Stocks Head Toward Worst Week of 2019 on Trade Worries

Wall Street's "fear gauge" is pacing for its first weekly advance of 2019

Wall Street's "fear gauge" is pacing for its first weekly advance of 2019

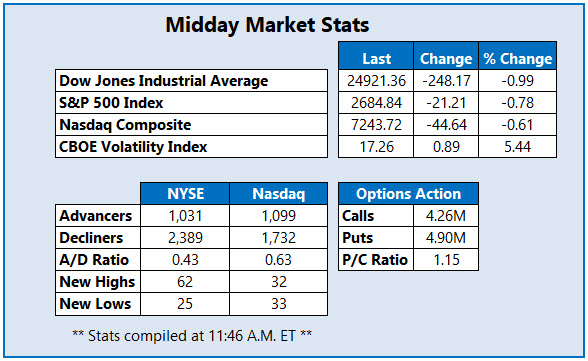

The Dow Jones Industrial Average (DJI) is down nearly 250 points at midday, on track to bring its weekly winning streak of six to a halt amid mounting U.S.-China trade tensions. The Wall Street Journal earlier reported that a trade deal draft has not even yet been agreed upon, casting further doubts ahead of the March 1 deadline.

The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are in the red, too, with both set for their biggest weekly drop since Dec. 21. Plus, all three indexes are heading toward their third straight daily loss, their longest losing streak of 2019. Elsewhere, Wall Street's "fear gauge," the Cboe Volatility Index (VIX) continues to climb, and is heading toward its first weekly gain of 2019.

Continue reading for more on today's market, including:

The surprise that has Mattel stock surging. The sinking communications stock rewarding patient short sellers.Plus, GE put volume spikes; Skechers soars on blowout earnings; and Qorvo issues weak guidance.

There's notable options activity surrounding former Dow stock General Electric Company (NYSE:GE). More than 618,000 puts have changed hands, 10 times the average intraday amount and volume pacing in the 100th percentile of its annual range. Trade-Alert highlights a big bearish adjustment, where one trader likely closed aMarch 8-9 put spread and rolled it out to the weekly 3/8 7- and 9-strike puts. GE stock is down 3.7% to trade at $9.69, after encountering familiar resistance at its 160-day trendline earlier this week.

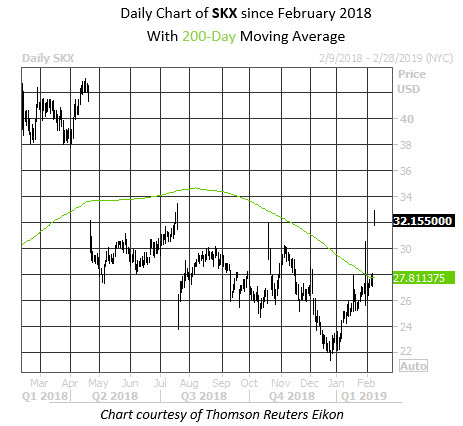

Skechers USA Inc (NYSE:SKX) is one of the top stocks on the New York Stock Exchange (NYSE) today, up 17.2% to trade at $32.16. The shoe retailer's fourth-quarter earnings beat and in-line revenue prompted price-target hikes from at least five brokerages, including one to $36 at Stifel. SKX is on track for its best day since October 2017, and is set to close above its 200-day moving average for the first time since April.

Qorvo Inc (NASDAQ:QRVO) is down 4.8% to trade at $63.41, after the Apple supplier's fourth-quarter guidance came in below Wall Street expectations due to weak smartphone demand. In response, Canaccord Genuity downgraded QRVO to "hold" from "buy," and joined three other brokerages in issuing price-target cuts -- though D.A. Davidson, BMO, and Needham raised their Qorvo target prices.