Stocks Sink as China Blacklist Rattles Tech Sector

Sentiment has turned chilly ahead of Thursday's high-level talks after the U.S. expanded its trade blacklist

Sentiment has turned chilly ahead of Thursday's high-level talks after the U.S. expanded its trade blacklist

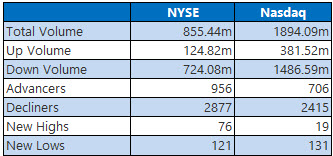

The Dow continued to slide today, ending more than 300 points lower after the U.S. expanded its trade blacklist to include 28 additional Chinese tech companies alongside Huawei, citing human rights violations -- a move that soured investor sentiment ahead of Thursday's high-level U.S.-China trade talks. The tech-rich Nasdaq was lower too, as the update crushed semiconductor stocks.

Elsewhere, Fed Chair Jerome Powell announced the imminent expansion of the central bank's balance sheet in response to recent volatility in overnight lending markets, but clarified, "This is not [quantitative easing]. In no sense is this QE." Against this backdrop, it was a negative finish across the board for the major equity indexes.

Continue reading for more on today's market, including:

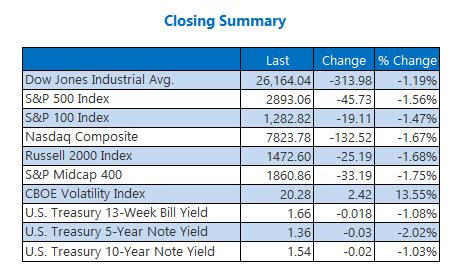

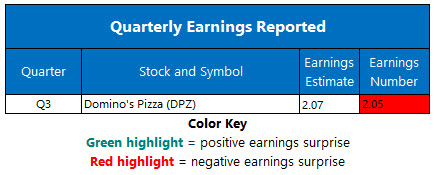

What the small-cap death cross means for IWM going forward. Behind Domino's Pizza stock's wild post-earnings trading. Why investors should scoop up CBOE calls now. Plus, one TGT bull's big bet; 2 healthcare stocks getting bull notes; and NIO stock's great day.The Dow Jones Industrial Average (DJI - 26,164.04) shed 313.9 points, or 1.2%. Walmart (WMT) was the only gainer of the 30 blue chips, up 0.3%, while Dow Inc (DOW) brought up the rear with a 2.9% loss.

The S&P 500 Index (SPX - 2,893.06) settled 45.7 points, or 1.6%, lower, while the Nasdaq Composite (IXIC - 7,823.78) lost 132.5 points, or 1.7%.

The Cboe Volatility Index (VIX - 20.28) added 2.4 points, or 13.6%, today, and closed back above the 20 level for the first time since Oct. 2.

5 Items on Our Radar Today

The Supreme Court is in a heated debate surrounding Title 7 of the Civil Rights Act, which protects individuals from workplace discrimination based on "sex," with three cases challenging this provision after being fired for their sexual orientations and identities.Debates over the matter went on for two hours and concluded at noon, with some justices suggesting they may defer to Congress on the matter. (CNBC)According to a poll from Washington Post-Shar School, 58% of respondents support the impeachment inquiry into President Donald Trump, compared to 45% in a separate poll released days earlier. The poll covered a random national sample of 1,007 adults and was taken via phone between Oct. 1 and 6. (Reuters)Behind this Target bull's well-timed bet. Analysts predict big things for these 2 heathcare sector newcomers. The deliveries update that helped lift electric auto stock NIO.

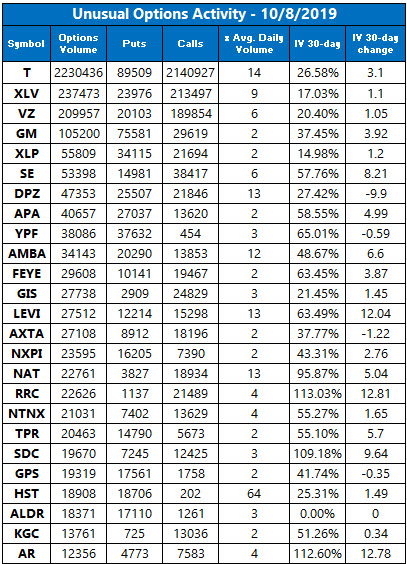

Data courtesy of Trade-Alert

Oil, Gold Slide as Investors Await Thursday Trade Meeting

Oil prices clocked another loss as trade turmoil continues to bubble. November-dated crude futures fell $0.12, or 0.2%, to settle at $52.63 a barrel.

Gold also pulled back, notching its third straight session in the red as the U.S. dollar strengthened. Gold futures for December delivery lost $0.50, or 0.03%, to end at $1,503.90 per ounce.