Stocks Drop on Black Friday, But Notch Best Month Since June

U.S.-China trade tensions remain high

U.S.-China trade tensions remain high

Stocks took a hit in today's low-volume, holiday-shortened session to close out November. The Dow shed more than 121 points at its session lows, as investors unpacked the latest U.S.-China trade tensions and the unofficial kickoff of the holiday shopping season. Despite today's drop, the Dow, S&P 500, and Nasdaq all posted solid weekly wins. And on top of that, all three benchmarks locked up their best month since June.

Continue reading for more on today's market, including:.

Western Digital stock faces off with key trendline before a bullish month.Tech Data stock ramped higher as Buffett got outbid.Plus, an ULTA bear note; Deere under pressure; and Facebook fixes its Thanksgiving outage.

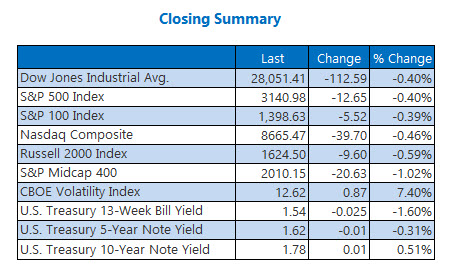

The Dow Jones Industrial Average (DJI - 28,051.41) posted a 112.6-point, or 0.4%, loss, with only seven of 30 blue chips ending higher. International Business Machines (IBM) jumped 0.5% to pace the gainers, and Dow Inc (DOW) had the worst day, dropping 1.7%. For the week, the Dow advanced 0.6%; for November, it gained 3.7%.

The S&P 500 Index (SPX - 3,140.98) shed 12.7 points, or 0.4%, and the Nasdaq Composite (IXIC - 8,665.47) lost 39.7 points, or 0.5%. The S&P 500 gained nearly 1% for the week and 3.4% on the month, while the Nasdaq posted weekly and monthly gains of 1.7% and 4.5%, respectively.

The Cboe Volatility Index (VIX - 12.62) popped, adding 0.9 point, or 7.4%. It added 2.3% on the week, but shed 4.5% for the month.

5 Items on Our Radar Today

President Donald Trump visited Afghanistan for the first time over Thanksgiving. Both the U.S. and the Taliban expressed interest at ending the 18-year conflict, with the latter group ready "restart the talks." (Reuters)Reports indicate Apple (AAPL) isconsidering shaking up its iPhone sizes in 2020. LG and Samsung have been named as suppliers for the screens and panels for the rumored launches. (CNBC)Ulta Beauty stock just suffered a pre-earnings blow.Deere stock picked up a new "sell" rating.Facebook went down over Thanksgiving yesterday.There are no earnings to report today.

Gold Eyes Worst Month In Three Years

Oil prices pulled back today as well, likely in response to the resignation of Iran's prime minister. At last check, January-dated crude futures were down $1.20, or 4.5%, at $55.43 per barrel. For the week, black gold slipped, but was on track to gain more than 3% for the month.

Gold prices were cautiously higher as investors await the next U.S.-China trade headline. February gold futures edged up $6.40, or 0.4%, to trade at $1,459.40 an ounce. For the month, the precious metal is down more than 3%, eyeing its worst month since November 2016.