Stronger Risk Appetite Sends Gold below $1,800 / Commodities / Gold & Silver 2020

Gold plunged below $1,800. Will these declines finally end?

Gold plunged below $1,800. Will these declines finally end?

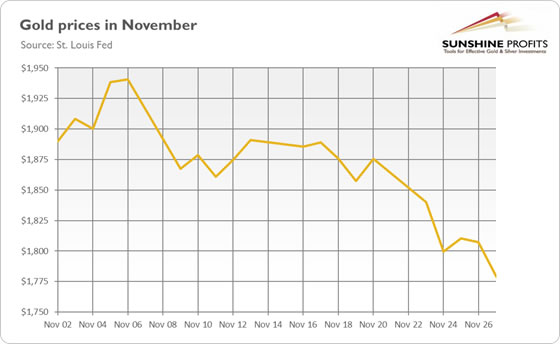

November doesn’t look like a good month for gold. The declines in the precious metals market continued last week. As the chart below shows, the price of the yellow metal dropped to $1,779 on Friday (November 27).

What is going on? Well, it seems that investors have switched into a risk-on state of mind, which sent the safe-haven assets such as gold substantially lower . You see, a lot of important things happened or are happening: a few vaccines are coming to the market, the formal transition of power from the current administration to President-elect Joe Biden has begun, and Biden picked Janet Yellen as his Treasury Secretary. All of this news reduced a substantial part of the uncertainty and has been welcomed by investors. They are convinced that the economy will find itself on the road to normality. The market participants have breathed a sigh of relief, reassured that the worst scenarios – of unconstrained pandemic, contested election, or an inexperienced, radical progressive responsible for U.S. financial matters – will not materialize.

Indeed, Wall Street can be happy. Yellen, the monetary dove , will work closely with the Fed (after all, Powell was on the Board of Governors under Yellen) to design whatever response necessary to sustain the asset price bubb… sorry, to stimulate the economy!

As a consequence of a stronger risk appetite and more optimistic economic outlook, investors started to price an interest rate hike in 2023. The more hawkish expectations have exerted downward pressure on gold prices.

Implications for Gold

But what about the more distant future of gold? Well, neither the vaccines, nor a Biden-Yellen duo will cure all of the U.S. economy’s problems over the long run. Actually, America will have to face a big health crisis in the very short term. The second wave of infections is already affecting the economy negatively. For example, personal income decreased 0.7 percent in October, followed by a 0.7 percent gain in September. And the number of initial claims have been rising again in November (albeit rather mildly so far).

The vaccines may take us into a new normality, but not to a unicorn fantasy land. Perhaps you don’t remember, but the pre-pandemic normality wasn’t wonderful, the pace of economic growth was not impressive, and indebtedness levels were already high. At present, economic growth is not going to accelerate substantially. The debt – both corporate and public debt – is considerably more substantial than before the pandemic . The real interest rates are lower, while the risk of inflation runs higher.

The return of normality could actually be positive for gold prices in the long run. Why? Because once the epidemic is over, a lot of people will want to travel, buy larger houses, and spend, spend, and spend some more! The pent-up demand, combined with some cracks in the supply chains, and increased broad money supply , could lead to the acceleration in inflation and thus, stronger demand for gold as an inflation hedge .

All these factors suggest that the price of gold should not return to a lower pre-epidemic level. After all, the world will come out of the pandemic with much higher debt levels and some lasting scars. Actually, the price of the yellow metal can continue its upward march in the medium or long run, however, it seems that gold requires a trigger to overcome its current weakness and move further north. That trigger can come in the form of the next U.S. stimulus package, some turmoil in the corporate debt markets, or the next dovish change in the Fed’s stance that could be announced in December. The reason might also be technical – gold could decline so much that the decline burns itself out as everyone who wants to sell will do so and the price – given the extremely bad sentiment - will be able to go in only one direction – up.

We will see – stay tuned!

Thank you for reading today’s free analysis. We hope youenjoyed it. If so, we would like to invite you to sign up for our free goldnewsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all ourpremium gold services, including our Gold & Silver Trading Alerts. Signup today!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.