Strong Chilean copper project pipeline expected to come online - report

In early December, Teck Resources announced it had sold a 30% indirect interest stake in Compania Minera Teck Quebrada Blanca S.A., owner of QB2, to the Sumitomo Corporation and Sumitomo Metal Mining Co. for 1.2B.

"QB2 is one of the world's premier undeveloped copper assets and this transaction further confirms the value of the project," said Don Lindsay, President and CEO of Teck said at the time. "This partnership significantly de-risks Teck's investment in the project, enhances our project economics and preserves our ability to continue to return capital to shareholders and reduce bonds currently outstanding."

"QB2 will be a long life, low-cost operation with major expansion potential, including the option to double production or more, to become a top five global copper producer," Lindsay added.

This week, Fitch Solutions increased its 2021 Chilean copper concentrate production growth forecasts to reflect the announcement of the production start date for the QuebradaBlanca Phase II (QB2) project, in newly released industry trend analysis highlighting Teck's Chilean investment.

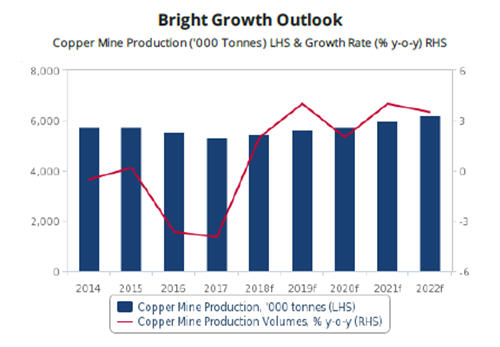

"Our production forecasts from 3.0% to 4.0% in 2021 as a strong project pipeline is expected to come online, along with QB2's first production for H221," the report reads. "Investor sentiment towards large scale copper projects remains resilient, especially amongst large industry players."

Teck's board has approved construction to begin in April 2019, and the the project is expected to produce 316 kt annually, a substantial increase from 23 kt in 2017.

QB2 will join Spence Growth Option (SGO), owned by BHP; Los Pelambres Expans ion Phase I, owned by Antofagasta; and the Mantoverde Expansion, owned by Mantos Copper with a projected production start date in 2021.

"The partnership highlights a resilient outlook among investors for expanding future copper production amidst enticing long term demand fundamentals," Fitch reports.

The report does have a caveat: one key downside risk to Fitch's otherwise positive outlook on Chilean copper production is the ongoing decline in the ore-grades in the country's mining sector.

Read the full report here.