Stocks Win 5 In a Row After Dovish Powell

Oil prices rose for a ninth straight session

Oil prices rose for a ninth straight session

The Dow explored a 311-point range on both sides of breakeven. Fueling the choppy trading were weakness in retail stocks after several retailers -- including Macy's (M) and Kohl's (KSS) -- reported dreary holiday sales numbers, uncertainty surrounding the ongoing government shutdown, and a warning on U.S. debt levels from Fed Chair Jerome Powell. However, Powell also echoed the relatively dovish tone toward interest rates heard in yesterday's Fed minutes, which helped the Dow, S&P 500, and Nasdaq eventually bring their daily win streaks to five.

Continue reading for more on today's market, including:

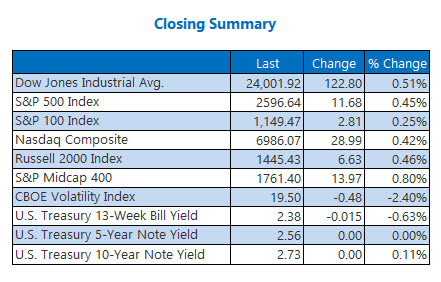

Yelp options bears eye bigger losses.FAANG fears sank this cloud name.This education stock bull signal has never been wrong.Plus, call traders target weed stocks; Twitter gets a double upgrade; and a Wedbush top pick.The Dow Jones Industrial Average (DJI - 24,001.92) closed near its session high, up 122.8 points, or 0.5%. Twenty Dow stocks finished in the green, led by Boeing's (BA) 2.6% pop. Pfizer (PFE) paced the 10 losers with its 2.4% decline.

The S&P 500 Index (SPX -2,596.64) added 11.7 points, or 0.5%, to close north of its 32-day moving average for the first time since Dec. 3. The Nasdaq Composite (IXIC - 6,986.07) gained 28.9 points, or 0.4%.

The Cboe Volatility Index (VIX - 19.50) gave back 0.5 point, or 2.4%, for its lowest close since Dec. 3.

5 Items on our Radar Today

In a tweet, President Donald Trump canceled his trip to a global economic summit later this month, citing the U.S. government shutdown. Trump tweeted, "Because of the Democrats intransigence on Border Security and the great importance of Safety for our Nation, I am respectfully cancelling my very important trip to Davos, Switzerland for the World Economic Forum." (Reuters)Ford Motor said it will make massive job cuts in Europe as part of broader restructuring efforts. The Detroit automaker said it will also shutter a factory in France, as it battles higher costs related to stiff emissions rules and slower growth. (New York Times)3 weed stocks saw heavy call trading today.Twitter scored its fifth straight win on a double upgrade.Wedbush tapped this tech stock as a top pick.

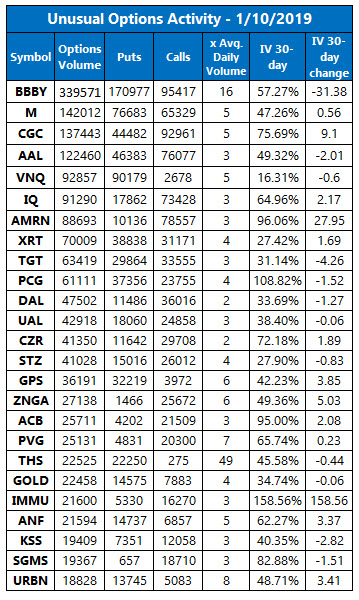

Data courtesy of Trade-Alert

Oil Nabs Longest Win Streak Since 2010

Oil prices erased earlier losses to notch a ninth straight win, their longest daily win streak since 2010. February-dated crude futures settled up 23 cents, or 0.4%, at $52.59 per barrel.

Gold futures topped out just shy of the $1,300 per ounce mark overnight. However, gold for February delivery reversed course as the dollar strengthened, ultimately closing down $4.60, or 0.4%, at $1,287.40 an ounce.