Stocks Surge as Apple Fuels Tech Rally

Investors also reacted to another drop in U.S. unemployment

Investors also reacted to another drop in U.S. unemployment

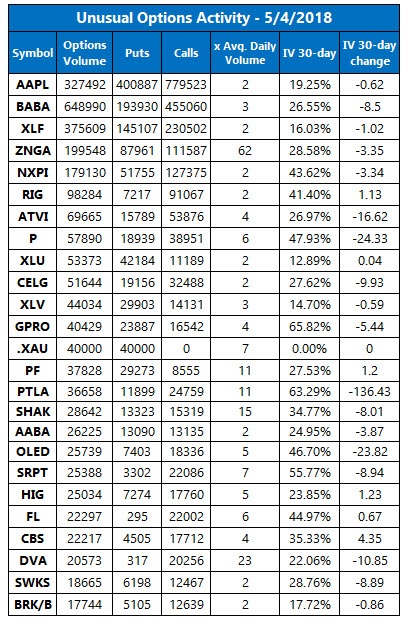

The Dow soared today, as news that Warren Buffett substantially increased his Apple (AAPL) position sparked a huge move from the tech giant. In fact, shares of the iPhone maker hit an all-time high and closed the week up 13.3% -- the best week in years for AAPL. The broader tech sector rallied as a result, helping the Dow and S&P erase almost all of their weekly losses, and ushering the Nasdaq to a weekly win. Elsewhere, investors also digested the nonfarm payrolls report for April, which revealed the lowest unemployment rate in 17 years, along with another strong uptick in oil prices.

Continue reading for more on today's market, including:

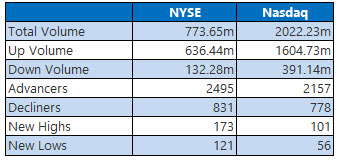

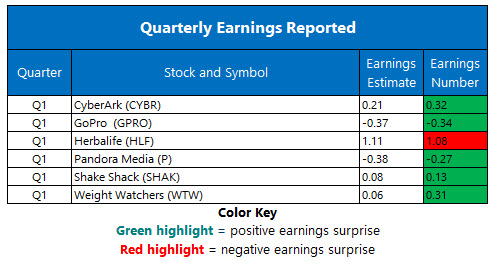

The ETF attracting options action ahead of NAFTA negotiations. Why this cybersecurity stock's rally could have legs. GoPro put traders targeted a familiar level amid the rally. Plus, Hertz bears pay up; Apple supplier flashes "buy"; and Pandora's record day.The Dow Jones Industrial Average (DJI - 24,262.51) was up more than 400 points at session highs, and closed with a 332.4-point, or 1.4%, win. Every Dow component but Chevron (CVX) closed in positive territory, with shares of the energy giant dropping 0.4%. Aside from AAPL's 3.9% surge, McDonald's (MCD) also had a strong performance, adding 3.1%. The Dow ended the week down 0.2%.

The S&P 500 Index (SPX - 2,663.42) rallied 33.7 points, or 1.3%, and the Nasdaq Composite (IXIC - 7,209.62) jumped 121.5 points, or 1.7%. The SPX fell 0.2% this week, while the Nasdaq closed up 1.3%.

The Cboe Volatility Index (VIX - 14.77) dipped 1.1 points, or 7.1%. The VIX shed 4.2% this week.

5 Items on Our Radar Today

Special Counsel Robert Mueller could be going beyond the powers of his position with his pursuit of former Trump campaign manager Paul Manafort, a federal judge said today. The judge said he didn't see the connection between the charges brought against Manafort and Mueller's Russia probe. (Reuters)Coming off an unusual earnings call where he called analysts' questions "dry" and "boring," Tesla CEO Elon Musk today again made headlines. Musk tweeted early this morning about a "short burn of the century comin soon," referring to the company's numerous short sellers. (CNBC)Hertz bears paid up for pre-earnings put options. Buy this Apple supplier now, if past is prologue. Inside Pandora stock's record day.

Data courtesy of Trade-Alert

Oil Closes Out Strong Week with a Win

Oil finished the week strong, as traders weighed potential sanctions on Iran. June-dated crude futures added $1.29, or 1.9%, to settle at $69.72 per barrel -- the highest close since late 2014. For the week, liquid gold closed up 2.4%.

Gold prices managed a small win today. Specifically, gold for June delivery tacked on $2, or 0.5%, to end at $1,312.70 per ounce. Gold lost 0.7% this week, however, marking a third straight weekly decline.