Stocks Settle Choppy Session Lower

The DJI briefly turned positive in late-day trading

The DJI briefly turned positive in late-day trading

The Dow explored a 332-point range on both sides of breakeven. The bulk of the action occurred to the downside as a cooling 10-year Treasury yield and disappointing data out of China reignited concerns over a slowing global economy, while sinking crude futures weighed on oil major Exxon Mobil (XOM). Strong sessions for Apple (AAPL) and Boeing (BA) briefly helped the blue-chip barometer turn higher in the final hour of trading, though the gains failed to hold. Likewise, the S&P 500 and Nasdaq ended lower for the third time in four sessions.

Continue reading for more on today's market, including:

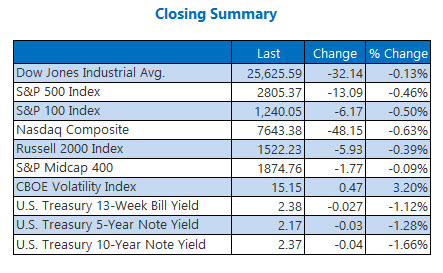

History says to bet on an April win for this ETF.Acacia shorts cheered a rare "sell" rating.Buyout buzz fueled hot Centene options volume.Plus, retail stock flashes pre-earnings buy signal; Square earns a fresh bull note; and one of the best stocks on Wall Street today.The Dow Jones Industrial Average (DJI - 25,625.59) closed down 32.1 points, or 0.1%. Walmart (WMT) and Chevron (CVX) paced the 21 Dow decliners, shedding 1.1% each, while Boeing (BA) and Travelers (TRV) led the nine advancers, adding 1% apiece.

The S&P 500 Index (SPX - 2,805.37) gave back 13.1 points, or 0.5%, while the Nasdaq Composite (IXIC - 7,643.38) surrendered 48.2 points, or 0.6%.

The Cboe Volatility Index (VIX - 15.15) added 0.5 point, or 3.2%.

5 Items on our Radar Today

Turkish stocks plunged as investors fled and the lira fell ahead of a key March 31 vote to determine authority over Turkey's cities. The BIST 100 Index plunged 5.7% for its worst day since July 2016. The benchmark has now shed more than 13% from a failed test of the 16,000 mark on March 19. (Bloomberg)U.K. Prime Minister Theresa May said she would step down from her top position if parliament passes her Brexit deal -- a measure that's already failed two times. "I know there is a desire for a new approach -- and new leadership -- in the second phase of the Brexit negotiations -- and I won't stand in the way of that," said May ahead of an extended April 12 Brexit deadline. (Reuters)This retail stock flashed a buy signal ahead of earnings.Square earned a fresh "outperform" rating.This retailer was one of the best stocks on Wall Street today.

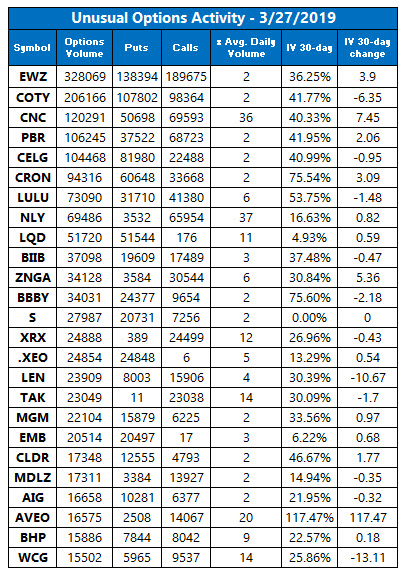

Data courtesy of Trade-Alert

Oil Prices Drop on Unexpected Supplies Build

Oil prices fell after the Energy Information Administration (EIA) said domestic crude inventories rose for the first time in three weeks -- compared to consensus estimates for a weekly drop in supplies. Crude for May delivery dropped 53 cents, or 0.9%, to settle at $59.41 per barrel.

Gold prices fell for a second straight day as the U.S. dollar strengthened. At the close, April-dated gold was down $4.60, or 0.4%, at $1,310.40 an ounce.