point, or 6.8%.

5 Items on our Radar Today

The Organization for Economic Cooperation and Development (OECD) cut its world growth forecasts for 2019 and 2020, citing uncertainty over trade negotiations and Brexit. The Paris-based OECD now expects the global economy to grow at 3.3% this year and 3.4% next year -- down 0.2 percentage point and 0.1 percentage point, respectively, from its November forecasts. (Reuters)Facebook CEO Mark Zuckerberg said he wants the social media site to become a more "privacy-focused platform." In a Facebook blog post, Zuckerberg laid out a set of multi-year initiatives for the company, including integrated and encrypted messaging across Messenger, WhatsApp, and Instagram, as well as secure data storage. (CNBC)This weed stock has cheap options right now.The headlines that sparked heavy demand for GE put options.CVS Health got hit with another bearish brokerage note.

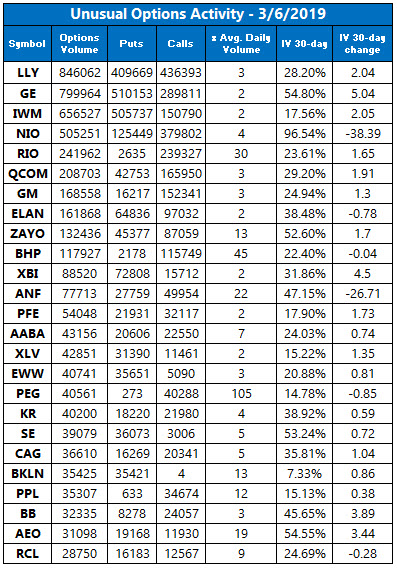

Data courtesy of Trade-Alert

Gold Snaps Losing Streak; Oil Drops After EIA Update

Oil prices took a hit today after the Energy Information Administration (EIA) reported a larger-than-expected rise in domestic crude inventories -- and the sixth increase in seven weeks. However, April-dated crude finished well off its intraday lows -- settling down 34 cents, or 0.6%, at $56.22 per barrel -- on a bigger-than-anticipated drop in gasoline stockpiles.

Gold closed higher for the first time in eight days -- snapping its longest daily losing streak in two years. Gold for April delivery ended the session up $2.90, or 0.2%, at $1,287.60 an ounce.