Stocks Retreat as Dow, S&P Eye Third Straight Loss

The major indexes are heading toward February gains, though

The major indexes are heading toward February gains, though

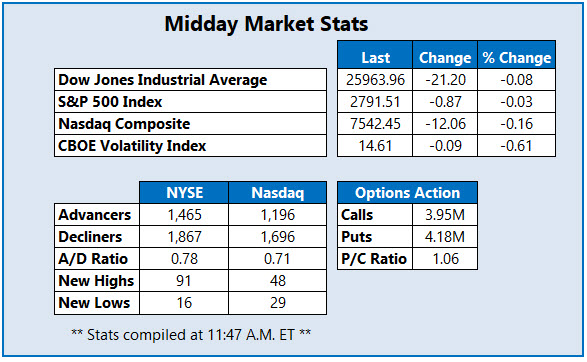

The Dow Jones Industrial Average (DJI) is marginally lower at midday, heading toward its third straight loss. The downside is being held in check by a better-than-expected fourth-quarter gross domestic product (GDP) reading, though. The S&P 500 Index (SPX) is also on track for a third straight loss, as weak earnings from Booking Holdings (BKNG) weigh on the consumer discretionary sector and traders digest the failed nuclear summit between President Donald Trump and North Korean leader Kim Jong Un. Nevertheless, the Dow, SPX, and Nasdaq Composite (IXIC) are all headed toward big February gains.

Continue reading for more on today's market, including:

Tesla stock gets "Fresh Pick" status ahead of today's big announcement.The latest biotech to join the cannabis craze.Plus, Kraft options bulls strike amid buyout buzz; and SeaWorld and Monster Beverage soar on upbeat earnings reports.

Options volume is accelerated on Kraft Heinz Co (NASDAQ:KHC). More than 42,000 call options have changed hands, four times the average intraday amount andtriple the number of puts traded. The March 32.50 call is leading the charge today, and it looks like new positions are being purchased. KHC is up 4.1% to trade at $33.50, on track to snap a five-day skid on buyout buzz. But thanks to a combination of bear notes and dismal earnings, Kraft stock is headed toward its worst month ever.

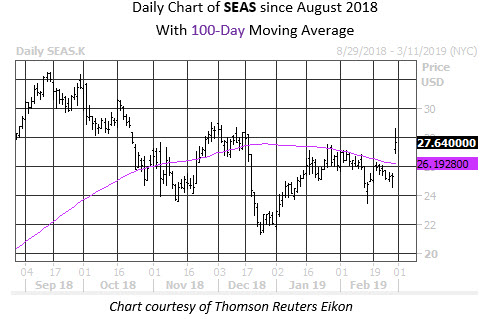

SeaWorld Entertainment Inc (NYSE:SEAS) is up 9.1% to trade at $27.64, one of the best stocks on the New York Stock Exchange (NYSE) today. The theme park operator reported a slimmer-than-expected fourth-quarter loss, while revenue and park attendance figures also exceeded expectations. In the span of a month, SEAS has shaken off an orca death to add 25% year-to-date, and today is on pace to close above former resistance at its 100-day moving average for the first time since December.

Meanwhile, the top stock on the S&P 500 today is Monster Beverage Corp (NASDAQ:MNST), up 9.7% to trade at $64.42. The beverage company's fourth-quarter earnings and revenue blew past expectations thanks to strong international sales. No fewer than seven price-target hikes have ensued, including one to $74 from $71 at Jefferies. MNST earlier tapped an annual high of $66.38, and has gapped away from short-term resistance at the $60-$62 area.