Stocks Cautiously Higher as Trade Deal Skepticism Lingers

Oil prices are sharply lower today

Oil prices are sharply lower today

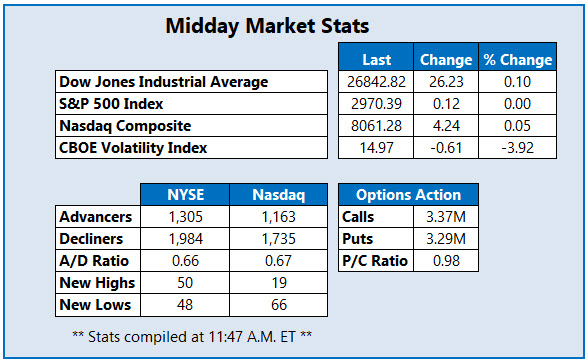

The Dow Jones Industrial Average (DJI) is cautiously higher to start the new week, as the U.S.-China trade optimism from Friday is replaced with skepticism. A Bloomberg report indicated China is hesitant to sign off on an official "phase one" deal, and labeled the Friday developments as "substantial progress," instead of the "greatest and biggest trade deal ever made" for U.S. farmers, as touted by President Donald Trump on Twitter.

The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are sitting just above breakeven, too, as investors exercise caution. Elsewhere, oil prices are sharply lower, with November-dated crude futures down 2.8% at $53.15 per barrel, at last check.

Continue reading for more on today's market, including:

Analyst: This fitness chain could be "best in class."The bank stock upgraded to "buy" before earnings.Plus, calls pop on Procter & Gamble stock; Western Digital stock upgraded; and EOG sinks with oil.

One name seeing heightened options volume today is Procter & Gamble Co (NYSE:PG), with 53,000 calls crossing the tape so far -- 14 times the average intraday amount, and 15 times the number of puts traded. It looks like most of the action has transpired at the November 100 and March 115 calls, with a trader possibly rolling up a large position. The surging Dow stock was last seen down 1% to trade at $119.94, despite J.P. Morgan Securities naming P&G a top pick for earnings season.

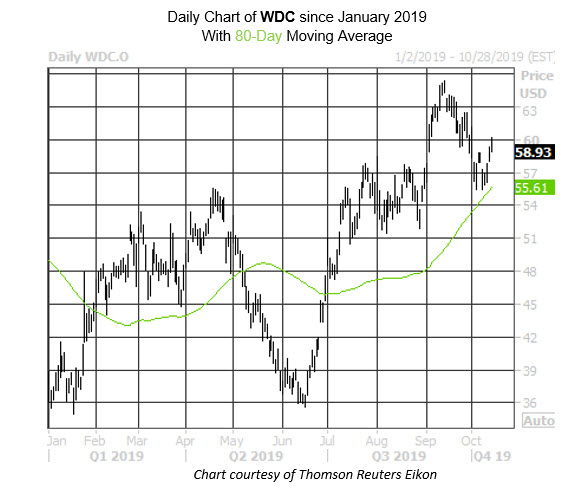

Western Digital Corp (NASDAQ:WDC) is one of the better stocks on the SPX today, up 1.9% to trade at $58.93. This comes after Loop Capital upgraded the semiconductor stock to "buy" from "hold," while hiking its price target to $75 from $50. The analyst in coverage is bullish on the company's valuation and potential revenue growth for 2020. WDC is heading toward its fourth straight win, after bouncing from its 80-day moving average last week.

With oil prices falling, EOG Resources Inc (NYSE:EOG) is struggling today, down 3.8% to trade at $66.68, and earlier nabbing a three-year low of $66.01. Also weighing on the oil name is a price-target cut to $105 from $110 at Susquehanna. EOG is down 23% year-to-date, and has found stiff resistance at the $88 level and $50 billion market cap.