Stocks Drift Higher as Fed Decision Looms

All three benchmarks are heading toward monthly wins

All three benchmarks are heading toward monthly wins

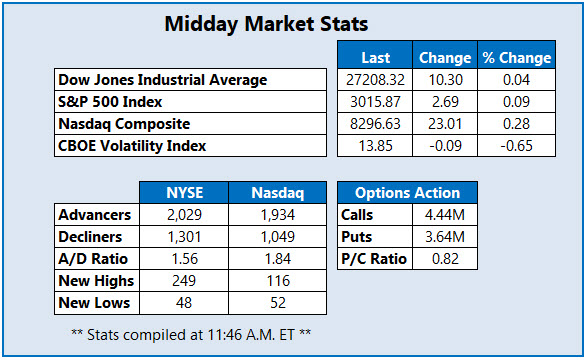

As July comes to a close, the Dow Jones Industrial Average (DJI) has traded on both sides of the aisle, but was last seen cautiously higher due to a post-earnings surge from Apple (AAPL). Meanwhile, the S&P 500 Index (SPX) also sits just above breakeven at midday, while the Nasdaq Composite (IXIC) is firmly in the black thanks to a tech sector rally. Nevertheless, all eyes are on the conclusion of today's Fed meeting, with the central bank widely expected to cut interest rates. Investors will also be clued in to post-decision remarks from Fed Chair Jerome Powell, set to take the podium at 2:30 p.m. ET.

Continue reading for more on today's market, including:

This clean energy stock could soar another 66%, per H.C. Wainwright.Advanced Micro Devices stock is reeling after dismal guidance.Plus, GrubHub options bears make a short-term wager; 19-year highs for Akamai Technologies; and an ugly quarterly report for Molson Coors.

GrubHub Inc (NYSE:GRUB) is seeing accelerated options trading today. More than 5,100 puts have traded -- three times what's typically seen at this point in the day, and volume in the 97th percentile of its annual range. Leading the charge is the weekly 8/9 60-strike put, where new positions are being opened. GrubHub stock was down 2.9% to trade at $67.88, at last check, so options bears are betting on more losses from the food delivery concern in the coming weeks.

One of the top stocks on the S&P 500 today is Akamai Technologies, Inc. (NASDAQ:AKAM). The shares are up 7% to trade at $89.92, after the cloud concern's second-quarter revenue beat expectations. Akamai also upped its 2019 guidance, prompting at least seven price-target hikes, the highest coming in at $97 from Craig-Hallum. AKAM earlier tapped a 19-year high of $90.28, and has added 47% year-to-date.

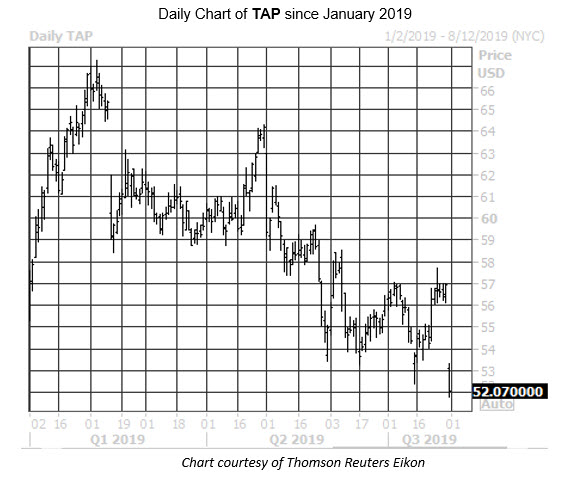

On the other end of the spectrum is Molson Coors Brewing Company (NYSE:TAP), down 7.5% to trade at $52.07, after the beverage maker's second-quarter revenue and sales fell short of expectations. Molson Coors' CEO Mark Hunter also announced his retirement, effective Sept. 27. TAP earlier fell to a five-year low of $51.80, and has breached its year-to-date breakeven level.