Stocks Decline as Trump Cabinet Turmoil Deepens: Markets Wrap

Arbuthnot Latham's Perdon Says U.S. Financials a Good Place to Be

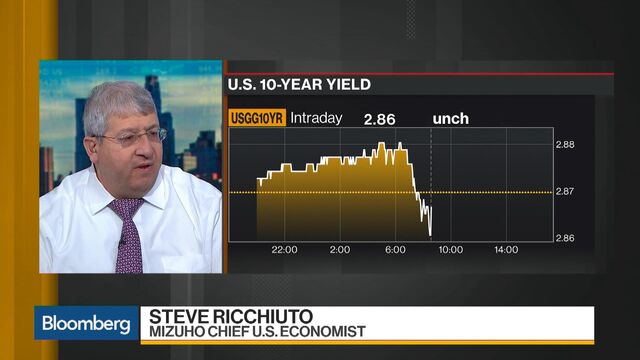

U.S. equities fell for the second straight day as markets took in Tuesday’s economic and political news. The 10-year Treasury yield fell while the dollar held steady.

While an inflation report reinforced the sense that economic growth is picking up without runaway price increases, energy shares weighed on the S&P 500 Index as oil declined on concern that global demand might not absorb burgeoning U.S. supplies. Retail sales and crude inventory figures due out Wednesday may offer more clues on the future of the economy.

Meanwhile, the sudden firing of U.S. Secretary of State Rex Tillerson -- to be replaced by CIA Director Mike Pompeo -- may have investors waiting for more shoes to drop at the White House, especially when it comes to trade policy.

“We’ve got a new person filling the shoes of the Secretary of State,” said Mike Bailey, director of research at FBB Capital Partners in Bethesda, Maryland. “Although the new person has been around in a different office previously, investors may just be concerned about what is this new person going to do? Could the new Secretary of State be more in line with Trump? Be more inclined towards protectionism?”

Tillerson’s removal followed an executive order from Trump blocking Broadcom Ltd. from acquiring Qualcomm Inc., scuttling a $117 billion hostile takeover that had been the subject of scrutiny on national security grounds. Qualcomm’s shares fell as much as 5.9 percent, weighing down the Nasdaq 100 Index.

Steve Ricchiuto, chief U.S. economist at Mizuho, says “it’s a bit of a return to Goldilocks” for equity markets.

(Source: Bloomberg)The European stock benchmark also faded as its trading session wore on. Earlier, Japanese stocks fluctuated, but they closed higher as Hong Kong and Chinese shares slipped. The yen dropped as investors digested the political fallout from a scandal embroiling the country’s finance minister.

Elsewhere, emerging-market equities gained for a fourth day. Bitcoin held above $9,000. Gold advanced.

Terminal users can read more in our markets blog.

Here are some of the key things happening this week:

And these are the main moves in markets:

Stocks

Currencies

Bonds

Commodities

— With assistance by Brian Chappatta, Adam Haigh, and Samuel Potter

Quotes from this ArticleBefore it's here, it's on the Bloomberg Terminal.LEARN MOREHave a confidential news tip?Get in touch with our reporters.Most Read